MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Pro Forma <strong>Financial</strong> <strong>Statements</strong> by Segment<br />

<strong>Itaú</strong> BBA<br />

<strong>Itaú</strong> BBA segment is responsible for banking operations<br />

with large companies <strong>and</strong> investment bank services. <strong>Itaú</strong><br />

BBA’s net income added up to R$ 789 million in the third<br />

quarter of 2010, increasing by 33.2% compared to the<br />

prior quarter. Return on allocated capital stood at 26.1%<br />

per year, while the efficiency ratio reached 35.7% in the<br />

period. The financial margin with clients totaled R$ 1,164<br />

million, or a 5.0% rise from the prior quarter.<br />

The outst<strong>and</strong>ing quality level of the credit portfolio must<br />

be highlighted, with 94.0% of the credits ascribed risk<br />

ratings “AA”, “A” <strong>and</strong> “B”, in accordance with the criteria set<br />

forth in the Brazilian Monetary Council Resolution 2,682. In<br />

this context, the result of loan losses ended the third<br />

quarter as R$ 143 million, mainly due to reversal of<br />

provisions amounting to R $ 110 million.<br />

In the third quarter, banking service fees totaled R$ 468<br />

million, declining by 3.9% when compared to the prior<br />

quarter, mostly as a result of the high volume of<br />

investment bank operations carried out in the second<br />

quarter of 2010. Non-interest expenses amounted R$ 533<br />

million, or a 1.7% decrease from the prior quarter.<br />

Consumer Credit<br />

The Consumer Credit segment result includes financial<br />

products <strong>and</strong> services offered to customers who are nonaccount<br />

holders. In the third quarter of 2010, net income<br />

of the segment was R$ 631 million, or a 7.0% decline in<br />

comparison with the second quarter of the year. Such<br />

variation is mainly related to the reduction in the financial<br />

margin with clients, since the willingness to make financed<br />

purchases on credit cards reduction on the this time of the<br />

year for seasonal reasons, <strong>and</strong> the increase in costs due to<br />

the expansion in the clients base <strong>and</strong> the replacement of<br />

cards under the migration from Unibanco to <strong>Itaú</strong>. Return<br />

on allocated capital was 33.7% per year, while the<br />

efficiency ratio reached 49.3% in the period. The credit<br />

portfolio totaled R$ 86,191 million, corresponding to a<br />

6.4% rise from the prior quarter balance.<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

On September 30, 2010, the financing of new vehicles<br />

accounted for 56.8% of the total vehicle portfolio balance,<br />

versus 56.1% at the end of the prior quarter. As result of<br />

changes introduced in the collection policy during the<br />

second quarter, we continued good performance in the<br />

recovery of credits previously written off as losses in this<br />

quarter.<br />

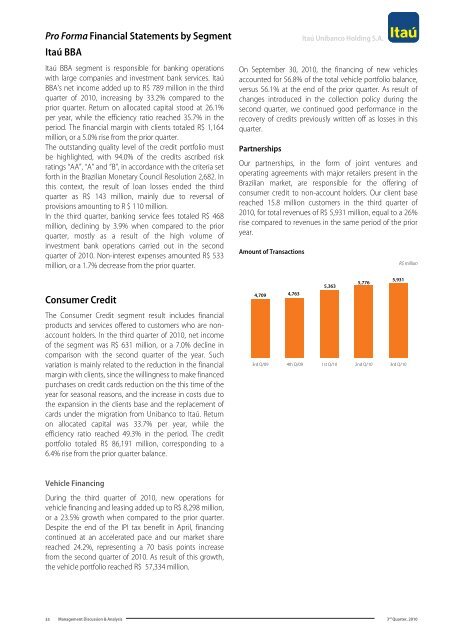

Partnerships<br />

Our partnerships, in the form of joint ventures <strong>and</strong><br />

operating agreements with major retailers present in the<br />

Brazilian market, are responsible for the offering of<br />

consumer credit to non-account holders. Our client base<br />

reached 15.8 million customers in the third quarter of<br />

2010, for total revenues of R$ 5,931 million, equal to a 26%<br />

rise compared to revenues in the same period of the prior<br />

year.<br />

Amount of Transactions<br />

4,709<br />

4,763<br />

5,363<br />

5,776<br />

5,931<br />

3rd Q/09 4th Q/09 1st Q/10 2nd Q/10 3rd Q/10<br />

R$ million<br />

Vehicle Financing<br />

During the third quarter of 2010, new operations for<br />

vehicle financing <strong>and</strong> leasing added up to R$ 8,298 million,<br />

or a 23.5% growth when compared to the prior quarter.<br />

Despite the end of the IPI tax benefit in April, financing<br />

continued at an accelerated pace <strong>and</strong> our market share<br />

reached 24.2%, representing a 70 basis points increase<br />

from the second quarter of 2010. As result of this growth,<br />

the vehicle portfolio reached R$ 57,334 million.<br />

35<br />

Management Discussion & Analysis 3 rd Quarter, 2010