1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

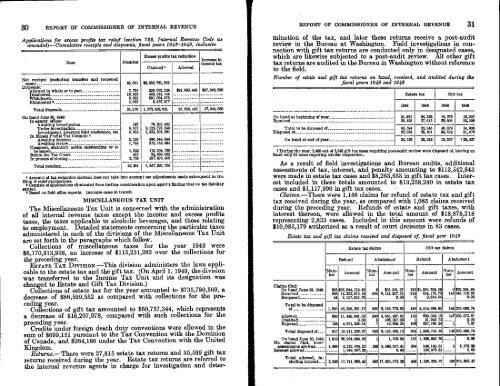

Applications for excess profits tax relief (section 722, <strong>Internal</strong> <strong>Revenue</strong> Code as<br />

amended)-Cumulative receipts and disposals, fiscal years 1942-<strong>1949</strong>, inclusive<br />

Item<br />

Number<br />

Excess profits tax reduction<br />

Claimed'<br />

Allowed<br />

Net receipts (excluding transfers and reopened<br />

cases) 53, 651 88, 230, 761, 359<br />

Disposals:<br />

Allowed in whole or in part 7, 791 239, 873,324 891, 650, 443 $37,048,630<br />

Disallowed 10, 659 430, 215,144<br />

Withdrawn 9, 865 697, 094, 076<br />

Eliminated 3,065 5,857, 077<br />

Total disposals_ 31,370 1,371, 839,621 91, 6W, 448 37,0480830<br />

On hand lime 30, <strong>1949</strong>:<br />

In agents' offices:<br />

Awaiting investigation 387 79, 205,464<br />

'Under investigation 5, 817 2,122,373, 544<br />

Investigated, awaiting field conference, etc_ 6, 632 1,333, 501, 591<br />

In Excess Profits Tax Council: '<br />

Awaiting decision 3,129 560, 548, 344<br />

Awaiting review 1, 789 373, 355, 494<br />

Unagreed, statutory notice outstanding or to<br />

be issued 1,322 116, 304, 768<br />

Before the Tax Court 437 34,656,033<br />

In process of closing 2, 768 237, 976, WO<br />

Total pending 22,281 4, 857, 921, 738<br />

Amount of tax reduction claimed does not take into account tax adjustments made subsequent to the<br />

BIN of relief applications.<br />

2 uomdsts of applications eliminated from further consideration upon agent's finding that no tax liability<br />

existed.<br />

Based on field office report& Includes cases in transit.<br />

MISCELLANEOUS TAX UNIT<br />

The Miscellaneous Tax Unit is concerned with the administration<br />

of all internal revenue taxes except the income and excess profits<br />

taxes, the taxes applicable to alcoholic beverages, and those relating<br />

to employment. Detailed statements concerning the particular taxes<br />

administered in each of the divisions of the Miscellaneous Tax Unit<br />

are set forth in the paragraphs which follow.<br />

Collections of miscellaneous taxes for the year <strong>1949</strong> were<br />

$6,170,913,938, an increase of $115,231,282 over the collections for<br />

the preceding year.<br />

ESTATE TAX DIVISION.-This division administers the laws applicable<br />

to the estate tax and the gift tax. (On April 1, <strong>1949</strong>,. the division<br />

was transferred to the Income Tax Unit and its designation was<br />

changed to Estate and Gift Tax Division.)<br />

Collections of estate tax for the year amounted to $735,780,569, a<br />

decrease of $86,599,552 as compared with collections for the preceding<br />

year.<br />

Collections of gift tax amounted to $60,757,344, which represents<br />

a decrease of $16,207,978, compared with such collections for the<br />

preceding year.<br />

Credits under foreign death duty conventions were allowed in the<br />

sum of $699,151 pursuant to the Tax Convention with the Dominion<br />

of Canada, and $264,186 under the Tax Convention with the United<br />

Kingdom<br />

Returns.-There were 27,815 estate tax returns and 35,599 gift tax<br />

returns received during the year. Estate tax returns are referred to<br />

the internal revenue agents in charge for investigation and deter-<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 31<br />

ruination of the tax, and later these returns receive a post-audit<br />

review in the Bureau at Washington. Field investigations in connection<br />

with gift tax returns are conducted only in designated cases,<br />

which are likewise subjected to a post-audit review. All other gift<br />

tax returns are audited in the Bureau in Washington without reference<br />

to the field<br />

Number of estate and gift tax returns on hand, received, and audited during the<br />

fiscal years 1948 and <strong>1949</strong><br />

Estate tax<br />

Gift tax<br />

1948 <strong>1949</strong> 1948 <strong>1949</strong><br />

On hand at beginning of year 21,091 24, 528 19, 276 19,307<br />

Received 25,493 27, 815 30,603 35, 599<br />

Total to be disposed of 46, 584 52, 343 49, 879 54, 906<br />

Disposed of 22, 056 26,101 30,572 31,479<br />

On band at end of year 24,528 26,242 19,307 23,427<br />

During the year, 2,486 out of 2,548 gift tax cases requiring post-audit review were disposed of, leaving on<br />

band only 62 cases requiring similar disposition.<br />

As a result of field investigations and Bureau audits, additional<br />

assessments of tax, interest, and penalty amounting to $113,542,843<br />

were made in estate tax cases and $8,263,653 in gift tax cases. Interest<br />

included in these totals amounted to $13,258,240 in estate tax<br />

cases and $1,117,990 in gift tax cases.<br />

Claims.-There were 1,166 claims for refund of estate tax and gift<br />

tax received during the year, as compared with 1,085 claims received<br />

during the preceding year. Refunds of estate and gift taxes, with<br />

interest thereon, were allowed in the total amount of $18,878,218<br />

representing 2,833 cases. Included in this amount were refunds of<br />

$10,083,179 authorized as a result of court decisions in 83 cases.<br />

Estate tax and gift tax claims received and disposed of, fiscal year <strong>1949</strong><br />

Number<br />

Estate tax claims<br />

Gift tax claims<br />

Refund Abatement Refund Abatement<br />

Amount<br />

Amount<br />

Num<br />

ber<br />

Amount<br />

Amount<br />

Claims filed:<br />

On hand Rine 30, 194& $25, 844, 752.42 9 $35, 541.27 195 $1,850, 708.5 6 $26,361.84<br />

Received 14, 232,975.49 594 9,121,237.65 218 654,170.73 142 243, 718.90<br />

Reopened 3, 157,553. 26 0.00 3 9,810.54 0.00<br />

Total to be disposed<br />

of 1,830 43,235, 281.17 603 9,156, 778.92 416 2, 514, 689.85 148 270,080. 74<br />

Allowed 11,440,001.63 8,943,497.85 153 629, 05119 147 270,073. 67<br />

Credited 0.00 198, 257.02 1 21,945.72 0.00<br />

Rejected 4,871,225.34 13,805.25 109 657,740.24 1 7.07<br />

Total disposed of 817 16,311,226.97 602 9,165,560.12 263 1,308,744.15 148 270, 080.74<br />

r A<br />

On hand June 30, <strong>1949</strong>_ 1,013 26,924,054.20 1,218. 80 1,205, 998.70 0.00<br />

No claims filed, overtosesements<br />

allowed 1,696 4,352, 424. 5 8,689,617.41 349,140.55 3 5, 778. 80<br />

Interest allowed 1, 949, 557.28 0.00 136,079.81 0.00<br />

-- A<br />

Total allowed, hp<br />

eluding interest._ 2,385 17, 741, 993.13 883 17,831,372. 448 1,136,22A. 27 150 275,852.47

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)