1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

34<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

During the year, a total of $3,089, including interest of $525, was<br />

refunded as the result of court decisions.<br />

Divisiox.—The Sales Tax Division is concerned with<br />

SALES TAX<br />

the administration of the manufacturers' excise taxes and the retail<br />

dealers' excise taxes on jewelry, furs, toilet preparations, luggage, etc.<br />

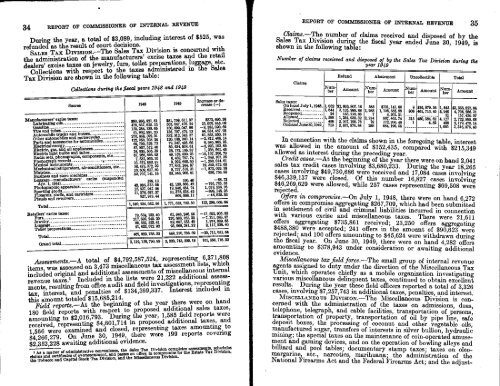

Collections with respect to the taxes administered in the Sales<br />

Tax Division are shown in the following table:<br />

Retailers' excise taxes:<br />

Furs<br />

Jewelry<br />

Luggage<br />

Toilet preparations_<br />

Total<br />

Grand total<br />

Collections during the fiscal years 1848 and <strong>1949</strong><br />

Source 1948 <strong>1949</strong><br />

Increase or decrease<br />

(—)<br />

Manufacturers' excise taxes:<br />

$80, 88A 921.61 $81,759, 611.97 $872,600.36<br />

Lubricating oils<br />

478, 637,625.15 603, 647,470.24 25,009, 845.09<br />

Gasoline<br />

159, 284,138.85 150,899, 047.98 —8, 385,090.69<br />

Tire and tubes<br />

91,962,891.20 136,797,379.13 44,834,487.93<br />

Automobile trucks and bues<br />

Oth er automobiles and motor cycles<br />

270 968, 392.21 2, 12, 342. 37 61,853,950.16<br />

Parts and accessories for automobiles<br />

1,, 22, 950 708.28 3320,1838,240.14 12,812,468.14<br />

—<br />

69, 700, 529.73 79, 347,495.66 9,646,985.93<br />

Electrical energy<br />

Electric, gas, and oil appliances<br />

87, 857, 612. 46 80,934, 508.61 —6,923,103.85<br />

24, 935, 505.39 26,172,166.87 1,236, 681.48<br />

Electric light bulbs and tubes<br />

Radio sets, phonographs, components, etc<br />

67,288, 866.93 49,159, 550. 23 —18, 107, 306.70<br />

7, 531, 905.10 8, 482, 797.74 —1,049, 107.36<br />

Phonograph records<br />

s<br />

10, 572,682.91 9, 29E 868.30 —1, 280,014.61<br />

Musical instruments<br />

Mechanical refrigerators, air-conditioners, etc... 58,473,3. 22<br />

10, 609, 6 7 5 2 77,833,244 . 87 19, 359, 873.65<br />

7.69 8, 737,618.31<br />

—1, 872 , 039.38<br />

Matches<br />

Business and more machines<br />

32, 707,141.16 83, 343,900.01 636,758. 85<br />

Luggage—manufacturers' excise (suspended<br />

189.13<br />

100.40<br />

—88.73<br />

A. Apo. I 1944)<br />

Photographic apparatus<br />

43, 935,373.95 43, 139,668.92 —795, 705.53<br />

18,827,947.98 10,846, 484. 74 1,018, 536.76<br />

S ding goods<br />

rms, shells, and cartridges<br />

11,276, 687.37 10, 378,538.42 —898,148.95<br />

857,913,44 809, 888.11 —48,025.33<br />

Pistols and revolvers<br />

1,649,234,052. 58 1,771, 532, 722.50 122, 298,669.04<br />

Total<br />

79, 539, 152.40<br />

217,899,249.20<br />

80, 632, 323.81<br />

91,852,012. 02<br />

61,946,246. 55<br />

210, 688, 165.33<br />

82, 807, 133.49<br />

93,969,241.32<br />

—17, 592,905.85<br />

—7,211,083.87<br />

1,974,809.68<br />

2,117, 22E1.40<br />

469, 922, 738.33 449,210, 786.69 —20, 711,951.64<br />

2,119, 158, 790.89 2, 220,743, 509.19 101, 586,718.30<br />

Assessments. —A total of $4,792,587,524, representing 6,371,808<br />

items, was assessed on 3,473 miscellaneous tax assessment lists, which<br />

included original and additional assessments of miscellaneous internal<br />

revenue taxes.' Included in the lists were 21,222 additional assessments,<br />

resulting from office audit and field investigations, representing<br />

tax, interest, and penalties of $134,369,337. Interest included in<br />

this amount totaled $15,685,214.<br />

Field reports.—At the beginning of the year there were on hand<br />

180 field reports with respect to proposed additional sales taxes,<br />

amounting to $2,016,793. During, the year, 1,585 field reports were<br />

received, representing $4,601,714 in proposed additional taxes, and<br />

1,566 were examined and closed, representing taxes amounting to<br />

$4,266,279. On June 30, <strong>1949</strong>, there were 199 reports covering<br />

$2,352,228 awaiting additional evidence.<br />

I As a matter of administrative convenience, the Sales Tax Division completes assessments, schedules<br />

claims and certificates of overamessment, and passes on offers in compromise fo<br />

for the Estate Tax Division,<br />

the Tobacco and Capital Stock Tax Divide/I, and the Miscellaneous Division.<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 35<br />

Claims.—The number of claims received and disposed of by the<br />

Sales Tax Division during the fiscal year ended June 30, <strong>1949</strong>, is<br />

shown in the following table:<br />

Number of claims receieved and disposed of by the Sales Tax Division during the<br />

year <strong>1949</strong><br />

Claims<br />

PI<br />

Sales taxes:<br />

On hand July 1,1948. 1,052<br />

Received<br />

1, 694<br />

Reopened<br />

24<br />

Allowed<br />

1, 598<br />

Rejected<br />

409<br />

OnbandJune30,<strong>1949</strong>_ 713<br />

Refund Abatement lincollectible Total<br />

Amount<br />

$2,606,807.18<br />

3,135,989. 88<br />

163, 218.86<br />

1,254,938.32<br />

2, 007,198.76<br />

E 633, 878.84<br />

Num<br />

ber<br />

586<br />

1, 988<br />

7<br />

2, 214<br />

78<br />

288<br />

Amount<br />

$731, 141. 60<br />

1,108 585.98<br />

9, 201.21<br />

987, 465.74<br />

172, 266.49<br />

6E4,196.56<br />

p<br />

8<br />

308<br />

315<br />

1<br />

Amount Num<br />

ber Amount -<br />

$18,879.06<br />

461, 710.45<br />

480, 694.62<br />

4.89<br />

1,645<br />

3,940<br />

31<br />

4,127<br />

488<br />

1,001<br />

$3,358,827.84<br />

4, 706, 286.31<br />

157, 420.07<br />

E 722,988. 88<br />

2,179,470.14<br />

3,318, 075.40<br />

In connection with the claims shown in the foregoing table interest<br />

was allowed in the amount of $152,435, compared with $215,349<br />

allowed as interest during the preceding year.<br />

Credit cases.—At the beginning of the year there were on hand 2,041<br />

sales tax credit cases involving $3,680,233. During the year 18,265<br />

cases involving $49,730,686 were received and 17,084 cases involving<br />

$46,339,137 were closed. Of this number 16,827 cases involving<br />

$46,269,629 were allowed, while 257 cases representing $69,508 were<br />

rejected.<br />

Offers in compromise.—On July 1, 1948, there were on hand 6,272<br />

offers in compromise aggregating $267,709, which had been submitted<br />

in settlement of civil and criminal liabilities incurred in connection<br />

with various excise and miscellaneous taxes. There were 21,611<br />

offers aggregating $735,861 received; 23,250 offers aggregating<br />

$488,380 were accepted; 241 offers in the amount of $90,623 were<br />

rejected; and 100 offers amounting to $45,624 were withdrawn during<br />

the fiscal year. On June 30, <strong>1949</strong>, there were on hand 4,282 offers<br />

amounting to $378,943 under consideration or awaiting additional<br />

evidence.<br />

Miscellaneous tax field force.—The small group of internal revenue<br />

agents assigned to duty under the direction of the Miscellaneous . Tax<br />

Unit, which operates chiefly as a mobile organization investigating<br />

various miscellaneous delinquent taxes, continued to obtain excellent<br />

results. During the year these field officers reported a total of 3,326<br />

cases, involving $7,257,743 in additional taxes, penalties, and interest.<br />

MISCELLANEOUS DIVISION.—The Miscellaneous Division is concerned<br />

with the administration of the taxes on admissions, dues,<br />

telephone, telegraph, and cable facilities, transportation of persons,<br />

transportation of property, transportation of oil by pipe line, safe<br />

deposit boxes, the processing of coconut and other vegetable oils,<br />

manufactured sugar, transfers of interests in silver bullion, hydraulic<br />

mining; the special taxes on the maintenance of coin-operated amusement<br />

and gaming devices, and on the operation of bowling alleys and<br />

billiard and pool tables; documentary stamp taxes; taxes on oleomargarine,<br />

etc., narcotics, marihuana; the administration of the<br />

National Firearms Act and the Federal Firearms Act; and the adjust-

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)