MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Analysis of the Net Income<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

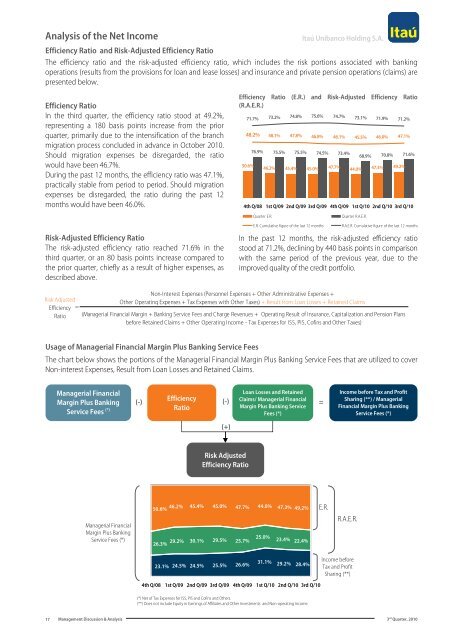

Efficiency Ratio <strong>and</strong> Risk-Adjusted Efficiency Ratio<br />

The efficiency ratio <strong>and</strong> the risk-adjusted efficiency ratio, which includes the risk portions associated with banking<br />

operations (results from the provisions for loan <strong>and</strong> lease losses) <strong>and</strong> insurance <strong>and</strong> private pension operations (claims) are<br />

presented below.<br />

Efficiency Ratio<br />

In the third quarter, the efficiency ratio stood at 49.2%,<br />

representing a 180 basis points increase from the prior<br />

quarter, primarily due to the intensification of the branch<br />

migration process concluded in advance in October 2010.<br />

Should migration expenses be disregarded, the ratio<br />

would have been 46.7%.<br />

During the past 12 months, the efficiency ratio was 47.1%,<br />

practically stable from period to period. Should migration<br />

expenses be disregarded, the ratio during the past 12<br />

months would have been 46.0%.<br />

Efficiency Ratio (E.R.) <strong>and</strong> Risk-Adjusted Efficiency Ratio<br />

(R.A.E.R.)<br />

71.7% 73.2% 74.8% 75.6% 74.7% 73.1% 71.9% 71.2%<br />

48.2%<br />

50.6%<br />

48.1% 47.8% 46.8% 46.1% 45.5% 46.0% 47.1%<br />

76.9% 75.5% 75.5% 74.5% 73.4%<br />

46.2% 45.4% 45.0% 47.7%<br />

68.9% 70.8% 71.6%<br />

44.0% 47.3% 49.2%<br />

4th Q/08 1st Q/09 2nd Q/09 3rd Q/09 4th Q/09 1st Q/10 2nd Q/10 3rd Q/10<br />

Quarter E.R.<br />

Quarter R.A.E.R.<br />

Risk-Adjusted Efficiency Ratio<br />

The risk-adjusted efficiency ratio reached 71.6% in the<br />

third quarter, or an 80 basis points increase compared to<br />

the prior quarter, chiefly as a result of higher expenses, as<br />

described above.<br />

E.R. Cumulative figure of the last 12 months<br />

R.A.E.R. Cumulative figure of the last 12 months<br />

In the past 12 months, the risk-adjusted efficiency ratio<br />

stood at 71.2%, declining by 440 basis points in comparison<br />

with the same period of the previous year, due to the<br />

improved quality of the credit portfolio.<br />

Risk Adjusted<br />

Efficiency =<br />

Ratio<br />

Non-Interest Expenses (Personnel Expenses + Other Administrative Expenses +<br />

Other Operating Expenses + Tax Expenses with Other Taxes) + Result from Loan Losses + Retained Claims<br />

(Managerial <strong>Financial</strong> Margin + Banking Service Fees <strong>and</strong> Charge Revenues + Operating Result of Insurance, Capitalization <strong>and</strong> Pension Plans<br />

before Retained Claims + Other Operating Income - Tax Expenses for ISS, PIS, Cofins <strong>and</strong> Other Taxes)<br />

Usage of Managerial <strong>Financial</strong> Margin Plus Banking Service Fees<br />

The chart below shows the portions of the Managerial <strong>Financial</strong> Margin Plus Banking Service Fees that are utilized to cover<br />

Non-interest Expenses, Result from Loan Losses <strong>and</strong> Retained Claims.<br />

Managerial <strong>Financial</strong><br />

Margin Plus Banking<br />

Service Fees (*)<br />

(-)<br />

Efficiency<br />

Ratio<br />

(-)<br />

Loan Losses <strong>and</strong> Retained<br />

Claims/ Managerial <strong>Financial</strong><br />

Margin Plus Banking Service<br />

Fees (*)<br />

=<br />

Income before Tax <strong>and</strong> Profit<br />

Sharing (**) / Managerial<br />

<strong>Financial</strong> Margin Plus Banking<br />

Service Fees (*)<br />

(+)<br />

Risk Adjusted<br />

Efficiency Ratio<br />

Managerial <strong>Financial</strong><br />

Margin Plus Banking<br />

Service Fees (*)<br />

46.2% 45.4% 45.0% 47.7% 44.0%<br />

50.6%<br />

47.3% 49.2%<br />

25.0%<br />

29.2% 30.1% 29.5% 25.7%<br />

23.4% 22.4%<br />

26.3%<br />

E.R.<br />

R.A.E.R.<br />

24.5% 25.5% 26.6%<br />

31.1%<br />

23.1% 24.5% 29.2% 28.4%<br />

4th Q/08 1st Q/09 2nd Q/09 3rd Q/09 4th Q/09 1st Q/10 2nd Q/10 3rd Q/10<br />

(*) Net of Tax Expenses for ISS, PIS <strong>and</strong> Cofins <strong>and</strong> Others.<br />

(**) Does not include Equity in Earnings of Affiliates <strong>and</strong> Other Investments <strong>and</strong> Non-operating Income.<br />

Income before<br />

Tax <strong>and</strong> Profit<br />

Sharing (**)<br />

17<br />

Management Discussion & Analysis 3 rd Quarter, 2010