MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

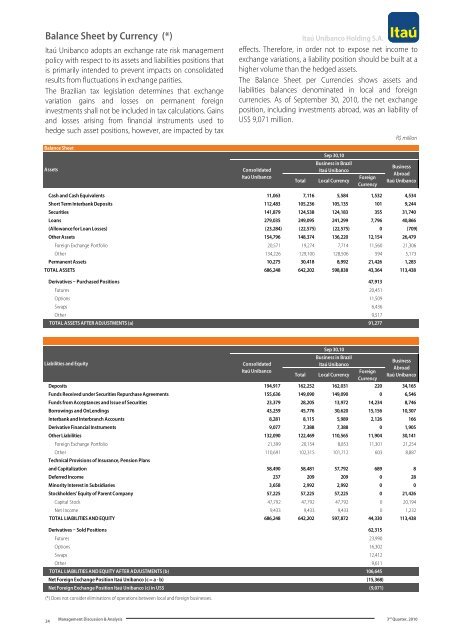

Balance Sheet by Currency (*)<br />

<strong>Itaú</strong> Unibanco adopts an exchange rate risk management<br />

policy with respect to its assets <strong>and</strong> liabilities positions that<br />

is primarily intended to prevent impacts on consolidated<br />

results from fluctuations in exchange parities.<br />

The Brazilian tax legislation determines that exchange<br />

variation gains <strong>and</strong> losses on permanent foreign<br />

investments shall not be included in tax calculations. Gains<br />

<strong>and</strong> losses arising from financial instruments used to<br />

hedge such asset positions, however, are impacted by tax<br />

Balance Sheet<br />

Assets<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

effects. Therefore, in order not to expose net income to<br />

exchange variations, a liability position should be built at a<br />

higher volume than the hedged assets.<br />

The Balance Sheet per Currencies shows assets <strong>and</strong><br />

liabilities balances denominated in local <strong>and</strong> foreign<br />

currencies. As of September 30, 2010, the net exchange<br />

position, including investments abroad, was an liability of<br />

US$ 9,071 million.<br />

Consolidated<br />

<strong>Itaú</strong> Unibanco<br />

Total<br />

Sep 30,10<br />

Business in Brazil<br />

<strong>Itaú</strong> Unibanco<br />

Local Currency<br />

Foreign<br />

Currency<br />

R$ million<br />

Business<br />

Abroad<br />

<strong>Itaú</strong> Unibanco<br />

Cash <strong>and</strong> Cash Equivalents 11,063 7,116 5,584 1,532 4,534<br />

Short Term Interbank Deposits 112,483 105,236 105,135 101 9,244<br />

Securities 141,879 124,538 124,183 355 31,740<br />

Loans 279,035 249,095 241,299 7,796 40,866<br />

(Allowance for Loan Losses) (23,284) (22,575) (22,575) 0 (709)<br />

Other Assets 154,796 148,374 136,220 12,154 26,479<br />

Foreign Exchange Portfolio 20,571 19,274 7,714 11,560 21,306<br />

Other 134,226 129,100 128,506 594 5,173<br />

Permanent Assets 10,275 30,418 8,992 21,426 1,283<br />

TOTAL ASSETS 686,248 642,202 598,838 43,364 113,438<br />

Derivatives – Purchased Positions 47,913<br />

Futures 20,451<br />

Options 11,509<br />

Swaps 6,436<br />

Other<br />

TOTAL ASSETS AFTER ADJUSTMENTS (a)<br />

9,517<br />

91,277<br />

Liabilities <strong>and</strong> Equity<br />

Consolidated<br />

<strong>Itaú</strong> Unibanco<br />

Sep 30,10<br />

Business in Brazil<br />

<strong>Itaú</strong> Unibanco<br />

Total Local Currency<br />

Foreign<br />

Currency<br />

Deposits 194,917 162,252 162,031 220 34,165<br />

Funds Received under Securities Repurchase Agreements 155,636 149,090 149,090 0 6,546<br />

Funds from Acceptances <strong>and</strong> Issue of Securities 23,379 28,205 13,972 14,234 8,746<br />

Borrowings <strong>and</strong> OnLendings 43,259 45,776 30,620 15,156 10,307<br />

Interbank <strong>and</strong> Interbranch Accounts 8,281 8,115 5,989 2,126 166<br />

Derivative <strong>Financial</strong> Instruments 9,077 7,388 7,388 0 1,905<br />

Other Liabilities 132,090 122,469 110,565 11,904 30,141<br />

Foreign Exchange Portfolio 21,399 20,154 8,853 11,301 21,254<br />

Other 110,691 102,315 101,712 603 8,887<br />

Technical Provisions of Insurance, Pension Plans<br />

<strong>and</strong> Capitalization 58,490 58,481 57,792 689 8<br />

Deferred Income 237 209 209 0 28<br />

Minority Interest in Subsidiaries 3,658 2,992 2,992 0 0<br />

Stockholders' Equity of Parent Company 57,225 57,225 57,225 0 21,426<br />

Capital Stock 47,792 47,792 47,792 0 20,194<br />

Net Income 9,433 9,433 9,433 0 1,232<br />

TOTAL LIABILITIES AND EQUITY<br />

686,248 642,202 597,872 44,330 113,438<br />

Derivatives – Sold Positions 62,315<br />

Futures 23,990<br />

Options 16,302<br />

Swaps 12,412<br />

Other<br />

TOTAL LIABILITIES AND EQUITY AFTER ADJUSTMENTS (b)<br />

9,611<br />

106,645<br />

Net Foreign Exchange Position <strong>Itaú</strong> Unibanco (c = a - b) (15,368)<br />

Net Foreign Exchange Position <strong>Itaú</strong> Unibanco (c) in US$ (9,071)<br />

(*) Does not consider eliminations of operations between local <strong>and</strong> foreign businesses.<br />

Business<br />

Abroad<br />

<strong>Itaú</strong> Unibanco<br />

24<br />

Management Discussion & Analysis 3 rd Quarter, 2010