The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>European</strong> E-<strong>Business</strong> <strong>Report</strong> 2005<br />

• <strong>The</strong>re is a positive interrelation between ICT-related process innovations and profitability.<br />

Firms that conducted ICT-related process innovations were 7% more likely to be profitable<br />

than otherwise comparable firms. However, this result should not be over-interpreted because<br />

our analysis does not allow conclusions about the direction of causality.<br />

• <strong>The</strong> relationship of innovation and financial performance does not vary among size classes.<br />

Results suggest that ICT remain important enablers of innovation in the automotive industry, and that<br />

innovative firms are more likely to grow. This should improve their chance of survival in an increasingly<br />

competitive market.<br />

Enterprises with different technology usage patterns<br />

An important matter for both business managers and policy-makers is to understand the relationship<br />

between technology usage and business performance: Does intensive usage of e-business<br />

technologies translate into superior business performance? <strong>The</strong> 2005 survey results of the e-<strong>Business</strong><br />

W@tch show that the degree of ICT deployment and usage differs significantly among firms in the<br />

automotive industry. Are these technological differences related to differences in firm level growth and<br />

profitability?<br />

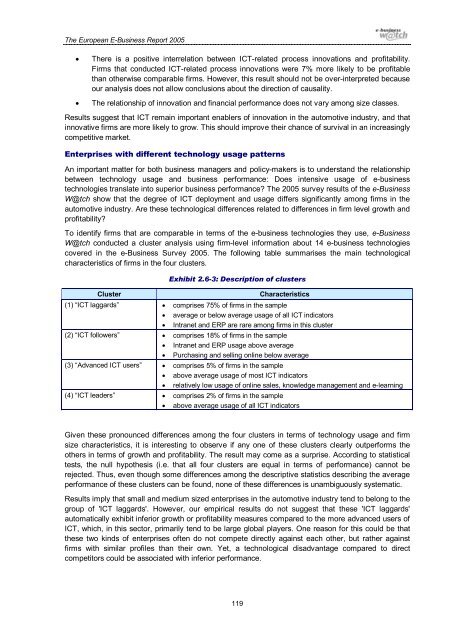

To identify firms that are comparable in terms of the e-business technologies they use, e-<strong>Business</strong><br />

W@tch conducted a cluster analysis using firm-level information about 14 e-business technologies<br />

covered in the e-<strong>Business</strong> Survey 2005. <strong>The</strong> following table summarises the main technological<br />

characteristics of firms in the four clusters.<br />

Cluster<br />

Exhibit 2.6-3: Description of clusters<br />

Characteristics<br />

(1) “ICT laggards” • comprises 75% of firms in the sample<br />

• average or below average usage of all ICT indicators<br />

• Intranet and ERP are rare among firms in this cluster<br />

(2) “ICT followers” • comprises 18% of firms in the sample<br />

• Intranet and ERP usage above average<br />

• Purchasing and selling online below average<br />

(3) “Advanced ICT users” • comprises 5% of firms in the sample<br />

• above average usage of most ICT indicators<br />

• relatively low usage of online sales, knowledge management and e-learning<br />

(4) “ICT leaders” • comprises 2% of firms in the sample<br />

• above average usage of all ICT indicators<br />

Given these pronounced differences among the four clusters in terms of technology usage and firm<br />

size characteristics, it is interesting to observe if any one of these clusters clearly outperforms the<br />

others in terms of growth and profitability. <strong>The</strong> result may come as a surprise. According to statistical<br />

tests, the null hypothesis (i.e. that all four clusters are equal in terms of performance) cannot be<br />

rejected. Thus, even though some differences among the descriptive statistics describing the average<br />

performance of these clusters can be found, none of these differences is unambiguously systematic.<br />

Results imply that small and medium sized enterprises in the automotive industry tend to belong to the<br />

group of 'ICT laggards'. However, our <strong>empirica</strong>l results do not suggest that these 'ICT laggards'<br />

automatically exhibit inferior growth or profitability measures compared to the more advanced users of<br />

ICT, which, in this sector, primarily tend to be large global players. One reason for this could be that<br />

these two kinds of enterprises often do not compete directly against each other, but rather against<br />

firms with similar profiles than their own. Yet, a technological disadvantage compared to direct<br />

competitors could be associated with inferior performance.<br />

119