Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

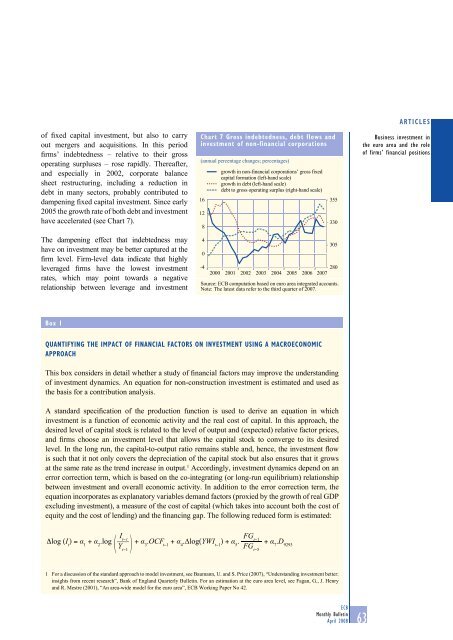

of fixed capital investment, but also to carry<br />

out mergers and acquisitions. In this period<br />

firms’ indebtedness – relative to their gross<br />

operating surpluses – rose rapidly. Thereafter,<br />

and especially in 2002, corporate balance<br />

sheet restructuring, including a reduction in<br />

debt in many sectors, probably contributed to<br />

dampening fixed capital investment. Since early<br />

2005 the growth rate of both debt and investment<br />

have accelerated (see Chart 7).<br />

The dampening effect that indebtedness may<br />

have on investment may be better captured at the<br />

firm level. Firm-level data indicate that highly<br />

leveraged firms have the lowest investment<br />

rates, which may point towards a negative<br />

relationship between leverage and investment<br />

Chart 7 Gross indebtedness, debt flows and<br />

investment of non-financial corporations<br />

(annual percentage changes; percentages)<br />

16<br />

12<br />

8<br />

4<br />

0<br />

-4<br />

growth in non-financial corporations’ gross fixed<br />

capital formation (left-hand scale)<br />

growth in debt (left-hand scale)<br />

debt to gross operating surplus (right-hand scale)<br />

355<br />

330<br />

305<br />

280<br />

2000 2001 2002 2003 2004 2005 2006 2007<br />

Source: ECB computation based on euro area integrated accounts.<br />

Note: The latest data refer to the third quarter of 2007.<br />

ARTICLES<br />

Business investment in<br />

the euro area and the role<br />

of firms’ financial positions<br />

Box 1<br />

QUANTIFYING THE IMPACT OF FINANCIAL FACTORS ON INVESTMENT USING A MACROECONOMIC<br />

APPROACH<br />

This box considers in detail whether a study of financial factors may improve the understanding<br />

of investment dynamics. An equation for non-construction investment is estimated and used as<br />

the basis for a contribution analysis.<br />

A standard specification of the production function is used to derive an equation in which<br />

investment is a function of economic activity and the real cost of capital. In this approach, the<br />

desired level of capital stock is related to the level of output and (expected) relative factor prices,<br />

and firms choose an investment level that allows the capital stock to converge to its desired<br />

level. In the long run, the capital-to-output ratio remains stable and, hence, the investment flow<br />

is such that it not only covers the depreciation of the capital stock but also ensures that it grows<br />

at the same rate as the trend increase in output. 1 Accordingly, investment dynamics depend on an<br />

error correction term, which is based on the co-integrating (or long-run equilibrium) relationship<br />

between investment and overall economic activity. In addition to the error correction term, the<br />

equation incorporates as explanatory variables demand factors (proxied by the growth of real GDP<br />

excluding investment), a measure of the cost of capital (which takes into account both the cost of<br />

equity and the cost of lending) and the financing gap. The following reduced form is estimated:<br />

⎛<br />

⎝<br />

⎞<br />

⎠<br />

FG t−1<br />

FG t−5<br />

1 For a discussion of the standard approach to model investment, see Baumann, U. and S. Price (2007), “Understanding investment better:<br />

insights from recent research”, <strong>Bank</strong> of England Quarterly <strong>Bulletin</strong>. For an estimation at the euro area level, see Fagan, G., J. Henry<br />

and R. Mestre (2001), “An area-wide model for the euro area”, ECB Working Paper No 42.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>April</strong> <strong>2008</strong><br />

63