Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Monthly Bulletin April 2008 - European Central Bank - Europa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ECONOMIC<br />

AND MONETARY<br />

DEVELOPMENTS<br />

5 EXCHANGE RATE AND BALANCE OF PAYMENTS<br />

DEVELOPMENTS<br />

Exchange rate<br />

and balance<br />

of payments<br />

developments<br />

5.1 EXCHANGE RATES<br />

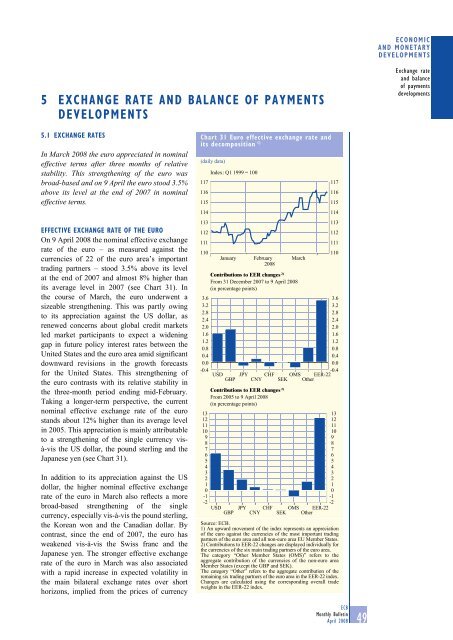

In March <strong>2008</strong> the euro appreciated in nominal<br />

effective terms after three months of relative<br />

stability. This strengthening of the euro was<br />

broad-based and on 9 <strong>April</strong> the euro stood 3.5%<br />

above its level at the end of 2007 in nominal<br />

effective terms.<br />

EFFECTIVE EXCHANGE RATE OF THE EURO<br />

On 9 <strong>April</strong> <strong>2008</strong> the nominal effective exchange<br />

rate of the euro – as measured against the<br />

currencies of 22 of the euro area’s important<br />

trading partners – stood 3.5% above its level<br />

at the end of 2007 and almost 8% higher than<br />

its average level in 2007 (see Chart 31). In<br />

the course of March, the euro underwent a<br />

sizeable strengthening. This was partly owing<br />

to its appreciation against the US dollar, as<br />

renewed concerns about global credit markets<br />

led market participants to expect a widening<br />

gap in future policy interest rates between the<br />

United States and the euro area amid significant<br />

downward revisions in the growth forecasts<br />

for the United States. This strengthening of<br />

the euro contrasts with its relative stability in<br />

the three-month period ending mid-February.<br />

Taking a longer-term perspective, the current<br />

nominal effective exchange rate of the euro<br />

stands about 12% higher than its average level<br />

in 2005. This appreciation is mainly attributable<br />

to a strengthening of the single currency visà-vis<br />

the US dollar, the pound sterling and the<br />

Japanese yen (see Chart 31).<br />

In addition to its appreciation against the US<br />

dollar, the higher nominal effective exchange<br />

rate of the euro in March also reflects a more<br />

broad-based strengthening of the single<br />

currency, especially vis-à-vis the pound sterling,<br />

the Korean won and the Canadian dollar. By<br />

contrast, since the end of 2007, the euro has<br />

weakened vis-à-vis the Swiss franc and the<br />

Japanese yen. The stronger effective exchange<br />

rate of the euro in March was also associated<br />

with a rapid increase in expected volatility in<br />

the main bilateral exchange rates over short<br />

horizons, implied from the prices of currency<br />

Chart 31 Euro effective exchange rate and<br />

its decomposition 1)<br />

(daily data)<br />

117<br />

116<br />

115<br />

114<br />

113<br />

112<br />

111<br />

110<br />

3.6<br />

3.2<br />

2.8<br />

2.4<br />

2.0<br />

1.6<br />

1.2<br />

0.8<br />

0.4<br />

0.0<br />

-0.4<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

Index: Q1 1999 = 100<br />

January<br />

February<br />

<strong>2008</strong><br />

March<br />

Contributions to EER changes 2)<br />

From 31 December 2007 to 9 <strong>April</strong> <strong>2008</strong><br />

(in percentage points)<br />

117<br />

116<br />

115<br />

114<br />

113<br />

112<br />

111<br />

110<br />

3.6<br />

3.2<br />

2.8<br />

2.4<br />

2.0<br />

1.6<br />

1.2<br />

0.8<br />

0.4<br />

0.0<br />

-0.4<br />

USD<br />

GBP<br />

JPY CHF<br />

CNY<br />

OMS EER-22<br />

SEK Other<br />

Contributions to EER changes 2)<br />

From 2005 to 9 <strong>April</strong> <strong>2008</strong><br />

(in percentage points)<br />

13<br />

12<br />

11<br />

10<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

USD JPY CHF OMS EER-22<br />

GBP CNY SEK Other<br />

Source: ECB.<br />

1) An upward movement of the index represents an appreciation<br />

of the euro against the currencies of the most important trading<br />

partners of the euro area and all non-euro area EU Member States.<br />

2) Contributions to EER-22 changes are displayed individually for<br />

the currencies of the six main trading partners of the euro area.<br />

The category “Other Member States (OMS)” refers to the<br />

aggregate contribution of the currencies of the non-euro area<br />

Member States (except the GBP and SEK).<br />

The category “Other” refers to the aggregate contribution of the<br />

remaining six trading partners of the euro area in the EER-22 index.<br />

Changes are calculated using the corresponding overall trade<br />

weights in the EER-22 index.<br />

ECB<br />

<strong>Monthly</strong> <strong>Bulletin</strong><br />

<strong>April</strong> <strong>2008</strong><br />

49