The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>The</strong> <strong>European</strong> E-<strong>Business</strong> <strong>Report</strong> 2005<br />

Large enterprises have indisputably a decisive role in determining the direction of e-business<br />

development in the automotive industry and, as confirmed by the e-<strong>Business</strong> W@tch evidence, the<br />

diffusion of all e-business technologies follows a clear top-down pattern.<br />

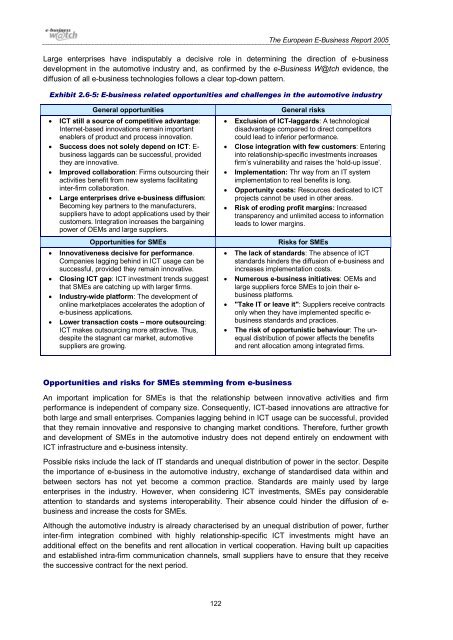

Exhibit 2.6-5: E-business related opportunities and challenges in the automotive industry<br />

General opportunities<br />

• ICT still a source of competitive advantage:<br />

Internet-based innovations remain important<br />

enablers of product and process innovation.<br />

• Success does not solely depend on ICT: E-<br />

business laggards can be successful, provided<br />

they are innovative.<br />

• Improved collaboration: Firms outsourcing their<br />

activities benefit from new systems facilitating<br />

inter-firm collaboration.<br />

• Large enterprises drive e-business diffusion:<br />

Becoming key partners to the manufacturers,<br />

suppliers have to adopt applications used by their<br />

customers. Integration increases the bargaining<br />

power of OEMs and large suppliers.<br />

Opportunities for SMEs<br />

• Innovativeness decisive for performance.<br />

Companies lagging behind in ICT usage can be<br />

successful, provided they remain innovative.<br />

• Closing ICT gap: ICT investment trends suggest<br />

that SMEs are catching up with larger firms.<br />

• Industry-wide platform: <strong>The</strong> development of<br />

online marketplaces accelerates the adoption of<br />

e-business applications.<br />

• Lower transaction costs – more outsourcing:<br />

ICT makes outsourcing more attractive. Thus,<br />

despite the stagnant car market, automotive<br />

suppliers are growing.<br />

General risks<br />

• Exclusion of ICT-laggards: A technological<br />

disadvantage compared to direct competitors<br />

could lead to inferior performance.<br />

• Close integration with few customers: Entering<br />

into relationship-specific investments increases<br />

firm’s vulnerability and raises the ‘hold-up issue’.<br />

• Implementation: Thr way from an IT system<br />

implementation to real benefits is long.<br />

• Opportunity costs: Resources dedicated to ICT<br />

projects cannot be used in other areas.<br />

• Risk of eroding profit margins: Increased<br />

transparency and unlimited access to information<br />

leads to lower margins.<br />

Risks for SMEs<br />

• <strong>The</strong> lack of standards: <strong>The</strong> absence of ICT<br />

standards hinders the diffusion of e-business and<br />

increases implementation costs.<br />

• Numerous e-business initiatives: OEMs and<br />

large suppliers force SMEs to join their e-<br />

business platforms.<br />

• "Take IT or leave it": Suppliers receive contracts<br />

only when they have implemented specific e-<br />

business standards and practices.<br />

• <strong>The</strong> risk of opportunistic behaviour: <strong>The</strong> unequal<br />

distribution of power affects the benefits<br />

and rent allocation among integrated firms.<br />

Opportunities and risks for SMEs stemming from e-business<br />

An important implication for SMEs is that the relationship between innovative activities and firm<br />

performance is independent of company size. Consequently, ICT-based innovations are attractive for<br />

both large and small enterprises. Companies lagging behind in ICT usage can be successful, provided<br />

that they remain innovative and responsive to changing market conditions. <strong>The</strong>refore, further growth<br />

and development of SMEs in the automotive industry does not depend entirely on endowment with<br />

ICT infrastructure and e-business intensity.<br />

Possible risks include the lack of IT standards and unequal distribution of power in the sector. Despite<br />

the importance of e-business in the automotive industry, exchange of standardised data within and<br />

between sectors has not yet become a common practice. Standards are mainly used by large<br />

enterprises in the industry. However, when considering ICT investments, SMEs pay considerable<br />

attention to standards and systems interoperability. <strong>The</strong>ir absence could hinder the diffusion of e-<br />

business and increase the costs for SMEs.<br />

Although the automotive industry is already characterised by an unequal distribution of power, further<br />

inter-firm integration combined with highly relationship-specific ICT investments might have an<br />

additional effect on the benefits and rent allocation in vertical cooperation. Having built up capacities<br />

and established intra-firm communication channels, small suppliers have to ensure that they receive<br />

the successive contract for the next period.<br />

122