alaska heating assistance programs policy manual - DPAweb ...

alaska heating assistance programs policy manual - DPAweb ...

alaska heating assistance programs policy manual - DPAweb ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

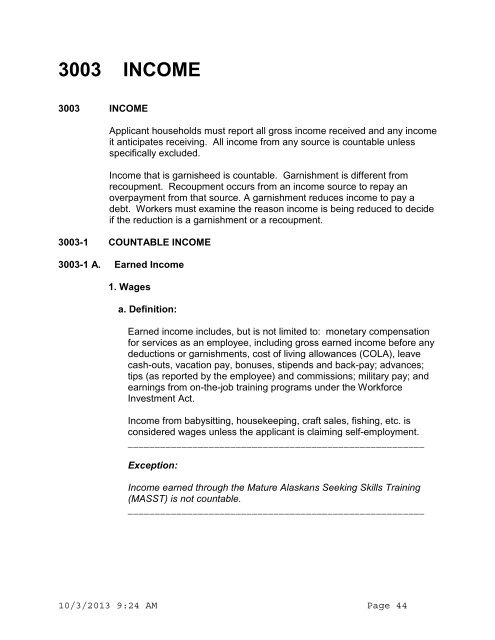

3003 INCOME<br />

3003 INCOME<br />

Applicant households must report all gross income received and any income<br />

it anticipates receiving. All income from any source is countable unless<br />

specifically excluded.<br />

Income that is garnisheed is countable. Garnishment is different from<br />

recoupment. Recoupment occurs from an income source to repay an<br />

overpayment from that source. A garnishment reduces income to pay a<br />

debt. Workers must examine the reason income is being reduced to decide<br />

if the reduction is a garnishment or a recoupment.<br />

3003-1 COUNTABLE INCOME<br />

3003-1 A. Earned Income<br />

1. Wages<br />

a. Definition:<br />

Earned income includes, but is not limited to: monetary compensation<br />

for services as an employee, including gross earned income before any<br />

deductions or garnishments, cost of living allowances (COLA), leave<br />

cash-outs, vacation pay, bonuses, stipends and back-pay; advances;<br />

tips (as reported by the employee) and commissions; military pay; and<br />

earnings from on-the-job training <strong>programs</strong> under the Workforce<br />

Investment Act.<br />

Income from babysitting, housekeeping, craft sales, fishing, etc. is<br />

considered wages unless the applicant is claiming self-employment.<br />

_______________________________________________________<br />

Exception:<br />

Income earned through the Mature Alaskans Seeking Skills Training<br />

(MASST) is not countable.<br />

_______________________________________________________<br />

10/3/2013 9:24 AM Page 44