The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>European</strong><br />

e-<strong>Business</strong> W@tch<br />

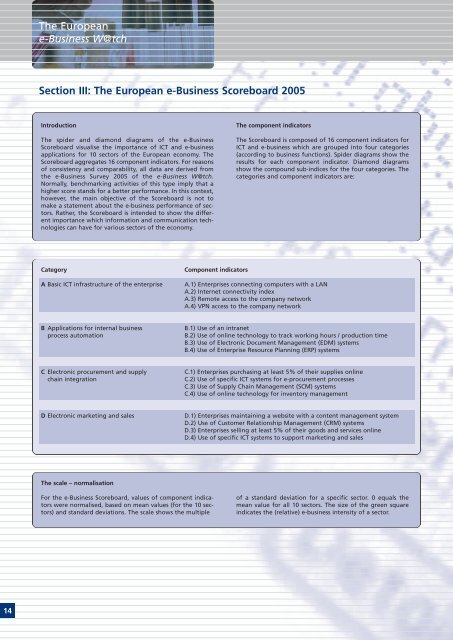

Section III: <strong>The</strong> <strong>European</strong> e-<strong>Business</strong> Scoreboard 2005<br />

Introduction<br />

<strong>The</strong> spider and diamond diagrams of the e-<strong>Business</strong><br />

Scoreboard visualise the importance of ICT and e-business<br />

applications for 10 sectors of the <strong>European</strong> economy. <strong>The</strong><br />

Scoreboard aggregates 16 component indicators. For reasons<br />

of consistency and comparability, all data are derived from<br />

the e-<strong>Business</strong> Survey 2005 of the e-<strong>Business</strong> W@tch.<br />

Normally, benchmarking activities of this type imply that a<br />

higher score stands for a better performance. In this context,<br />

however, the main objective of the Scoreboard is not to<br />

make a statement about the e-business performance of sectors.<br />

Rather, the Scoreboard is intended to show the different<br />

importance which information and communication technologies<br />

can have for various sectors of the economy.<br />

<strong>The</strong> component indicators<br />

<strong>The</strong> Scoreboard is composed of 16 component indicators for<br />

ICT and e-business which are grouped into four categories<br />

(according to business functions). Spider diagrams show the<br />

results for each component indicator. Diamond diagrams<br />

show the compound sub-indices for the four categories. <strong>The</strong><br />

categories and component indicators are:<br />

Category<br />

A Basic ICT infrastructure of the enterprise<br />

Component indicators<br />

A.1) Enterprises connecting computers with a LAN<br />

A.2) Internet connectivity index<br />

A.3) Remote access to the company network<br />

A.4) VPN access to the company network<br />

B Applications for internal business<br />

process automation<br />

B.1) Use of an intranet<br />

B.2) Use of online technology to track working hours / production time<br />

B.3) Use of Electronic Document Management (EDM) systems<br />

B.4) Use of Enterprise Resource Planning (ERP) systems<br />

C Electronic procurement and supply<br />

chain integration<br />

C.1) Enterprises purchasing at least 5% of their supplies online<br />

C.2) Use of specific ICT systems for e-procurement processes<br />

C.3) Use of Supply Chain Management (SCM) systems<br />

C.4) Use of online technology for inventory management<br />

D Electronic marketing and sales<br />

D.1) Enterprises maintaining a website with a content management system<br />

D.2) Use of Customer Relationship Management (CRM) systems<br />

D.3) Enterprises selling at least 5% of their goods and services online<br />

D.4) Use of specific ICT systems to support marketing and sales<br />

<strong>The</strong> scale – normalisation<br />

For the e-<strong>Business</strong> Scoreboard, values of component indicators<br />

were normalised, based on mean values (for the 10 sectors)<br />

and standard deviations. <strong>The</strong> scale shows the multiple<br />

of a standard deviation for a specific sector. 0 equals the<br />

mean value for all 10 sectors. <strong>The</strong> size of the green square<br />

indicates the (relative) e-business intensity of a sector.<br />

14