MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

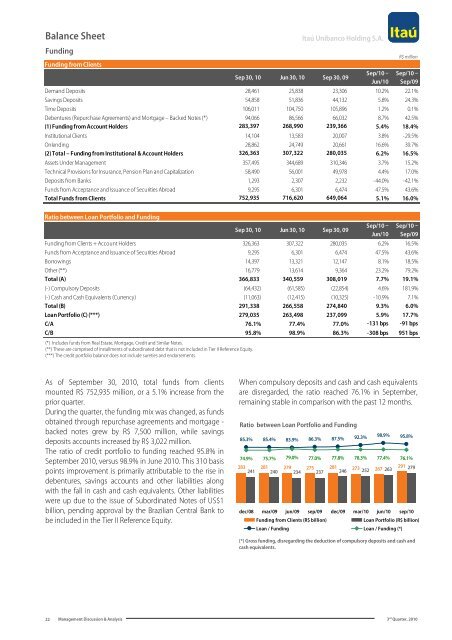

Balance Sheet<br />

Funding<br />

Funding from Clients<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

Sep 30, 10 Jun 30, 10 Sep 30, 09<br />

Sep/10 –<br />

Jun/10<br />

R$ million<br />

Sep/10 –<br />

Sep/09<br />

Dem<strong>and</strong> Deposits 28,461 25,838 23,306 10.2% 22.1%<br />

Savings Deposits 54,858 51,836 44,132 5.8% 24.3%<br />

Time Deposits 106,011 104,750 105,896 1.2% 0.1%<br />

Debentures (Repurchase Agreements) <strong>and</strong> Mortgage – Backed Notes (*) 94,066 86,566 66,032 8.7% 42.5%<br />

(1) Funding from Account Holders 283,397 268,990 239,366 5.4% 18.4%<br />

Institutional Clients 14,104 13,583 20,007 3.8% -29.5%<br />

Onlending 28,862 24,749 20,661 16.6% 39.7%<br />

(2) Total – Funding from Institutional & Account Holders 326,363 307,322 280,035 6.2% 16.5%<br />

Assets Under Management 357,495 344,689 310,346 3.7% 15.2%<br />

Technical Provisions for Insurance, Pension Plan <strong>and</strong> Capitalization 58,490 56,001 49,978 4.4% 17.0%<br />

Deposits from Banks 1,293 2,307 2,232 -44.0% -42.1%<br />

Funds from Acceptance <strong>and</strong> Issuance of Securities Abroad 9,295 6,301 6,474 47.5% 43.6%<br />

Total Funds from Clients 752,935 716,620 649,064 5.1% 16.0%<br />

Ratio between Loan Portfolio <strong>and</strong> Funding<br />

(*) Includes funds from Real Estate, Mortgage, Credit <strong>and</strong> Similar Notes.<br />

(**) These are comprised of installments of subordinated debt that is not included in Tier II Reference Equity.<br />

(***) The credit portfolio balance does not include sureties <strong>and</strong> endorsements.<br />

Sep 30, 10 Jun 30, 10 Sep 30, 09<br />

Sep/10 –<br />

Jun/10<br />

Sep/10 –<br />

Sep/09<br />

Funding from Clients + Account Holders 326,363 307,322 280,035 6.2% 16.5%<br />

Funds from Acceptance <strong>and</strong> Issuance of Securities Abroad 9,295 6,301 6,474 47.5% 43.6%<br />

Borrowings 14,397 13,321 12,147 8.1% 18.5%<br />

Other (**) 16,779 13,614 9,364 23.2% 79.2%<br />

Total (A) 366,833 340,559 308,019 7.7% 19.1%<br />

(-) Compulsory Deposits (64,432) (61,585) (22,854) 4.6% 181.9%<br />

(-) Cash <strong>and</strong> Cash Equivalents (Currency) (11,063) (12,415) (10,325) -10.9% 7.1%<br />

Total (B) 291,338 266,558 274,840 9.3% 6.0%<br />

Loan Portfolio (C) (***) 279,035 263,498 237,099 5.9% 17.7%<br />

C/A 76.1% 77.4% 77.0% -131 bps -91 bps<br />

C/B 95.8% 98.9% 86.3% -308 bps 951 bps<br />

As of September 30, 2010, total funds from clients<br />

mounted R$ 752,935 million, or a 5.1% increase from the<br />

prior quarter.<br />

During the quarter, the funding mix was changed, as funds<br />

obtained through repurchase agreements <strong>and</strong> mortgage -<br />

backed notes grew by R$ 7,500 million, while savings<br />

deposits accounts increased by R$ 3,022 million.<br />

The ratio of credit portfolio to funding reached 95.8% in<br />

September 2010, versus 98.9% in June 2010. This 310 basis<br />

points improvement is primarily attributable to the rise in<br />

debentures, savings accounts <strong>and</strong> other liabilities along<br />

with the fall in cash <strong>and</strong> cash equivalents. Other liabilities<br />

were up due to the issue of Subordinated Notes of US$1<br />

billion, pending approval by the Brazilian Central Bank to<br />

be included in the Tier II Reference Equity.<br />

When compulsory deposits <strong>and</strong> cash <strong>and</strong> cash equivalents<br />

are disregarded, the ratio reached 76.1% in September,<br />

remaining stable in comparison with the past 12 months.<br />

Ratio between Loan Portfolio <strong>and</strong> Funding<br />

85.3% 85.4% 83.9% 86.3% 87.5% 92.3% 98.9% 95.8%<br />

74.9% 75.7% 79.0% 77.0% 77.8% 78.3% 77.4% 76.1%<br />

283 281 279 275 281 273<br />

291<br />

241<br />

267<br />

240 234 237 246 252 263 279<br />

dec/08 mar/09 jun/09 sep/09 dec/09 mar/10 jun/10 sep/10<br />

Funding from Clients (R$ billion)<br />

Loan Portfolio (R$ billion)<br />

Loan / Funding Loan / Funding (*)<br />

(*) Gross funding, disregarding the deduction of compulsory deposits <strong>and</strong> cash <strong>and</strong><br />

cash equivalents.<br />

22<br />

Management Discussion & Analysis 3 rd Quarter, 2010