MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Pro Forma <strong>Financial</strong> <strong>Statements</strong> by Segment<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

Pro Forma Adjustments <strong>and</strong> Allocated Capital<br />

The pro forma financial information takes into account the<br />

impacts associated with the allocation of capital. To this<br />

end, adjustments were made to the financial statements,<br />

based on a proprietary model that considers the credit,<br />

market <strong>and</strong> operating risks, as well as the regulatory<br />

framework <strong>and</strong> the level of fixed asset formation.<br />

We determine the Risk Adjusted Return on Capital<br />

(RAROC), an operating performance indicator consistently<br />

adjusted to the capital required to support the risk of asset<br />

<strong>and</strong> liability positions taken.<br />

Adjustments made to the balance sheet <strong>and</strong> statement of<br />

income for the period are based on the business units’<br />

managerial information.<br />

The Corporate+Treasury column shows the results<br />

associated with excess capital, excess subordinated debt<br />

<strong>and</strong> the carrying cost of the net balance of deferred taxes.<br />

It also shows the cost of the treasury operation, equity in<br />

the earnings of companies not yet linked to the different<br />

segments, as well as the adjustments for minority interests<br />

in subsidiaries <strong>and</strong> the market financial margin.<br />

Since the 4 th quarter of 2009, the Corporate+Treasury<br />

column also comprises the consolidation of 30% of Porto<br />

Seguro.<br />

Income Tax <strong>and</strong> Social Contribution on Net Income effects<br />

on the payment of Interest on Own Capital for each<br />

segment were reversed <strong>and</strong> subsequently reallocated to<br />

the individual segments in proportion to the amount of<br />

Tier I capital, while the financial statements were adjusted<br />

in order to replace net book value with market level<br />

funding. The financial statements were then adjusted to<br />

include revenues associated with the allocated capital. The<br />

cost of subordinated debt <strong>and</strong> the related remuneration at<br />

market prices were allocated to the segments on a pro rata<br />

basis, in accordance with the Tier I allocated capital.<br />

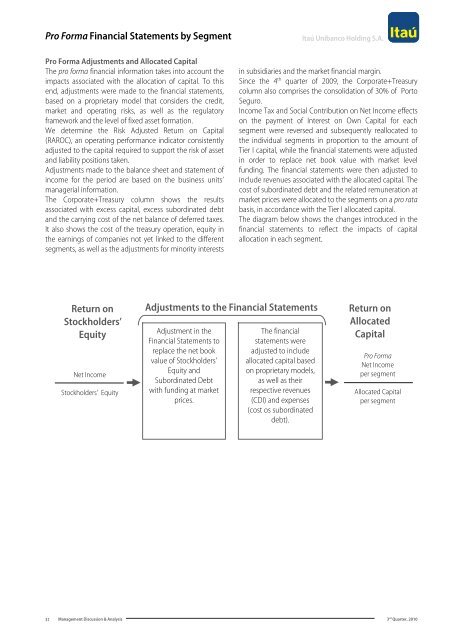

The diagram below shows the changes introduced in the<br />

financial statements to reflect the impacts of capital<br />

allocation in each segment.<br />

Return on<br />

Stockholders’<br />

Equity<br />

Net Income<br />

Stockholders’ Equity<br />

Adjustments to the <strong>Financial</strong> <strong>Statements</strong><br />

Adjustment in the<br />

<strong>Financial</strong> <strong>Statements</strong> to<br />

replace the net book<br />

value of Stockholders’<br />

Equity <strong>and</strong><br />

Subordinated Debt<br />

with funding at market<br />

prices.<br />

The financial<br />

statements were<br />

adjusted to include<br />

allocated capital based<br />

on proprietary models,<br />

as well as their<br />

respective revenues<br />

(CDI) <strong>and</strong> expenses<br />

(cost os subordinated<br />

debt).<br />

Return on<br />

Allocated<br />

Capital<br />

Pro Forma<br />

Net Income<br />

per segment<br />

Allocated Capital<br />

per segment<br />

31<br />

Management Discussion & Analysis 3 rd Quarter, 2010