The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

The European e-Business Report The European e ... - empirica

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>The</strong> <strong>European</strong> E-<strong>Business</strong> <strong>Report</strong> 2005<br />

However, the implementation of SCM solutions in the F&B sector appears to be still fairly low among<br />

SMEs, although it rises to 36% in firms with more than 250 employees. In total, adoption is higher in<br />

terms of employment (21%) than on average in the 10 sectors studied (15%).<br />

Many firms have made considerable investments in e-procurement systems. While in larger firms the<br />

overriding need is to overcome organisational and cultural resistance, in SMEs there are technological<br />

and financial capability limitations to consider. Particularly for the smallest firms, it is possible for e-<br />

procurement to take place not through the adoption of their own systems, which are usually costly to<br />

acquire and run, but by participating in auctions and other forms of transaction that can be carried out<br />

via specialised portals and marketplaces.<br />

22% of firms, involving 43% of employees, in the F&B industry use online purchasing. This is lower<br />

than on average, but in line with sectors such as the textile industry and construction. 56% of large<br />

firms use e-procurement. For the majority of firms that buy online, supplies purchased online account<br />

for less than 5% of the total procurement volume. <strong>The</strong> percentage of firms supporting e-procurement<br />

processes with specific ICT solutions (dedicated software or internet-based services) is generally<br />

quite low at 5% of all firms (28% of large companies).<br />

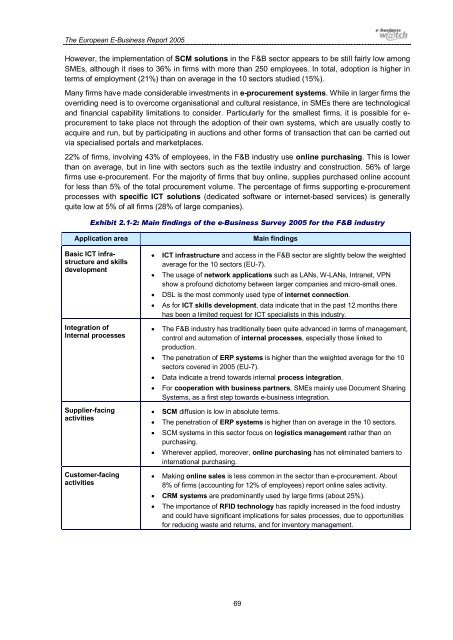

Exhibit 2.1-2: Main findings of the e-<strong>Business</strong> Survey 2005 for the F&B industry<br />

Application area<br />

Basic ICT infrastructure<br />

and skills<br />

development<br />

Integration of<br />

Internal processes<br />

Supplier-facing<br />

activities<br />

Customer-facing<br />

activities<br />

Main findings<br />

• ICT infrastructure and access in the F&B sector are slightly below the weighted<br />

average for the 10 sectors (EU-7).<br />

• <strong>The</strong> usage of network applications such as LANs, W-LANs, Intranet, VPN<br />

show a profound dichotomy between larger companies and micro-small ones.<br />

• DSL is the most commonly used type of internet connection.<br />

• As for ICT skills development, data indicate that in the past 12 months there<br />

has been a limited request for ICT specialists in this industry.<br />

• <strong>The</strong> F&B industry has traditionally been quite advanced in terms of management,<br />

control and automation of internal processes, especially those linked to<br />

production.<br />

• <strong>The</strong> penetration of ERP systems is higher than the weighted average for the 10<br />

sectors covered in 2005 (EU-7).<br />

• Data indicate a trend towards internal process integration.<br />

• For cooperation with business partners, SMEs mainly use Document Sharing<br />

Systems, as a first step towards e-business integration.<br />

• SCM diffusion is low in absolute terms.<br />

• <strong>The</strong> penetration of ERP systems is higher than on average in the 10 sectors.<br />

• SCM systems in this sector focus on logistics management rather than on<br />

purchasing.<br />

• Wherever applied, moreover, online purchasing has not eliminated barriers to<br />

international purchasing.<br />

• Making online sales is less common in the sector than e-procurement. About<br />

8% of firms (accounting for 12% of employees) report online sales activity.<br />

• CRM systems are predominantly used by large firms (about 25%).<br />

• <strong>The</strong> importance of RFID technology has rapidly increased in the food industry<br />

and could have significant implications for sales processes, due to opportunities<br />

for reducing waste and returns, and for inventory management.<br />

69