MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

MD&A and Financial Statements (PDF) - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Balance Sheet<br />

Securities Portfolio<br />

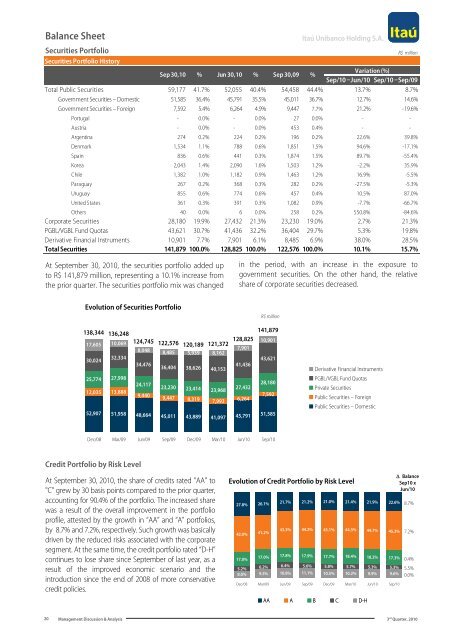

Securities Portfolio History<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

R$ million<br />

Sep 30,10 % Jun 30,10 % Sep 30,09 %<br />

Variation (%)<br />

Sep/10 –Jun/10 Sep/10 –Sep/09<br />

Total Public Securities 59,177 41.7% 52,055 40.4% 54,458 44.4% 13.7% 8.7%<br />

Government Securities – Domestic 51,585 36.4% 45,791 35.5% 45,011 36.7% 12.7% 14.6%<br />

Government Securities – Foreign 7,592 5.4% 6,264 4.9% 9,447 7.7% 21.2% -19.6%<br />

Portugal - 0.0% - 0.0% 27 0.0% - -<br />

Austria - 0.0% - 0.0% 453 0.4% - -<br />

Argentina 274 0.2% 224 0.2% 196 0.2% 22.6% 39.8%<br />

Denmark 1,534 1.1% 788 0.6% 1,851 1.5% 94.6% -17.1%<br />

Spain 836 0.6% 441 0.3% 1,874 1.5% 89.7% -55.4%<br />

Korea 2,043 1.4% 2,090 1.6% 1,503 1.2% -2.2% 35.9%<br />

Chile 1,382 1.0% 1,182 0.9% 1,463 1.2% 16.9% -5.5%<br />

Paraguay 267 0.2% 368 0.3% 282 0.2% -27.5% -5.3%<br />

Uruguay 855 0.6% 774 0.6% 457 0.4% 10.5% 87.0%<br />

United States 361 0.3% 391 0.3% 1,082 0.9% -7.7% -66.7%<br />

Others 40 0.0% 6 0.0% 258 0.2% 550.8% -84.6%<br />

Corporate Securities 28,180 19.9% 27,432 21.3% 23,230 19.0% 2.7% 21.3%<br />

PGBL/VGBL Fund Quotas 43,621 30.7% 41,436 32.2% 36,404 29.7% 5.3% 19.8%<br />

Derivative <strong>Financial</strong> Instruments 10,901 7.7% 7,901 6.1% 8,485 6.9% 38.0% 28.5%<br />

Total Securities 141,879 100.0% 128,825 100.0% 122,576 100.0% 10.1% 15.7%<br />

At September 30, 2010, the securities portfolio added up<br />

to R$ 141,879 million, representing a 10.1% increase from<br />

the prior quarter. The securities portfolio mix was changed<br />

in the period, with an increase in the exposure to<br />

government securities. On the other h<strong>and</strong>, the relative<br />

share of corporate securities decreased.<br />

Evolution of Securities Portfolio<br />

R$ million<br />

138,344 141,879<br />

136,248<br />

10,069 124,745 122,576 120,189 121,372 128,825 10,901<br />

17,605<br />

8,048<br />

7,901<br />

8,485 5,939 8,162<br />

30,024<br />

32,334<br />

43,621<br />

34,476<br />

41,436<br />

36,404 38,626 40,153<br />

25,774 27,998<br />

24,117<br />

28,180<br />

23,230 23,414<br />

13,888<br />

23,968<br />

27,432<br />

12,035<br />

9,440<br />

7,592<br />

9,447 8,319 7,993<br />

6,264<br />

52,907 51,958 48,664 45,011 43,889 41,097 45,791 51,585<br />

Derivative <strong>Financial</strong> Instruments<br />

PGBL/VGBL Fund Quotas<br />

Private Securities<br />

Public Securities – Foreign<br />

Public Securities – Domestic<br />

Dec/08 Mar/09 Jun/09 Sep/09 Dec/09 Mar/10 Jun/10 Sep/10<br />

Credit Portfolio by Risk Level<br />

At September 30, 2010, the share of credits rated "AA" to<br />

"C" grew by 30 basis points compared to the prior quarter,<br />

accounting for 90.4% of the portfolio. The increased share<br />

was a result of the overall improvement in the portfolio<br />

profile, attested by the growth in “AA” <strong>and</strong> “A” portfolios,<br />

by 8.7% <strong>and</strong> 7.2%, respectively. Such growth was basically<br />

driven by the reduced risks associated with the corporate<br />

segment. At the same time, the credit portfolio rated “D-H”<br />

continues to lose share since September of last year, as a<br />

result of the improved economic scenario <strong>and</strong> the<br />

introduction since the end of 2008 of more conservative<br />

credit policies.<br />

Evolution of Credit Portfolio by Risk Level<br />

27.8% 26.1% 21.7% 21.2% 21.0% 21.4% 21.9% 22.6%<br />

42.0% 41.2%<br />

43.3% 44.2% 45.1% 44.3% 44.7% 45.3%<br />

Dec/08 Mar/09 Jun/09 Sep/09 Dec/09 Mar/10 Jun/10 Sep/10<br />

AA<br />

A<br />

B<br />

C<br />

D-H<br />

Δ Balance<br />

Sep10 x<br />

Jun/10<br />

8.7%<br />

7.2%<br />

17.0%<br />

17.0% 17.8% 17.9% 17.7% 18.4% 18.2% 17.3% 0.4%<br />

5.2% 6.2% 6.4% 5.6% 5.8% 5.7% 5.3% 5.3% 5.5%<br />

8.0% 9.5% 10.8% 11.1% 10.5% 10.2% 9.9% 9.6% 0.0%<br />

20<br />

Management Discussion & Analysis 3 rd Quarter, 2010