MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pro Forma <strong>Financial</strong> <strong>Statements</strong> by Segment<br />

Commercial Bank<br />

The Commercial Bank result is derived in the offering of<br />

financial products <strong>and</strong> banking services to a diversified<br />

client base, including individuals <strong>and</strong> companies. The<br />

segment includes retail clients (individuals <strong>and</strong> very small<br />

companies), high-income clients, wealthy clients (private<br />

bank) <strong>and</strong> small <strong>and</strong> mid-size companies.<br />

In the third quarter of 2010, recurring net income of the<br />

Commercial Bank totaled R$ 1,483 million, remaining<br />

practically stable. In this quarter there was the 6.6%<br />

growth in financial margin with clients, mainly driven by<br />

growth in the loan portfolio.<br />

The non-interest expenses grew 5.4% over the previous<br />

quarter, mainly caused by the intensification of the<br />

migration process of Unibanco's branch platform to <strong>Itaú</strong>.<br />

The credit portfolio totaled R$ 114,805 million, or a 5%<br />

increase compared with the prior period. The commercial<br />

Bank return on allocated capital reached 31.7% per annum<br />

while the efficiency ratio stood at 53.3% in the period.<br />

Some Commercial Bank Highlights:<br />

Assets Under Management (AUM)<br />

R$ billion<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

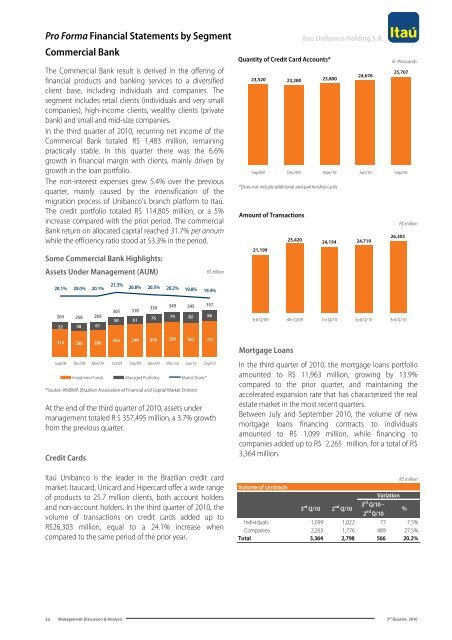

Quantity of Credit Card Accounts*<br />

in thous<strong>and</strong>s<br />

25,707<br />

24,676<br />

23,520 23,280 23,800<br />

Sep/09 Dec/09 Mar/10 Jun/10 Sep/10<br />

*Does not include additional <strong>and</strong> partnership cards<br />

Amount of Transactions<br />

R$ million<br />

26,303<br />

25,420<br />

24,154 24,719<br />

21,199<br />

20.1% 20.0% 20.1% 21.3% 20.8% 20.5% 20.2% 19.8% 19.4%<br />

265 258 269<br />

52<br />

58 61<br />

305 310<br />

59 61<br />

334 349 345 357<br />

76 79 82 86<br />

3rd Q/09 4th Q/09 1st Q/10 2nd Q/10 3rd Q/10<br />

214 200 208<br />

245 249 258 269 262<br />

Sep/08 Dec/08 Mar/09 Jun/09 Sep/09 Dec/09 Mar/10 Jun/10 Sep/10<br />

Investment Funds Managed Portfolios Market Share *<br />

*Source: ANBIMA (Brazilian Association of <strong>Financial</strong> <strong>and</strong> Capital Market Entities)<br />

At the end of the third quarter of 2010, assets under<br />

management totaled R $ 357,495 million, a 3.7% growth<br />

from the previous quarter.<br />

Credit Cards<br />

<strong>Itaú</strong> Unibanco is the leader in the Brazilian credit card<br />

market. Itaucard, Unicard <strong>and</strong> Hipercard offer a wide range<br />

of products to 25.7 million clients, both account holders<br />

<strong>and</strong> non-account holders. In the third quarter of 2010, the<br />

volume of transactions on credit cards added up to<br />

R$26,303 million, equal to a 24.1% increase when<br />

compared to the same period of the prior year.<br />

272<br />

Mortgage Loans<br />

In the third quarter of 2010, the mortgage loans portfolio<br />

amounted to R$ 11,963 million, growing by 13.9%<br />

compared to the prior quarter, <strong>and</strong> maintaining the<br />

accelerated expansion rate that has characterized the real<br />

estate market in the most recent quarters.<br />

Between July <strong>and</strong> September 2010, the volume of new<br />

mortgage loans financing contracts to individuals<br />

amounted to R$ 1,099 million, while financing to<br />

companies added up to R$ 2,265 million, for a total of R$<br />

3,364 million.<br />

R$ million<br />

Volume of contracts<br />

Variation<br />

3 rd Q/10 2 nd Q/10<br />

3 rd Q/10 –<br />

2 nd Q/10<br />

%<br />

Individuals 1,099 1,022 77 7.5%<br />

Companies 2,265 1,776 489 27.5%<br />

Total 3,364 2,798 566 20.2%<br />

34<br />

Management Discussion & Analysis 3 rd Quarter, 2010