alaska heating assistance programs policy manual - DPAweb ...

alaska heating assistance programs policy manual - DPAweb ...

alaska heating assistance programs policy manual - DPAweb ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

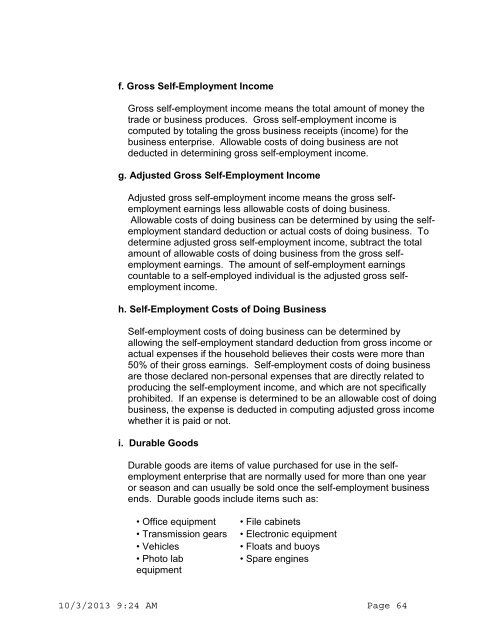

f. Gross Self-Employment Income<br />

Gross self-employment income means the total amount of money the<br />

trade or business produces. Gross self-employment income is<br />

computed by totaling the gross business receipts (income) for the<br />

business enterprise. Allowable costs of doing business are not<br />

deducted in determining gross self-employment income.<br />

g. Adjusted Gross Self-Employment Income<br />

Adjusted gross self-employment income means the gross selfemployment<br />

earnings less allowable costs of doing business.<br />

Allowable costs of doing business can be determined by using the selfemployment<br />

standard deduction or actual costs of doing business. To<br />

determine adjusted gross self-employment income, subtract the total<br />

amount of allowable costs of doing business from the gross selfemployment<br />

earnings. The amount of self-employment earnings<br />

countable to a self-employed individual is the adjusted gross selfemployment<br />

income.<br />

h. Self-Employment Costs of Doing Business<br />

Self-employment costs of doing business can be determined by<br />

allowing the self-employment standard deduction from gross income or<br />

actual expenses if the household believes their costs were more than<br />

50% of their gross earnings. Self-employment costs of doing business<br />

are those declared non-personal expenses that are directly related to<br />

producing the self-employment income, and which are not specifically<br />

prohibited. If an expense is determined to be an allowable cost of doing<br />

business, the expense is deducted in computing adjusted gross income<br />

whether it is paid or not.<br />

i. Durable Goods<br />

Durable goods are items of value purchased for use in the selfemployment<br />

enterprise that are normally used for more than one year<br />

or season and can usually be sold once the self-employment business<br />

ends. Durable goods include items such as:<br />

• Office equipment<br />

• Transmission gears<br />

• Vehicles<br />

• Photo lab<br />

equipment<br />

• File cabinets<br />

• Electronic equipment<br />

• Floats and buoys<br />

• Spare engines<br />

10/3/2013 9:24 AM Page 64