Annual Report 2010 - Outokumpu

Annual Report 2010 - Outokumpu

Annual Report 2010 - Outokumpu

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

21<br />

Group earnings per share totalled EUR -0.68 in <strong>2010</strong> (2009: EUR -1.86). Total<br />

shareholder return (TSR) was 6.6% (2009: 64.4%). TSR is calculated as the<br />

annual change in the <strong>Outokumpu</strong> share price plus the dividend, divided by the<br />

starting share price for the year concerned. <strong>Outokumpu</strong>'s share price was<br />

EUR 13.26 at the beginning of the year and increased to EUR 17.88 on 6 April<br />

<strong>2010</strong> before falling back to EUR 13.88 at the end of the year (respective market<br />

capitalisation of EUR 2 525 million). Dividends for 2009 totalling EUR 64 million<br />

(EUR 0.35 per share) were paid in <strong>2010</strong>.<br />

In accordance with the Board of Directors' established dividend policy, the payout<br />

ratio over a business cycle should be at least one-third of the Group's profit for the<br />

period with the aim of making stable annual payments to shareholders. In its<br />

annual dividend proposal, the Board of Directors, in addition to financial results,<br />

takes into consideration <strong>Outokumpu</strong>'s investment and development needs. The<br />

Board of Directors is proposing to the <strong>Annual</strong> General Meeting to be held on 24<br />

March 2011 that a dividend of EUR 0.25 per share be paid for <strong>2010</strong>. The<br />

corresponding dividend yield is 1.8%. <strong>Outokumpu</strong>'s average dividend payout ratio<br />

over the past five years has been approximately 65%.<br />

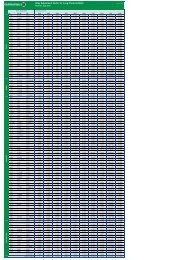

Share-related key figures<br />

€ <strong>2010</strong> 2009<br />

Earnings per share -0.68 -1.86<br />

Equity per share 13.05 13.54<br />

Dividend per share 0.25 1) 0.35<br />

Share price on 31 Dec 13.88 13.26<br />

Market capitalisation on 31 Dec, € million 2 525 2 400<br />

1) The Board of Directors' proposal to the <strong>Annual</strong> General Meeting.<br />

Economic value added<br />

<strong>Outokumpu</strong>'s overall financial objective is to generate the maximum sustainable economic value added (EVA) on capital<br />

invested by the company's shareholders. <strong>Outokumpu</strong> uses the weighted average cost of capital (WACC) in defining the<br />

capital charge for economic value added, and applies this when assessing the profitability of investment projects and<br />

defining the economic and commercial value of the Group's business operations. In <strong>2010</strong>, <strong>Outokumpu</strong>'s WACC after<br />

taxes was approximately 6%. This figure was obtained using a target capital structure in which the weight given to equity<br />

is 60% and the weight given to debt is 40%. The cost of equity was 8.4% and the after-tax cost of debt was 3.3%. In<br />

<strong>2010</strong>, economic value added by <strong>Outokumpu</strong> totalled EUR -284 million (2009: EUR -551 million).<br />

Factors affecting <strong>Outokumpu</strong>'s profitability<br />

The stainless steel business is cyclical. In addition to the company's own actions, Group profitability depends on the<br />

current stage in the global economic cycle and particularly on levels of industrial investment activity. Historical long-term<br />

demand for stainless steel has been growing at an annual rate of 5–6%. Changes in regional or global production<br />

capacity can sometimes have an adverse effect on stainless markets, resulting in temporary imbalances between supply<br />

and demand. Increasing stainless steel production capacity in China will continue to have an effect on the global supply<br />

situation in future years.<br />

<strong>Outokumpu</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2010</strong> – <strong>Outokumpu</strong> – Management discussion