MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

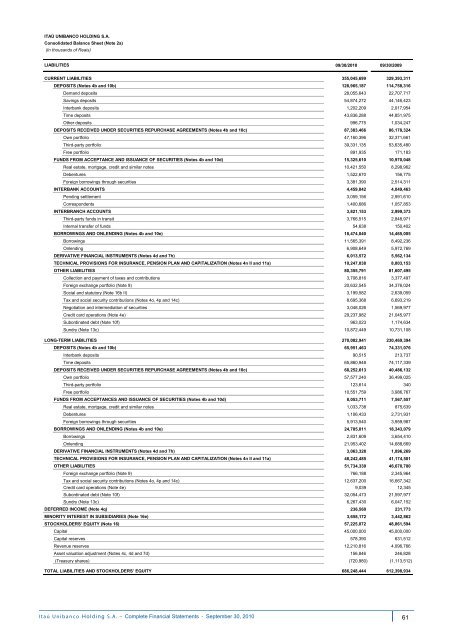

ITAÚ UNIBANCO HOLDING S.A.<br />

Consolidated Balance Sheet (Note 2a)<br />

(In thous<strong>and</strong>s of Reais)<br />

LIABILITIES<br />

09/30/2010 09/30/2009<br />

CURRENT LIABILITIES<br />

355,045,699 329,393,311<br />

DEPOSITS (Notes 4b <strong>and</strong> 10b)<br />

128,965,187 114,758,316<br />

Dem<strong>and</strong> deposits 28,055,643 22,707,717<br />

Savings deposits 54,874,272 44,146,423<br />

Interbank deposits 1,202,209 2,017,954<br />

Time deposits 43,836,288 44,851,975<br />

Other deposits 996,775 1,034,247<br />

DEPOSITS RECEIVED UNDER SECURITIES REPURCHASE AGREEMENTS (Notes 4b <strong>and</strong> 10c)<br />

87,383,466 86,178,324<br />

Own portfolio 47,160,396 32,371,661<br />

Third-party portfolio 39,331,135 53,635,480<br />

Free portfolio 891,935 171,183<br />

FUNDS FROM ACCEPTANCE AND ISSUANCE OF SECURITIES (Notes 4b <strong>and</strong> 10d)<br />

15,325,610 10,970,048<br />

Real estate, mortgage, credit <strong>and</strong> similar notes 10,421,550 8,298,962<br />

Debentures 1,522,670 156,775<br />

Foreign borrowings through securities 3,381,390 2,514,311<br />

INTERBANK ACCOUNTS<br />

4,459,842 4,049,463<br />

Pending settlement 3,059,156 2,991,610<br />

Correspondents 1,400,686 1,057,853<br />

INTERBRANCH ACCOUNTS<br />

3,821,153 2,999,373<br />

Third-party funds in transit 3,766,515 2,848,971<br />

Internal transfer of funds 54,638 150,402<br />

BORROWINGS AND ONLENDING (Notes 4b <strong>and</strong> 10e)<br />

18,474,040 14,465,005<br />

Borrowings 11,565,391 8,492,236<br />

Onlending 6,908,649 5,972,769<br />

DERIVATIVE FINANCIAL INSTRUMENTS (Notes 4d <strong>and</strong> 7h)<br />

6,013,572 5,562,134<br />

TECHNICAL PROVISIONS FOR INSURANCE, PENSION PLAN AND CAPITALIZATION (Notes 4n II <strong>and</strong> 11a)<br />

10,247,038 8,803,153<br />

OTHER LIABILITIES<br />

80,355,791 81,607,495<br />

Collection <strong>and</strong> payment of taxes <strong>and</strong> contributions 3,706,816 3,377,497<br />

Foreign exchange portfolio (Note 9) 20,632,545 34,376,024<br />

Social <strong>and</strong> statutory (Note 16b II) 3,199,582 2,639,059<br />

Tax <strong>and</strong> social security contributions (Notes 4o, 4p <strong>and</strong> 14c) 8,695,368 6,693,219<br />

Negotiation <strong>and</strong> intermediation of securities 3,048,026 1,569,977<br />

Credit card operations (Note 4e) 29,237,982 21,045,977<br />

Subordinated debt (Note 10f) 963,023 1,174,634<br />

Sundry (Note 13c) 10,872,449 10,731,108<br />

LONG-TERM LIABILITIES<br />

270,082,941 230,469,394<br />

DEPOSITS (Notes 4b <strong>and</strong> 10b)<br />

65,951,463 74,331,076<br />

Interbank deposits 90,515 213,737<br />

Time deposits 65,860,948 74,117,339<br />

DEPOSITS RECEIVED UNDER SECURITIES REPURCHASE AGREEMENTS (Notes 4b <strong>and</strong> 10c)<br />

68,252,613 40,486,132<br />

Own portfolio 57,577,240 36,499,025<br />

Third-party portfolio 123,614 340<br />

Free portfolio 10,551,759 3,986,767<br />

FUNDS FROM ACCEPTANCES AND ISSUANCE OF SECURITIES (Notes 4b <strong>and</strong> 10d)<br />

8,053,711 7,567,557<br />

Real estate, mortgage, credit <strong>and</strong> similar notes 1,033,738 875,639<br />

Debentures 1,106,433 2,731,931<br />

Foreign borrowings through securities 5,913,540 3,959,987<br />

BORROWINGS AND ONLENDING (Notes 4b <strong>and</strong> 10e)<br />

24,785,011 18,343,079<br />

Borrowings 2,831,609 3,654,410<br />

Onlending 21,953,402 14,688,669<br />

DERIVATIVE FINANCIAL INSTRUMENTS (Notes 4d <strong>and</strong> 7h)<br />

3,063,328 1,896,269<br />

TECHNICAL PROVISIONS FOR INSURANCE, PENSION PLAN AND CAPITALIZATION (Notes 4n II <strong>and</strong> 11a)<br />

48,242,485 41,174,501<br />

OTHER LIABILITIES<br />

51,734,330 46,670,780<br />

Foreign exchange portfolio (Note 9) 766,188 2,345,964<br />

Tax <strong>and</strong> social security contributions (Notes 4o, 4p <strong>and</strong> 14c) 12,637,200 16,667,342<br />

Credit card operations (Note 4e) 9,039 12,345<br />

Subordinated debt (Note 10f) 32,054,473 21,597,977<br />

Sundry (Note 13c) 6,267,430 6,047,152<br />

DEFERRED INCOME (Note 4q)<br />

236,560 231,773<br />

MINORITY INTEREST IN SUBSIDIARIES (Note 16e)<br />

3,658,172 3,442,862<br />

STOCKHOLDERS’ EQUITY (Note 16)<br />

57,225,072 48,861,594<br />

Capital<br />

45,000,000 45,000,000<br />

Capital reserves<br />

578,390 631,512<br />

Revenue reserves<br />

12,210,816 4,096,766<br />

Asset valuation adjustment (Notes 4c, 4d <strong>and</strong> 7d)<br />

156,846 246,828<br />

(Treasury shares)<br />

(720,980) (1,113,512)<br />

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY<br />

686,248,444 612,398,934<br />

<strong>Itaú</strong> Unibanco S.A. – - September0, 2010 61