Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

LATIN AMERICA<br />

In Latin America, economic activity continued to expand at a fast pace, driven by robust domestic<br />

demand and elevated commodity prices. In Brazil, real GDP growth increased to an annual rate<br />

of 6.1% in the fourth quarter of 2007, up from 5.6% in the third quarter. Private consumption and<br />

investment were the main drivers of growth. Moreover, private consumption continued to be strong<br />

in January of this year, with retail sales rising by 10.9% compared with a year earlier. Activity also<br />

remained robust in Argentina, where real GDP expanded by 9.2% compared with a year earlier in<br />

the fourth quarter of 2007. Inflationary pressures remained strong, however, with annual inflation at<br />

8.4% in February <strong>2008</strong>. In Mexico, industrial production rebounded in January, increasing by 3.1%<br />

compared with a year earlier. Annual inflation stood at 3.7% in February, broadly unchanged since<br />

December.<br />

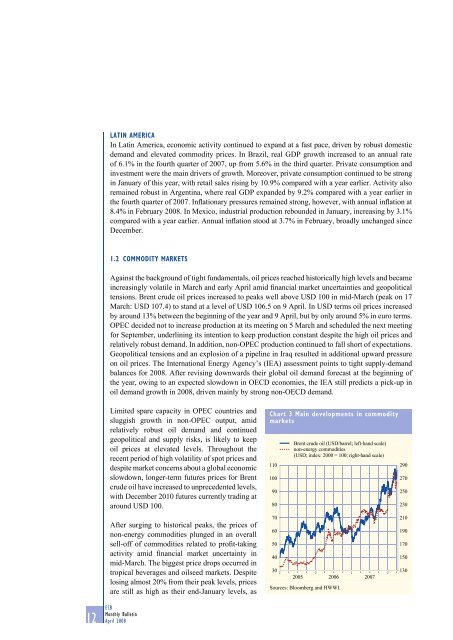

1.2 COMMODITY MARKETS<br />

Against the background of tight fundamentals, oil prices reached historically high levels and became<br />

increasingly volatile in March and early <strong>April</strong> amid financial market uncertainties and geopolitical<br />

tensions. Brent crude oil prices increased to peaks well above USD 100 in mid-March (peak on 17<br />

March: USD 107.4) to stand at a level of USD 106.5 on 9 <strong>April</strong>. In USD terms oil prices increased<br />

by around 13% between the beginning of the year and 9 <strong>April</strong>, but by only around 5% in euro terms.<br />

OPEC decided not to increase production at its meeting on 5 March and scheduled the next meeting<br />

for September, underlining its intention to keep production constant despite the high oil prices and<br />

relatively robust demand. In addition, non-OPEC production continued to fall short of expectations.<br />

Geopolitical tensions and an explosion of a pipeline in Iraq resulted in additional upward pressure<br />

on oil prices. The International Energy Agency’s (IEA) assessment points to tight supply-demand<br />

balances for <strong>2008</strong>. After revising downwards their global oil demand forecast at the beginning of<br />

the year, owing to an expected slowdown in OECD economies, the IEA still predicts a pick-up in<br />

oil demand growth in <strong>2008</strong>, driven mainly by strong non-OECD demand.<br />

Limited spare capacity in OPEC countries and<br />

sluggish growth in non-OPEC output, amid<br />

relatively robust oil demand and continued<br />

geopolitical and supply risks, is likely to keep<br />

oil prices at elevated levels. Throughout the<br />

recent period of high volatility of spot prices and<br />

despite market concerns about a global economic<br />

slowdown, longer-term futures prices for Brent<br />

crude oil have increased to unprecedented levels,<br />

with December 2010 futures currently trading at<br />

around USD 100.<br />

Chart 3 Main developments in commodity<br />

markets<br />

110<br />

100<br />

90<br />

80<br />

Brent crude oil (USD/barrel; left-hand scale)<br />

non-energy commodities<br />

(USD; index: 2000 = 100; right-hand scale)<br />

290<br />

270<br />

250<br />

230<br />

After surging to historical peaks, the prices of<br />

non-energy commodities plunged in an overall<br />

sell-off of commodities related to profit-taking<br />

activity amid financial market uncertainty in<br />

mid-March. The biggest price drops occurred in<br />

tropical beverages and oilseed markets. Despite<br />

losing almost 20% from their peak levels, prices<br />

are still as high as their end-January levels, as<br />

12 ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>April</strong> <strong>2008</strong><br />

70<br />

60<br />

50<br />

40<br />

30<br />

2005 2006 2007<br />

Sources: Bloomberg and HWWI.<br />

210<br />

190<br />

170<br />

150<br />

130