1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

profit-sharing, and annuity plans under section 165(a) of the <strong>Internal</strong><br />

<strong>Revenue</strong> Code as amended; the exempt status of employees' trusts<br />

under that section; the effect of terminations and curtailments of such<br />

plans on their prior qualification; the effect of investments of trust<br />

funds in the stock or securities of the employer on the continued qualification<br />

of the plans of which the trusts are parts; the taxability of beneficiaries<br />

of exempt and nonexempt trusts under section 165 (b) and<br />

(c), respectively; the annuity treatment under section 22 (b)(2)(B);<br />

and related matters.<br />

Rulings are issued and advice is furnished to taxpayers and other<br />

interested parties. Rulings issued through the field offices and findings<br />

with respect to tax liability after examination of the applicable tax<br />

returns are subject to post review in Washington. Data with respect<br />

to applications received and rulings issued are summarized as follows:<br />

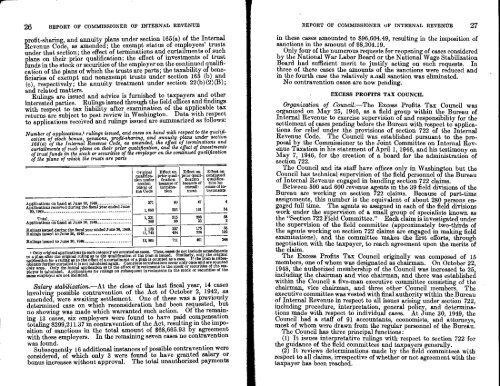

Number of applications,' rulings issued, and cases on hand with respect to the qualification<br />

of stock bonus, pensions, profit-sharing, and annuity plans under section<br />

165(a) of the <strong>Internal</strong> <strong>Revenue</strong> Code, as amended, the effect of terminations and<br />

curtailments of such plans on their prat qualification, and the effect of investments<br />

of trust funds in the stock or securities of the employer on the continued qualification<br />

of the plans of which the trusts are parts<br />

Original<br />

qualifies-<br />

Won under<br />

section<br />

165(a) of<br />

the Code<br />

Effect on<br />

prior quell-<br />

&anon<br />

because of<br />

termination<br />

Effect on<br />

prior quailnaafi=<br />

because of<br />

curtailment<br />

Effect on<br />

continued<br />

qualifiestion<br />

because<br />

of investments<br />

Applications on hand at June 30, 1948 271 80 47 4<br />

Applications received during the fiscal year ended June<br />

30, <strong>1949</strong><br />

1,060 235 161 54<br />

Total<br />

1, 331 315 208 58<br />

Applications on hand at June 30, <strong>1949</strong> 208 88 33 2<br />

Rulings issued during the fiscal year ended June 30,1940. 1,123 227 175 68<br />

Rulings issued to June 30, 1948 11,742 484 226 192<br />

Rulings issued to June 30, <strong>1949</strong> 12,865 711 401 248<br />

I Only original applications in each category are counted as cases. Thus, cases do not include amendments<br />

to a plan after the original ruling as to the qualification of the plan i issued. Similarly, only the original<br />

application for a ruling as to the effect of a curtailment of a plan is counted as a case. If the plan is subsequently<br />

further curtailed it isnot tabulated again. Complete terminations occur only once and are counted<br />

Only once. Only the initial application as to the effect of investments in the stock or securities of the employer<br />

is tabulated. Applications for rulings on subsequent investments in the stock or securities of the<br />

same employer are not included.<br />

Salary stabilization.—At the close of the last fiscal year, 14 cases<br />

involving possible contravention of the Act of October 2, 1942, as<br />

amended, were awaiting settlement. One of these was a previously<br />

determined case on which reconsideration had been requested, but<br />

no showing was made which warranted such action. Of the remaining<br />

13 cases, six employers were found to have paid compensation<br />

totaling $299,211.37 in contravention of the Act, resulting in the imposition<br />

of sanctions in the total amount of $68,665.93 by agreement<br />

with these employers. In the remaining seven cases no contravention<br />

was found.<br />

Subsequently 16 additional instances of possible contravention were<br />

considered, of which only 3 were found to have granted salary or<br />

bonus increases without approval. The total unauthorized payments<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 27<br />

in these cases amounted to $96,604.49, resulting in the imposition of<br />

sanctions in the amount of $8,204.19.<br />

Only four of the numerous requests for reopening of cases considered<br />

by the National War Labor Board or the National Wage Stabilization<br />

Board had sufficient merit to justify acting on such requests. In<br />

three of these cases the amounts of the sanctions were reduced and<br />

in the fourth case the relatively small sanction was eliminated.<br />

No contravention cases are now pending.<br />

EXCESS PROFITS TAX COUNCIL<br />

Organizaticm, of Council.—The Excess Profits Tax Council was<br />

organized on May 25, 1946, as a field group within the Bureau of<br />

<strong>Internal</strong> <strong>Revenue</strong> to exercise supervision of and responsibility for the<br />

settlement of cases pending before the Bureau with respect to applications<br />

for relief under the provisions of section 722 of the <strong>Internal</strong><br />

<strong>Revenue</strong> Code. The Council was established pursuant to the proposal<br />

by the Commissioner to the Joint Committee on <strong>Internal</strong> <strong>Revenue</strong><br />

Taxation in his statement of April 1, 1946, and his testimony on<br />

May 7, 1946, for the creation of a board for the administration of<br />

section 722.<br />

The Council and its staff have offices only in Washington but the<br />

Council has technical supervision of the field personnel of the Bureau<br />

of <strong>Internal</strong> <strong>Revenue</strong> engaged in handling section 722 claims.<br />

Between 500 and 600 revenue agents in the 39 field divisions of the<br />

Bureau are working on section 722 claims. Because of part-time<br />

assignments, this number is the equivalent of about 280 persons engaged<br />

full time. The agents so assigned in each of the field divisions<br />

work under the supervision of a small group of specialists known as<br />

the "Section 722 Field Committee." Each claim is investigated under<br />

the supervision of the field committee (approximately two-thirds of<br />

the agents working on section 722 claims are engaged in making field<br />

examinations), and the committee makes the first efforts, through<br />

negotiation with the taxpayer, to reach agreement upon the merits of<br />

the claim.<br />

The Excess Profits Tax Council originally was composed of 15<br />

members, one of whom was designated as chairman. On October 22,<br />

1948, the authorized membership of the Council was increased to 25,<br />

including the chairman and vice chairman, and there was established<br />

within the Council a five-man executive committee consisting of the<br />

chairman, vice chairman, and three other Council members. The<br />

executive committee was vested with final authority within the Bureau<br />

of <strong>Internal</strong> <strong>Revenue</strong> in respect to all issues arising under section 722,<br />

including procedure, interpretation, general policy, and determinations<br />

made with respect to individual cases. At June 30, <strong>1949</strong>, the<br />

Council had a staff of 91 accountants, economists, and attorneys,<br />

most of whom were drawn from the regular personnel of the Bureau.<br />

The Council has three principal functions:<br />

(1) It issues interpretative rulings with respect to section 722 for<br />

the guidance of the field committees and taxpayers generally.<br />

(2) It reviews determinations made by the field committees with<br />

respect to all claims, irrespective of whether or not agreement with the<br />

taxpayer has been reached.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)