Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Australia Post Annual Report 2008–09

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

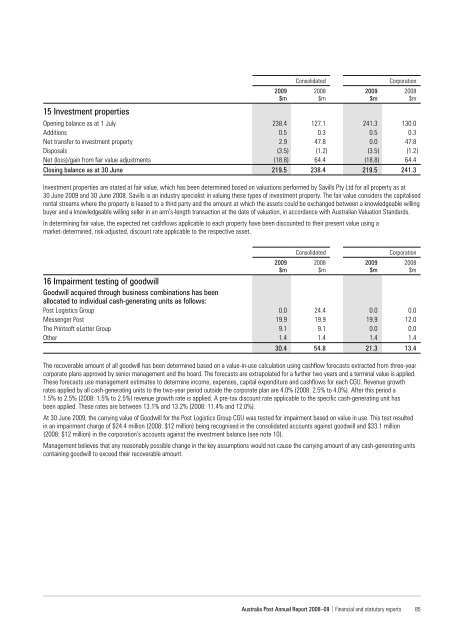

15 Investment properties<br />

Opening balance as at 1 July<br />

Additions<br />

Net transfer to investment property<br />

Disposals<br />

Net (loss)/gain from fair value adjustments<br />

2009<br />

$m<br />

Consolidated Corporation<br />

Closing balance as at 30 June 219.5 238.4 219.5 241.3<br />

Investment properties are stated at fair value, which has been determined based on valuations performed by Savills Pty Ltd for all property as at<br />

30 June 2009 and 30 June 2008. Savills is an industry specialist in valuing these types of investment property. The fair value considers the capitalised<br />

rental streams where the property is leased to a third party and the amount at which the assets could be exchanged between a knowledgeable willing<br />

buyer and a knowledgeable willing seller in an arm’s-length transaction at the date of valuation, in accordance with <strong>Australia</strong>n Valuation Standards.<br />

In determining fair value, the expected net cashflows applicable to each property have been discounted to their present value using a<br />

market-determined, risk-adjusted, discount rate applicable to the respective asset.<br />

16 Impairment testing of goodwill<br />

Goodwill acquired through business combinations has been<br />

allocated to individual cash-generating units as follows:<br />

<strong>Post</strong> Logistics Group<br />

Messenger <strong>Post</strong><br />

The Printsoft eLetter Group<br />

Other<br />

238.4<br />

0.5<br />

2.9<br />

(3.5)<br />

(18.8)<br />

2009<br />

$m<br />

0.0<br />

19.9<br />

9.1<br />

1.4<br />

2008<br />

$m<br />

127.1<br />

0.3<br />

47.8<br />

(1.2)<br />

64.4<br />

2009<br />

$m<br />

241.3<br />

0.5<br />

0.0<br />

(3.5)<br />

(18.8)<br />

2008<br />

$m<br />

130.0<br />

0.3<br />

47.8<br />

(1.2)<br />

64.4<br />

Consolidated Corporation<br />

2008<br />

$m<br />

24.4<br />

19.9<br />

9.1<br />

1.4<br />

2009<br />

$m<br />

0.0<br />

19.9<br />

0.0<br />

1.4<br />

2008<br />

$m<br />

0.0<br />

12.0<br />

0.0<br />

1.4<br />

30.4 54.8 21.3 13.4<br />

The recoverable amount of all goodwill has been determined based on a value-in-use calculation using cashflow forecasts extracted from three-year<br />

corporate plans approved by senior management and the board. The forecasts are extrapolated for a further two years and a terminal value is applied.<br />

These forecasts use management estimates to determine income, expenses, capital expenditure and cashflows for each CGU. Revenue growth<br />

rates applied by all cash-generating units to the two-year period outside the corporate plan are 4.0% (2008: 2.5% to 4.0%). After this period a<br />

1.5% to 2.5% (2008: 1.5% to 2.5%) revenue growth rate is applied. A pre-tax discount rate applicable to the specific cash-generating unit has<br />

been applied. These rates are between 13.1% and 13.2% (2008: 11.4% and 12.0%).<br />

At 30 June 2009, the carrying value of Goodwill for the <strong>Post</strong> Logistics Group CGU was tested for impairment based on value in use. This test resulted<br />

in an impairment charge of $24.4 million (2008: $12 million) being recognised in the consolidated accounts against goodwill and $33.1 million<br />

(2008: $12 million) in the corporation’s accounts against the investment balance (see note 10).<br />

Management believes that any reasonably possible change in the key assumptions would not cause the carrying amount of any cash-generating units<br />

containing goodwill to exceed their recoverable amount.<br />

<strong>Australia</strong> <strong>Post</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2008–09</strong> | Financial and statutory reports 85