MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

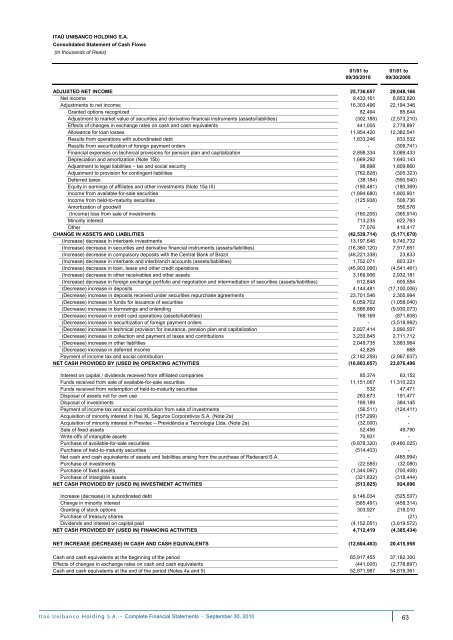

ITAÚ UNIBANCO HOLDING S.A.<br />

Consolidated Statement of Cash Flows<br />

(In thous<strong>and</strong>s of Reais)<br />

01/01 to<br />

09/30/2010<br />

01/01 to<br />

09/30/2009<br />

ADJUSTED NET INCOME<br />

25,736,657 29,048,166<br />

Net income<br />

9,433,161 6,853,820<br />

Adjustments to net income:<br />

16,303,496 22,194,346<br />

Granted options recognized 82,494 85,644<br />

Adjustment to market value of securities <strong>and</strong> derivative financial instruments (assets/liabilities) (302,188) (2,573,210)<br />

Effects of changes in exchange rates on cash <strong>and</strong> cash equivalents 441,005 2,778,897<br />

Allowance for loan losses 11,954,420 12,382,541<br />

Results from operations with subordinated debt 1,833,246 833,532<br />

Results from securitization of foreign payment orders - (309,741)<br />

<strong>Financial</strong> expenses on technical provisions for pension plan <strong>and</strong> capitalization 2,898,334 3,089,433<br />

Depreciation <strong>and</strong> amortization (Note 15b) 1,669,292 1,640,143<br />

Adjustment to legal liabilities – tax <strong>and</strong> social security 98,898 1,809,860<br />

Adjustment to provision for contingent liabilities (762,828) (305,323)<br />

Deferred taxes (38,184) (590,540)<br />

Equity in earnings of affiliates <strong>and</strong> other investments (Note 15a III) (180,481) (180,369)<br />

Income from available-for-sale securities (1,894,680) 1,800,901<br />

Income from held-to-maturity securities (125,938) 508,736<br />

Amortization of goodwill - 556,576<br />

(Income) loss from sale of investments (160,205) (365,914)<br />

Minority interest 713,235 622,763<br />

Other 77,076 410,417<br />

CHANGE IN ASSETS AND LIABILITIES<br />

(42,539,714) (5,171,670)<br />

(Increase) decrease in interbank investments<br />

13,197,646 9,740,732<br />

(Increase) decrease in securities <strong>and</strong> derivative financial instruments (assets/liabilities)<br />

(16,360,120) 7,917,651<br />

(Increase) decrease in compulsory deposits with the Central Bank of Brazil<br />

(48,221,338) 23,833<br />

(Increase) decrease in interbank <strong>and</strong> interbranch accounts (assets/liabilities)<br />

1,752,071 803,321<br />

(Increase) decrease in loan, lease <strong>and</strong> other credit operations<br />

(45,903,066) (4,541,461)<br />

(Increase) decrease in other receivables <strong>and</strong> other assets<br />

3,169,906 2,932,181<br />

(Increase) decrease in foreign exchange portfolio <strong>and</strong> negotiation <strong>and</strong> intermediation of securities (assets/liabilities)<br />

612,848 605,584<br />

(Decrease) increase in deposits<br />

4,144,481 (17,100,006)<br />

(Decrease) increase in deposits received under securities repurchase agreements<br />

23,701,546 2,305,994<br />

(Decrease) increase in funds for issuance of securities<br />

6,059,702 (1,058,040)<br />

(Decrease) increase in borrowings <strong>and</strong> onlending<br />

8,566,880 (9,930,073)<br />

(Decrease) increase in credit card operations (assets/liabilities)<br />

768,169 (871,608)<br />

(Decrease) increase in securitization of foreign payment orders<br />

- (3,518,992)<br />

(Decrease) increase in technical provision for insurance, pension plan <strong>and</strong> capitalization 2,827,414 3,890,507<br />

(Decrease) increase in collection <strong>and</strong> payment of taxes <strong>and</strong> contributions<br />

3,233,845 2,711,712<br />

(Decrease) increase in other liabilities<br />

2,049,735 3,883,964<br />

(Decrease) increase in deferred income 42,826 668<br />

Payment of income tax <strong>and</strong> social contribution<br />

(2,182,259) (2,967,637)<br />

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES<br />

(16,803,057) 23,876,496<br />

Interest on capital / dividends received from affiliated companies<br />

Funds received from sale of available-for-sale securities<br />

Funds received from redemption of held-to-maturity securities<br />

Disposal of assets not for own use<br />

Disposal of investments<br />

Payment of income tax <strong>and</strong> social contribution from sale of investments<br />

Acquisition of minority interest in <strong>Itaú</strong> XL Seguros Corporativos S.A. (Note 2a)<br />

Acquisition of minority interest in Previtec – Previdência e Tecnologia Ltda. (Note 2a)<br />

Sale of fixed assets<br />

Write-offs of intangible assets<br />

Purchase of available-for-sale securities<br />

Purchase of held-to-maturity securities<br />

Net cash <strong>and</strong> cash equivalents of assets <strong>and</strong> liabilities arising from the purchase of Redecard S.A.<br />

Purchase of investments<br />

Purchase of fixed assets<br />

Purchase of intangible assets<br />

NET CASH PROVIDED BY (USED IN) INVESTMENT ACTIVITIES<br />

85,374 63,152<br />

11,151,067 11,310,223<br />

532 47,471<br />

263,673 191,477<br />

189,189 384,145<br />

(56,511) (124,411)<br />

(157,299) -<br />

(32,000) -<br />

52,456 49,790<br />

70,931 -<br />

(9,878,320) (9,460,025)<br />

(514,403) -<br />

- (485,994)<br />

(22,585) (32,080)<br />

(1,344,097) (700,408)<br />

(321,832) (318,444)<br />

(513,825) 924,896<br />

Increase (decrease) in subordinated debt 9,146,034 (525,537)<br />

Change in minority interest (585,491) (458,314)<br />

Granting of stock options 303,927 218,010<br />

Purchase of treasury shares - (21)<br />

Dividends <strong>and</strong> interest on capital paid (4,152,051) (3,619,572)<br />

NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES 4,712,419 (4,385,434)<br />

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS (12,604,463) 20,415,958<br />

Cash <strong>and</strong> cash equivalents at the beginning of the period<br />

65,917,455 37,182,300<br />

Effects of changes in exchange rates on cash <strong>and</strong> cash equivalents (441,005) (2,778,897)<br />

Cash <strong>and</strong> cash equivalents at the end of the period (Notes 4a <strong>and</strong> 5)<br />

52,871,987 54,819,361<br />

<strong>Itaú</strong> Unibanco S.A. – - September0, 2010 63