Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

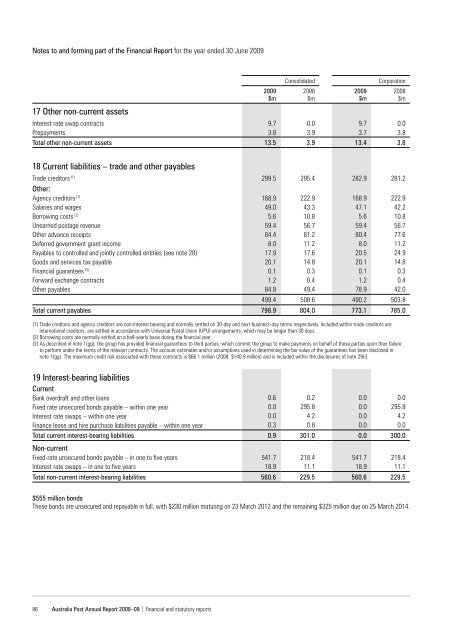

Notes to and forming part of the Financial <strong>Report</strong> for the year ended 30 June 2009<br />

17 Other non-current assets<br />

Interest rate swap contracts<br />

Prepayments<br />

86<br />

<strong>Australia</strong> <strong>Post</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008–09</strong> | Financial and statutory reports<br />

2009<br />

$m<br />

Consolidated Corporation<br />

Total other non-current assets 13.5 3.9 13.4 3.8<br />

18 Current liabilities – trade and other payables<br />

Trade creditors (1) 299.5 295.4 282.9 281.2<br />

Other:<br />

Agency creditors (1)<br />

Salaries and wages<br />

Borrowing costs (2)<br />

Unearned postage revenue<br />

Other advance receipts<br />

Deferred government grant income<br />

Payables to controlled and jointly controlled entities (see note 28)<br />

Goods and services tax payable<br />

Financial guarantees (3)<br />

Forward exchange contracts<br />

Other payables<br />

499.4 508.6 490.2 503.8<br />

Total current payables 798.9 804.0 773.1 785.0<br />

(1) Trade creditors and agency creditors are non-interest bearing and normally settled on 30-day and next-business-day terms respectively. Included within trade creditors are<br />

international creditors, are settled in accordance with Universal <strong>Post</strong>al Union (UPU) arrangements, which may be longer than 30 days.<br />

(2) Borrowing costs are normally settled on a half-yearly basis during the financial year.<br />

(3) As described in note 1(gg), the group has provided financial guarantees to third parties, which commit the group to make payments on behalf of these parties upon their failure<br />

to perform under the terms of the relevant contracts. The account estimates and/or assumptions used in determining the fair value of the guarantees has been disclosed in<br />

note 1(gg). The maximum credit risk associated with these contracts is $66.1 million (2008: $140.9 million) and is included within the disclosures of note 29(i).<br />

19 Interest-bearing liabilities<br />

Current<br />

Bank overdraft and other loans<br />

Fixed rate unsecured bonds payable – within one year<br />

Interest rate swaps – within one year<br />

Finance lease and hire purchase liabilities payable – within one year<br />

Total current interest-bearing liabilities 0.9 301.0 0.0 300.0<br />

Non-current<br />

Fixed-rate unsecured bonds payable – in one to five years<br />

Interest rate swaps – in one to five years<br />

Total non-current interest-bearing liabilities 560.6 229.5 560.6 229.5<br />

$555 million bonds<br />

These bonds are unsecured and repayable in full, with $230 million maturing on 23 March 2012 and the remaining $325 million due on 25 March 2014.<br />

9.7<br />

3.8<br />

168.9<br />

49.0<br />

5.6<br />

59.4<br />

84.4<br />

8.0<br />

17.9<br />

20.1<br />

0.1<br />

1.2<br />

84.8<br />

0.6<br />

0.0<br />

0.0<br />

0.3<br />

541.7<br />

18.9<br />

2008<br />

$m<br />

0.0<br />

3.9<br />

222.9<br />

43.3<br />

10.8<br />

56.7<br />

81.2<br />

11.2<br />

17.6<br />

14.8<br />

0.3<br />

0.4<br />

49.4<br />

0.2<br />

295.8<br />

4.2<br />

0.8<br />

218.4<br />

11.1<br />

2009<br />

$m<br />

9.7<br />

3.7<br />

168.9<br />

47.1<br />

5.6<br />

59.4<br />

80.4<br />

8.0<br />

20.5<br />

20.1<br />

0.1<br />

1.2<br />

78.9<br />

0.0<br />

0.0<br />

0.0<br />

0.0<br />

541.7<br />

18.9<br />

2008<br />

$m<br />

0.0<br />

3.8<br />

222.9<br />

42.2<br />

10.8<br />

56.7<br />

77.6<br />

11.2<br />

24.9<br />

14.8<br />

0.3<br />

0.4<br />

42.0<br />

0.0<br />

295.8<br />

4.2<br />

0.0<br />

218.4<br />

11.1