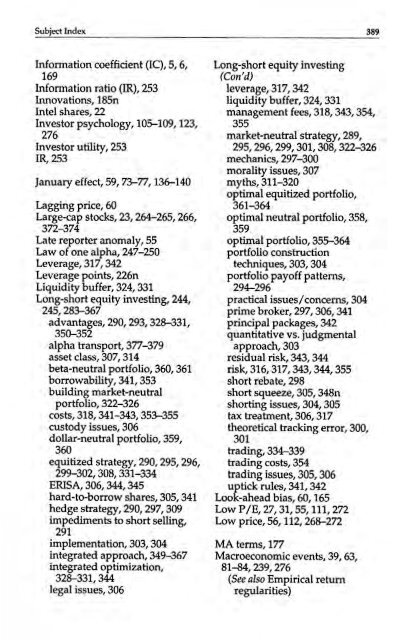

Subject Index 389 Information coefficient (IC), 5,6, 169 Information ratio (R), 253 Innovations, 185n Intel shares, 22 Investor psychology, 105-109,123, 276 Investor utility, 253 IR, 253 January effect, 59,73-77,136-140 Lagging price, 60 Large-cap stocks, 23,264-265,266, 372-374 Late reporter anomaly, 55 Law of one alpha, 247-250 Leverage, 317,342 Leverage points, 226n Liquidity buffer, 324,331 Long-short equity investing, 244, 245,283-367 advantages, 290,293,328-331, . 350-352 alpha transport, 377-379 asset class, 307,314 beta-neutral portfolio, 360,361 borrowability, 341,353 building market-neutral , portfolio, 322-326 costs, 318,341443,353-355 custody issues, 306 dollar-neutral portfolio, 359, 360 equitized strategy, 290,295,296, 299-302,308,331-334 ERISA, 306,344,345 hard-to-borrow shares, 305,341 hedge strategy, 290,297,309 impediments to short selling, 291 implementation, 303,304 integrated approach, 349-367 integrated optimization, 328-331,344 legal issues, 306 Long-short equity investing (Con’d) leverage, 317,342 liquidity buffer, 324,331 management fees, 318,343,354, 355 market-neutral strategy, 289, 295,296,299,301,308,322-326 mechanics, 297-300 morality issues, 307 myths, 311-320 optimal equitized portfolio, 361-364 optimal neutral portfolio, 358, 359 optimal portfolio, 355-364 portfolio construction techniques, 303,304 portfolio payoff patterns, 294-296 practical issues/concerns, 304 prime broker, 297,306,341 principal packages, 342 quantitative vs. judgmental approach, 303 residual risk, 343,344 risk, 316,317,343,344,355 short rebate, 298 short squeeze, 305,348n shorting issues, 304,305 tax treatment, 306,317 theoretical tracking error, 300, 301 trading, 334-339 trading costs, 354 trading issues, 305,306 uptick rules, 341,342 Look-ahead bias, 60,165 Low P/E, 27,31,55,111,272 Low price, 56,112,268-272 MA terms, 177 Macroeconomic events, 39,63, 81-84,239,276 (See also Empirical return regularities)

390 Subied Index MAE, 170,182 Market complexity, 12,15,20, 2545,236-238 anomalies, 26,27 anomalous pockets of inefficiency (API), 35-39 Bayesian random walk forecasting, 4143 empirical return regularities (ERRS), 37,3941 modeling empirical return regularities, 40,41 pure returns, 21,22,29-31,35 return effects (see Return effects) Market ineffiaency, 31,32 Market-neutral long-short portfolio, 289,295,296,299,301, 308,322-326 Market psychology, 105-109,123, 276 ME, 169,182 Mean absolute error (MAE), 170, 182 Mean error (ME), 169,182 Measurement error, 193-196 (See also Predictor specification) Measures of central tendency, 194, 195 Methodology: disentangling, 59-61 ' . forecasting techniques (see Forecasting techniques) value modeling (DDM), 110,113 Mispriced securities, 19 Missing data values, 209-212 Modeling empirical return regularities, 40,41 Molecular biology, 25 Monotone regression, 224n, 225n Moving-average (MA) terms, 177 Multicollinearity, 62 Multifactor CAPM, 33,64 Multivariate regression, 110 Multivariate time series techniques, 40 nth-order autocorrelation, 183n Ndive returns, 21-22,29,62,110, 268-272,274 Negative surprises, 38,58 Neglect, 56,111 Newton's laws of motion, 25 Nonlinearity, 22,239 (See also Distributed effects) Noise, 107,171 Nonzero intercepts, 44n OLS regression, 170 One unit of exposure, 113 One-way causality, 175 Opening prices, 150 Optimization techniques, 9,13, 231,232,241 Ordered systems, 20,25 Ordinary least-squares (0s) regression, 170 Out-of-sample tests, 40,170,171 Overfitting, 41,177 Overpricing, 327 Overreaction, 109 p value, 224n Pairs trading, 303 Passive management, 4,10,26, 370 Pearson correlation, 224n Performance attribution, 233 Portfolio construction, 2,241-242, 229-282 high-definition style rotation, 263-282 holistic approach, 23.5-250 residual risk, 251-261 unified approach, 235-246 (See also Long-short equity investing) Portfolio optimization, 2,13,231, 232,241 Portmanteau Q statistic, 174 Predictor specification, 193-227 alternative specifications for portfolio screening, 196-204

- Page 2 and 3:

EQUITY MANAGEMENT.

- Page 4 and 5:

EQUITY MANAGEMENT Quantitative Anal

- Page 6 and 7:

To Ilene, Lauren, Julie, Sam, and E

- Page 8 and 9:

CONTENTS Foreword by Harry M. Marko

- Page 10 and 11:

Contents ix Chapter 4 Calendar Anom

- Page 12 and 13:

Contents xi Implications 272 High-D

- Page 14 and 15:

FOREWORD by Harry M. Markowitz, Nob

- Page 16 and 17:

Foreword xv In practice, of course,

- Page 18 and 19:

Foreword xvii that an RDM would con

- Page 20 and 21:

xix

- Page 22 and 23:

INTRODUCTION Life on the Leading Ed

- Page 24 and 25:

Life on the Leading Edge 3 tion abo

- Page 26 and 27:

Life on the Leading Edge 5 clude th

- Page 28 and 29:

Life on the Edge Leading 7 stocks t

- Page 30 and 31:

Life on the Leading Edge 9 . Quanti

- Page 32 and 33:

Life on the Leading Edge 11 By the

- Page 34 and 35:

Life on the Leading Edge 13 ple, st

- Page 36 and 37:

Life on the Leading Edge 15 find be

- Page 38 and 39:

Life on the Leading Edge 17 equal t

- Page 40 and 41:

P A R T ONE Selecting Securities A

- Page 42 and 43:

Selectine Securities 21 stocks. Suc

- Page 44 and 45:

selecting secunties 23 unmoved by s

- Page 46 and 47:

CHAPTER 1 The Complexity of the Sto

- Page 48 and 49:

The Complexity of the Stock Market

- Page 50 and 51:

The Complexity of the Stock Market

- Page 52 and 53:

The Complexity of the St& Market 31

- Page 54 and 55:

The Complexity of the Stock Market

- Page 56 and 57:

The Complexity of the Stock Market

- Page 58 and 59:

The Complexity of the St& Market 37

- Page 60 and 61:

The of the Complexity Stock Market

- Page 62 and 63:

The Complexity of the Stock Market

- Page 64 and 65:

The Comdexitv of the Stock Market 4

- Page 66 and 67:

The Complexity of the Stock Market

- Page 68 and 69:

V 7

- Page 70 and 71:

Disentangling Equity Return Regular

- Page 72 and 73:

Disentangling Equity Rehun Regulari

- Page 74 and 75:

Disentangling Equity Rehun Regulari

- Page 76 and 77:

Disentangling Equity Return Regular

- Page 78 and 79:

Disentangling Equity Return Regular

- Page 80 and 81:

Disentangling Equity Return Regular

- Page 82 and 83:

Disentangling Equity Return Regular

- Page 85 and 86:

64 selecting securities aged 59 bas

- Page 87 and 88:

66 selecting Securities FIGURE 2-2

- Page 89 and 90:

68 selecting securities FIGURE 2-3

- Page 91 and 92:

70 selecting securities tic of 17.8

- Page 93 and 94:

72 selecting securities Some Implic

- Page 95 and 96:

74 selecting securities Table 2-2 d

- Page 98 and 99:

Disentangling Equity Return Regular

- Page 100:

I l

- Page 103 and 104:

82 Seleaine Securities these time-s

- Page 105 and 106:

84 selecting securities of 9.7. The

- Page 107 and 108:

86 selecting securities 2. There ar

- Page 109 and 110:

and deferring gains [as per Constan

- Page 111 and 112:

90 selecting securities 35. For exa

- Page 113 and 114:

92 selecting securities 49. Before

- Page 115 and 116:

94 selecting securities Ball, R. 19

- Page 117 and 118:

96 selecting securities Iowa, Ames.

- Page 119 and 120:

98 Seleaine securities James, W. an

- Page 121 and 122:

100 selecting securities Nicholson,

- Page 123 and 124:

102 selecting securities Tinic, S.

- Page 125 and 126:

104 selecting securities VALUE AND

- Page 127 and 128:

106 selecting securities Street Jou

- Page 129 and 130:

108 Selectine Securities This is no

- Page 131 and 132:

110 selecting securities plaining s

- Page 133 and 134:

112

- Page 135 and 136:

114 selecting securities transient

- Page 137 and 138:

116 selecting securities Na'ive Exp

- Page 139 and 140:

118 selecting securities (1988c)l.

- Page 141 and 142:

l20 selecting securities average of

- Page 143 and 144:

122 selecting securities FIGURE 3-1

- Page 145 and 146:

124 selecting securities We have de

- Page 147 and 148:

126 selecting securities movements

- Page 149 and 150:

l28 selecting securities 34. Pensio

- Page 151 and 152:

130 selecting securities Einhom, S.

- Page 153 and 154:

132 Selectine securities Poterba, J

- Page 155 and 156:

This Page Intentionally Left Blank

- Page 157 and 158:

136 selecting securities The availa

- Page 159 and 160:

138 selecting securities subsequent

- Page 161 and 162:

140 selecting securities FIGURE 4-1

- Page 163 and 164:

142 Selectine securities FIGURE 4-2

- Page 165 and 166:

144 selecting securities others usi

- Page 167 and 168:

146 Selectine Securities FIGURE 4-3

- Page 169 and 170:

l48 SelectirlE securities a market

- Page 171 and 172:

150 . selecringsecurities There is

- Page 173 and 174:

152 selecting securities 1981 and 1

- Page 175 and 176:

154 seleding securities Chari,V., R

- Page 177 and 178:

156 Selectine securities McNichols,

- Page 179 and 180:

This Page Intentionally Left Blank

- Page 181 and 182:

160 selecting securities that betwe

- Page 183 and 184:

162 selecting securities Handa, Kot

- Page 185 and 186:

164 selecting securities risk does

- Page 187 and 188:

166 selecting securities returns ac

- Page 189 and 190:

168 selecting securities ket return

- Page 191 and 192:

~ more 170 Selectine securities tiv

- Page 193 and 194:

h h h h W v ) 000000 m N m w r "80q

- Page 195 and 196:

~~~ ~ ~~ 174 selecting securities A

- Page 197 and 198:

176 selecting securities hibit feed

- Page 199 and 200:

178 Seledine securities multivariat

- Page 201 and 202:

-2 1982 1983 1984 1985 1986 1987 18

- Page 203 and 204:

182 selecting securities rate produ

- Page 205 and 206:

184 Seledine Securities 11. Further

- Page 207 and 208:

186 Seleaine securities REFERENCES

- Page 209 and 210:

188 selecting securities Fama, E. a

- Page 211 and 212:

190 selecting securities Miller, E.

- Page 213 and 214:

This Page Intentionally Left Blank

- Page 215 and 216:

194 Selectine Securities modeling p

- Page 217 and 218:

196 selecting securities surement e

- Page 220:

Earnings Estimates, Predictor Speaf

- Page 224 and 225:

Earnings Estimates, Predictor Speci

- Page 226 and 227:

Earnings Estimates, Predictor Speci

- Page 228 and 229:

Earnings Estimates, Predictor Speci

- Page 230 and 231:

Earnings Estimates, Predictor Speci

- Page 232 and 233:

0 a I "F c2 . 2 0

- Page 234:

Earnings Estimates, Predictor Speci

- Page 237 and 238:

216 selecting securities The Return

- Page 239 and 240:

U) J U) C Q) U) C S r jo-0 eke I C

- Page 241 and 242:

?68% $1-0 I 220

- Page 243 and 244:

222 Seleaine Securitiff ings data f

- Page 245 and 246:

224 selecting securities 4. The dif

- Page 247 and 248:

226 selecting securities 20. Note t

- Page 249 and 250:

This Page Intentionally Left Blank

- Page 251 and 252:

230 Managing Portfolios have concen

- Page 253 and 254:

232 Managing Portfolios portfolios.

- Page 255 and 256:

234 Manaeine Portfolios of investme

- Page 257 and 258:

236 Managing Portfolios There is, n

- Page 259 and 260:

238 Managing Portfolios bound to ig

- Page 261 and 262:

240 Managing Portfolios expected to

- Page 263 and 264:

242 Managing Portfolios mance attri

- Page 265 and 266:

244 Managing Portfolios those inves

- Page 267 and 268:

246 Managing Portfolios vide a bigg

- Page 269 and 270:

248 Managing Portfolios If the firm

- Page 271 and 272:

250 Managing Portfolios REFERENCE J

- Page 273 and 274:

252 Managing Portfolios This invest

- Page 275 and 276:

254 Managing Portfolios FIGURE S-l

- Page 277 and 278:

256 Managing Portfolios manager‘s

- Page 279 and 280:

258 Managing Portfolios FIGURE S 4

- Page 281 and 282:

260 Managing Portfolios Imposition

- Page 283 and 284:

This Page Intentionally Left Blank

- Page 285 and 286:

264 Managing Portfolios Recent stud

- Page 288 and 289:

High-Definition Style Rotation 267

- Page 290 and 291:

0 N

- Page 293 and 294:

272 Managing Portfolios TABLE 10-2

- Page 295 and 296:

274 Managing Portfolios ing pure re

- Page 297 and 298:

276 Managing Portfolios HIGH-DEFINI

- Page 299 and 300:

278 Managing Portfolios - FIGURE 10

- Page 301 and 302:

280 Managing Portfolios FIGURE 10-S

- Page 303 and 304:

282 Managing Portfolios REFERENCES

- Page 305 and 306:

284 Expanding Opportunities and “

- Page 307 and 308:

286 Expanding Opportunities such as

- Page 309 and 310:

This Page Intentionally Left Blank

- Page 311 and 312:

290 ExpandingOpprtunities vided sho

- Page 313 and 314:

292 Expandingoppo~ties F I G U R E

- Page 315 and 316:

294 Expanding Opportunities F I G U

- Page 317 and 318:

2% ExpandingOpportunities FIGURE 11

- Page 319 and 320:

298 Expanding Opportunities Typical

- Page 321 and 322:

300 Expandingopportunities F I G U

- Page 323 and 324:

302 Expanding Opportunities news st

- Page 325 and 326:

304 ExpandingOpportunities dinate l

- Page 327 and 328:

306 ExpandingOpportunities Also, ma

- Page 329 and 330:

308 Expanding Opportunities FIGURE

- Page 331 and 332:

310 Expanding oppo~ties -and- . 199

- Page 333 and 334:

312 ExpandingOpportunities applied

- Page 335 and 336:

314 Expanding Opportunities A secur

- Page 337 and 338:

316 ExpandingOpportunities in 1987,

- Page 339 and 340:

318 Expanding Opportunities the $4.

- Page 341 and 342:

320 Expanding Opportunities portfol

- Page 343 and 344:

322 Expanding Opportunities managem

- Page 345 and 346:

324 Expanding Opportunities The sec

- Page 347 and 348:

326 Expanding Opportunities Overall

- Page 349 and 350:

328 Expanding Opportunities risen o

- Page 351 and 352:

330 Expanding Opportunities lio and

- Page 353 and 354:

332 Expanding Opportunities FIGURE

- Page 355 and 356:

334 Expanding Opportunities , use o

- Page 358:

The Long and Short on Long-Short 33

- Page 361 and 362: 340

- Page 363 and 364: Uptick rules can delay, or in some

- Page 365 and 366: 344 Expanding Opportunities expecte

- Page 367 and 368: Nonsymmetrical distributions of sec

- Page 369 and 370: 11. We assume a futures margin of 4

- Page 371 and 372: 350 Expanding Opportunities see, lo

- Page 373 and 374: 352 Expanding Opportunities case, t

- Page 375 and 376: Trading Costs Some other costs of l

- Page 377 and 378: 356 Expanding Opportunities We use

- Page 379 and 380: 358 Expanding The optimal portfolio

- Page 381 and 382: 360 Expanding Opportunities N H = C

- Page 383 and 384: 362 Expanding Opportunities . Consi

- Page 385 and 386: 364 Expanding Opportunities mark se

- Page 387 and 388: 366 Expanding Opportunities not be

- Page 389 and 390: This Page Intentionally Left Blank

- Page 391 and 392: 370 Expanding Opportunities securit

- Page 393 and 394: 372 Expanding Opportunities maximiz

- Page 395 and 396: 374 ExpandingOpportunities uity ret

- Page 397 and 398: 376 Expanding Opportunities may be

- Page 399 and 400: 378 Expanding Opportunities from se

- Page 401 and 402: hance good performance, but they ca

- Page 403 and 404: 382 Name Index Clarke, Roger G., 25

- Page 405 and 406: 384 Name Index Levis, M., 174,175,1

- Page 407 and 408: 386 Name Index Swanson, H., 183,188

- Page 409: 388 Subject Index Disentangling equ

- Page 413 and 414: 392 Subiect Jndex Security analysis

- Page 415 and 416: This Page Intentionally Left Blank