1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

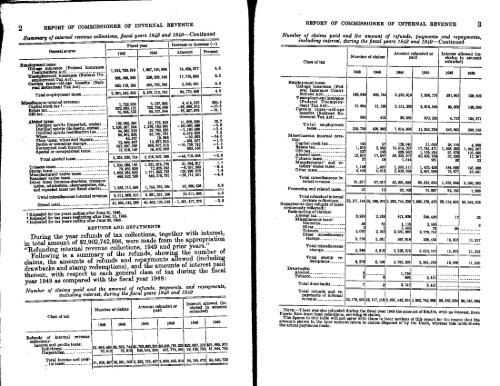

Summary of internal revenue collections, fiscal years 1948 and <strong>1949</strong>-Continued<br />

General source<br />

Employment tans:<br />

'Old-age insurance (Federal Insurance<br />

Contributions Act)<br />

Unemployment insurance (Federal Unemployment<br />

Tax Act)<br />

Carriers taxes-old-age benefits (Railroad<br />

Retirement Tax Act)<br />

Total employment taxes<br />

2,381,342,353<br />

Fiscal year<br />

Miscellaneous internal revenue:<br />

Capital stock tax<br />

1,722,833<br />

822,380,121<br />

Estate tax 76,965,322<br />

Glft tax<br />

' Digit-Med :spirits (Imported, excise) 109,985,295<br />

Distilled spirits (domestic, excise)._ 1,326,267,594<br />

Distilled spirits rectification tax<br />

34,983,322<br />

Wines<br />

60,981,<br />

4557 2, 836<br />

Floor taxes, wines and liquors<br />

Bottle or container stamps<br />

12,489,467<br />

Fermented malt liquors<br />

697,097,258<br />

Special or occupational taxes<br />

13, 519,426<br />

Total alcohol taxes<br />

2,255,328,754<br />

Tobacco taxes<br />

I, 3W,280, 153<br />

Stamp taxes<br />

79,485,936<br />

Manufacturers' excise taxes<br />

1,649,234,053<br />

Retailers' excise taxes<br />

469,922,738<br />

Other taxes (communications, transportation,<br />

admissions, oleomargarine, etc.,<br />

and repealed taxes not listed above)_... 1,855, 711,499<br />

Total miscellaneous internal revenue.<br />

Grand total<br />

I Repealed for tax years ending after June 30, 1946.<br />

I Repealed for tax years beginning after Dec. 31, 1945.<br />

Repealed for tax years ending after June 30, 1945.<br />

Increase or decrease (-)<br />

Amount<br />

21, 594,617<br />

-6,637,893<br />

122,298, 670<br />

- 20, 711,951<br />

97,080,695<br />

Percent<br />

REFUNDS AND REPAYMENTS<br />

During the year refunds of tax collections, together with interest,<br />

in total amount of $2,902,742,898, were made from the appropriation<br />

"Refunding internal revenue collections, <strong>1949</strong> and prior years."<br />

Following is a summary of the refunds, showing the number of<br />

claims, the amounts of refunds and repayments allowed (including<br />

drawbacks and stamp redemptions), and the amounts of interest paid<br />

thereon, with respect to each general class of tax during the fiscal<br />

year <strong>1949</strong> as compared with the fiscal year 1948:<br />

Number of claims paid and the amount of refunds, payments, and repayments,<br />

including interest, during the fiscal years 1948 and <strong>1949</strong><br />

Class of tax<br />

1948<br />

1,612,720,919<br />

208,508,300<br />

560,113,134<br />

8,311,009, 410<br />

Number of claims<br />

<strong>1949</strong><br />

687,150,996<br />

226,228,180<br />

562,733,585<br />

2,476,112, 762<br />

6,137, 508<br />

72.6, 780, 589<br />

60,757,344<br />

121, 773, 303<br />

1,276,180,995<br />

33,793,236<br />

65,<br />

719, 565<br />

12, 297,810<br />

686,357, 516<br />

14,402,982<br />

2,210,607,168<br />

1,321,874,770<br />

72,828,043<br />

1, 771, 532,723<br />

449,210,787<br />

1, 752,792,194<br />

8,381,521,106<br />

Amount refunded or<br />

paid<br />

74,930,077<br />

17,719,880<br />

2,620,451<br />

94, 770,409<br />

4,414,675<br />

-86, 599,552<br />

-16,207,978<br />

11,808,008<br />

- 50.086, 599<br />

-1,190,086<br />

4,819,925<br />

-22,992<br />

-201,657<br />

- 10,729, 742<br />

883,556<br />

- 44,719,588<br />

70,511,696<br />

Interest allowed m-<br />

eluded in amou C nt<br />

refunded)<br />

1948 <strong>1949</strong> 1948 <strong>1949</strong> 1948 <strong>1949</strong><br />

46<br />

8.5<br />

0.5<br />

4.0<br />

256.2<br />

-10.5<br />

-21.1<br />

10.7<br />

-9.8<br />

- 3.4<br />

7.9<br />

-54.0<br />

- 1.6<br />

-1.5<br />

6.5<br />

-2.0<br />

1.7<br />

-8.4<br />

7.4<br />

- 4.4<br />

5.9<br />

0.8<br />

41,864,542, 295 40,463,125,019 -1,031,417, 276 -3.3<br />

Class of tax<br />

Employment taxes:<br />

Old-age insurance (Federal<br />

Insurance Contributions<br />

Act)<br />

Unemployment insurance<br />

(Federal Unemployment<br />

Tax Act)<br />

Carriers taxes-old-age<br />

benefits (Railroad Retirement<br />

Tax Act)<br />

Total employment<br />

taxes<br />

Miscellaneous internal revenue:<br />

Capital stock tax<br />

Estate tax<br />

Gift tax<br />

Alcohol taxes<br />

Tobacco taxes<br />

Manufacturers' and retailers'<br />

excise taxes<br />

Other taxes<br />

Total miscellaneous internal<br />

revenue<br />

Processing and related taxes<br />

Total refunds of <strong>Internal</strong><br />

revenue collections__ _<br />

Repayments (not refunds of taxes<br />

erroneously collected):<br />

Redemption of stamps:<br />

Alcohol tax<br />

Miscellaneous taxes:<br />

Narcotics<br />

Silver<br />

Tobacco<br />

Other miscellaneous<br />

stamps<br />

Drawbacks:<br />

Alcohol<br />

Tobacco<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 3<br />

Number of claims paid and the amount of refunds, payments and repayments,<br />

including interest, during the fiscal years 1948 and <strong>1949</strong>-Continued<br />

Total miscellaneous<br />

stamps<br />

Total stamp redemptions<br />

Total drawbacks<br />

Total refunds and repayments<br />

of internal<br />

revenue<br />

Number of claims<br />

Amount refunded or<br />

paid<br />

Interest allowed (in.<br />

cludep in amount<br />

refunded)<br />

1948 <strong>1949</strong> 1948 <strong>1949</strong> 1948 <strong>1949</strong><br />

198,896<br />

11,604<br />

305<br />

406, 744<br />

13,126<br />

412<br />

5,073,015<br />

2, 511, 236<br />

30,685<br />

7,858,778<br />

2,818,346<br />

570,210<br />

237, 967<br />

98,006<br />

4,722<br />

139,602<br />

196,980<br />

104, 571<br />

210,755 420,282 7,619,938 11, 243,339 340,695 390,553<br />

136<br />

1,910<br />

327<br />

12,915<br />

27<br />

1,148<br />

6, 408<br />

47<br />

2, 384<br />

448<br />

17,837<br />

18<br />

1,46<br />

4, 815<br />

128,040<br />

10, 014,297<br />

628, 930<br />

38, 230, 397<br />

1,344<br />

1,350,111<br />

2,938, 769<br />

31,692<br />

17, 741,471<br />

1,136, 224<br />

42,503, 783<br />

961<br />

1, 422, 438<br />

2, 691, 086<br />

28,119<br />

1, 568, 292<br />

91, 678<br />

27,503<br />

30<br />

164,688<br />

75,677<br />

4, 999<br />

1,949, 567<br />

136, 080<br />

17,287<br />

32<br />

193,360<br />

95,061<br />

21,871 27,016 53, 291, 988 65,527,635 1,953,985 2,396,365<br />

2,933<br />

21 12 82,108 71,687 32,183 7,885<br />

2,171,144 39,108,973 2, 293, 744,339 2,899,378, 470 56, 514,935 86, 335, 535<br />

58<br />

2,070<br />

3,215<br />

2,318<br />

61<br />

2,195<br />

3,581<br />

471,826<br />

1,118<br />

453<br />

2,950, 89<br />

367,918<br />

349,420<br />

3,300<br />

76<br />

2, 770, 742<br />

238,439<br />

17<br />

99<br />

15,873<br />

25<br />

8<br />

11,317<br />

5,346 5,818 3,323,379 3,012,557 15,972 11,325<br />

8,279 8,136 3, 795, 205 3,381, 978 15,989 11,350<br />

5<br />

2<br />

1,756<br />

9 991<br />

2,451<br />

7 9 2, 747 2, 451<br />

32,179,430 39,117,118 2,297, 542,291 2,902, 742,898 56, 630,924 88,346,884<br />

Non.-There was also refunded during the fiscal year <strong>1949</strong> the amount of $16,610, with no interest, from<br />

Puerto Rico trust fund collections, covering 46 claims.<br />

The figures in this table will no agree with those in ater sections of this report for the reason that the<br />

amounts shown in the later sections relate to claims disposed of by the Units, whereas this table- shows<br />

the actual payments made.<br />

Refunds of internal revenue<br />

collections:<br />

Income and profits taxes:<br />

Individual<br />

Corporation<br />

Total income and prof-<br />

„ its taxes<br />

31, 882,485<br />

76,012 38,582,744 $1,703,802,201 $2,408,761,223<br />

78,919 528,953,206<br />

413, 779,591 $22,037,370<br />

32, 150, 702<br />

931,895,975<br />

51,844, 756<br />

1, 918, 497 38,681,663 2,232, 755,407 2,822,535,814 54,188,072 83,690,732

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)