1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

218 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 219<br />

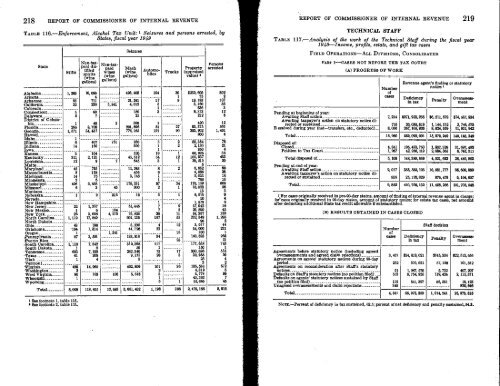

TABLE 116.-Enforcement, Alcohol Tax Unit: I Seizures and persons arrested, by<br />

States, fiscal year <strong>1949</strong><br />

Seizures<br />

TECHNICAL STAFF<br />

TABLE 117.-Analysis of the work of the Technical Staff during the fiscal<br />

<strong>1949</strong>-Income, profits, estate, and gift tax cases<br />

FIELD OPERATIONS-ALL DIVISIONS, CONSOLIDATED<br />

year<br />

State<br />

Stills<br />

Non-taxpaid<br />

distilled<br />

spirits<br />

gallons) (wine<br />

Non-taeyard<br />

n<br />

wines<br />

(wine<br />

gallons)<br />

Mash<br />

,.„;,..,<br />

(wine<br />

gallons)<br />

Automobiles<br />

Trucks<br />

Property<br />

(appraised<br />

value) s<br />

Alabama 1,263 10,086 4M,468 104 30 *239,605<br />

Arizona 4 1 75<br />

Arkansas 85 711 21,241 17 9 19, 183<br />

California 22 230 5,841 4,612 6 3,160<br />

Colorado 1 636<br />

Connecticut 5 60 180 3 8,313<br />

Delaware 5 7 25 212<br />

District of Columbia<br />

1 46 2 300 1 400<br />

Florida 286 8,708 201,696 51 27 93,375<br />

Georgia 1,571 34,437 776,165 191 90 303,902<br />

Hawaii 300<br />

Idaho 1<br />

Illinois 6 407 751 230 I 2 85,354<br />

Indiana 14 166 590 1 2 2,130<br />

Iowa 1 850<br />

Kansas 3 104 523 19 1 60,925<br />

Kentucky 311 9 121 45, 512 54 12 105, 937<br />

Louisiana 12 9 7 645 3 1 20, 515<br />

Maine 5<br />

Maryland 45 796 11,243 8 2 6,852<br />

Massachusetts 8 158 455 6 4,086<br />

Michigan 14 75 3,148 1 2,033<br />

Minnesota 2 6 1 700<br />

Mississippi 496 3,658 170,531 87 34 176,159<br />

Missouri 6 3 45 300 2 1 10,023<br />

Montana 13<br />

Nebraska 1 2 316 10 3 1 8,915<br />

Nevada 10<br />

New Hampshire__ 1 1,873<br />

New Jersey 22 1,367 51,445 7 9 57,042<br />

New Mexico 1 6 104 7 2 20, 899<br />

New York 26 3,008 4, 276 76, 825 ao 11 64,397<br />

North Carolina 1, 119 17,849 611,135 197 55 232,349<br />

North Dakota 96<br />

Ohio 43 198 5,330 4 12 3,917<br />

Oklahoma 194 1,314 44,723 22 64,000<br />

Oregon 1 1,241 16 100<br />

_Pennsylvania 87 3,591 133,810 34 140,823<br />

-Puerto Rico 23<br />

:South Carolina 1,118 7,342 312,398 117 177,658<br />

South Dakota 1 8 50 1 150<br />

• Tennessee 603 7,100 282,340 73 17 330,686<br />

Texas 61 208 9,175 28 3 32, 955<br />

Utah 1 4 3 25<br />

Vermont<br />

486 14,966 402,809 101 36 135,536<br />

Washington 2 2 4,319<br />

West Virginia 86 103 100 5, 518 3 6, 774<br />

Wisconsin 1 1 45,383<br />

Wyoming 6 1 15,662<br />

Persons<br />

arrested<br />

Total 8,008 118,855 12, 683 3, 661, 432 1,198 398 2,475, 188 8,911<br />

1 See footnote 1, table 115.<br />

See footnote 2, table 115.<br />

acqw=r4c !.wr gr Aug sgm9 Itecan :w irg-prrig-s-<br />

Agreements before statutory notice (including agreed<br />

overassessments and agreed claim rejections)<br />

Agreements on agents' statutory notices during 90-day<br />

period<br />

Agreements on reconsideration after Staff's statutory<br />

notices<br />

Defaults on Staff's statutory notices (no petition filed) _ _<br />

Defaults on agents' statutory notices sustained by Staff<br />

(no petition filed)<br />

Unagreed overassessments and claim rejections<br />

Total<br />

PART I-CASES NOT BEFORE THE TAX COURT<br />

(A) PROGRESS OF WORK<br />

Number<br />

of<br />

cases<br />

Number<br />

of<br />

cases<br />

3,457<br />

252<br />

51<br />

613<br />

119<br />

349<br />

4,841<br />

<strong>Revenue</strong> agent's finding or statutory<br />

notice<br />

Deficiency<br />

in tas<br />

Penalty<br />

Staff decision<br />

Overuses,-<br />

meat<br />

Pending at beginning of year:<br />

Awaiting Staff action<br />

Awaiting taxpayer's action on statutory notice directed<br />

7,214 8271, 953, 256 $6, 211, 578 $74, 467, 834<br />

or sustained<br />

Received during year (net-transfers, etc., deducted)<br />

710<br />

8,036<br />

20,030,819<br />

267, 105,926<br />

1, 144, 312<br />

8, 624, 059<br />

3, 746, 673<br />

61,931, 942<br />

Total 15,961 559,090,001 15, 979, 949 140, 146,349<br />

Disposed of:<br />

Closed 4, 841 105,433, 750 1,8328 7,3 31, 697, 492<br />

Petition to Tax Court 1, 267 42, 956, 119 2, 884,365 6,743, 311<br />

Total disposed of 6, 108 148,389,889 4, 521, 693 38, 440, 803<br />

Pending at end of year:<br />

Awaiting Staff action<br />

Awaiting taxpayer's action on statutory notice directed<br />

9, 017 385, 580,103 10, 681,777 95, 60D, 889<br />

or sustained 835 25,120, 029 876,479<br />

6,104,657<br />

Total 9,852 410, 700, 132 11, 458, 256 101,705, 546<br />

; For Cases 0 ly received in pre-90-day status, amount of finding of internal revenue agent in charge;<br />

foetuses originally received in 90-day status, amount of statutory notice; for estate tax cases, net amount<br />

after deducting additional State tax credit allowable if substantiated.<br />

(B) RESULTS OBTAINED IN CASES CLOSED<br />

Overassess.<br />

meat<br />

$22, 513, 656<br />

101,812<br />

407, 207<br />

2, 115,371<br />

18,123<br />

820,646<br />

25, 976,816<br />

NOTE -Percent of deficiency in tax sustained, 62.6; percent of ne deficiency and penalty sustained, 64.3.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)