Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

Prices and<br />

costs<br />

in oil prices in dollars in February, from the<br />

already very high levels reached at the beginning<br />

of the year, was only partly absorbed by the<br />

appreciation of the exchange rate of the euro.<br />

Besides energy price developments, a<br />

further sharp increase in food prices strongly<br />

contributed to overall HICP inflation in<br />

February. With a joint weight of 19.6% in the<br />

HICP basket, both processed and unprocessed<br />

food price developments contributed on<br />

average around 0.8 percentage point to annual<br />

HICP inflation between September 2007 and<br />

February <strong>2008</strong>.<br />

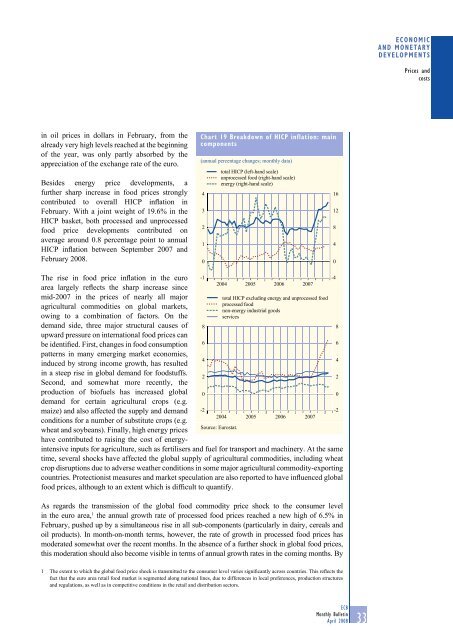

Chart 19 Breakdown of HICP inflation: main<br />

components<br />

(annual percentage changes; monthly data)<br />

4<br />

3<br />

2<br />

1<br />

0<br />

total HICP (left-hand scale)<br />

unprocessed food (right-hand scale)<br />

energy (right-hand scale)<br />

16<br />

12<br />

8<br />

4<br />

0<br />

The rise in food price inflation in the euro<br />

area largely reflects the sharp increase since<br />

mid-2007 in the prices of nearly all major<br />

agricultural commodities on global markets,<br />

owing to a combination of factors. On the<br />

demand side, three major structural causes of<br />

upward pressure on international food prices can<br />

be identified. First, changes in food consumption<br />

patterns in many emerging market economies,<br />

induced by strong income growth, has resulted<br />

in a steep rise in global demand for foodstuffs.<br />

Second, and somewhat more recently, the<br />

production of biofuels has increased global<br />

demand for certain agricultural crops (e.g.<br />

maize) and also affected the supply and demand<br />

conditions for a number of substitute crops (e.g.<br />

wheat and soybeans). Finally, high energy prices<br />

have contributed to raising the cost of energyintensive<br />

inputs for agriculture, such as fertilisers and fuel for transport and machinery. At the same<br />

time, several shocks have affected the global supply of agricultural commodities, including wheat<br />

crop disruptions due to adverse weather conditions in some major agricultural commodity-exporting<br />

countries. Protectionist measures and market speculation are also reported to have influenced global<br />

food prices, although to an extent which is difficult to quantify.<br />

As regards the transmission of the global food commodity price shock to the consumer level<br />

in the euro area, 1 the annual growth rate of processed food prices reached a new high of 6.5% in<br />

February, pushed up by a simultaneous rise in all sub-components (particularly in dairy, cereals and<br />

oil products). In month-on-month terms, however, the rate of growth in processed food prices has<br />

moderated somewhat over the recent months. In the absence of a further shock in global food prices,<br />

this moderation should also become visible in terms of annual growth rates in the coming months. By<br />

-1<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

2004 2005 2006<br />

2007<br />

total HICP excluding energy and unprocessed food<br />

processed food<br />

non-energy industrial goods<br />

services<br />

2004 2005 2006<br />

Source: Eurostat.<br />

2007<br />

-4<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

1 The extent to which the global food price shock is transmitted to the consumer level varies significantly across countries. This reflects the<br />

fact that the euro area retail food market is segmented along national lines, due to differences in local preferences, production structures<br />

and regulations, as well as in competitive conditions in the retail and distribution sectors.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>April</strong> <strong>2008</strong><br />

33