1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

158 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

ALCOHOL, DISTILLED SPIRITS, BEER, WINES, ETC.<br />

I. PLANTS AND PERMITTEES, AND BASIC PERMITS UNDER THE FEDERAL ALCOHOL<br />

ADMINISTRATION ACT<br />

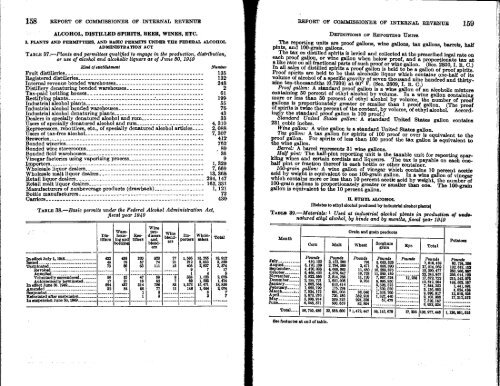

TABLE 37.-Plants and permittees qualified to engage in the production, distribution,<br />

or use of alcohol and alcoholic liquors as of June 30, <strong>1949</strong><br />

Hind of establishment<br />

Fruit distilleries<br />

Registered distilleries<br />

<strong>Internal</strong> revenue bonded warehouses<br />

Distillery denaturing bonded warehouses<br />

Tax-paid bottling houses<br />

Rectifying plants<br />

Industrial alcohol plants<br />

Industrial alcohol bonded warehouses<br />

Industrial alcohol denaturing plants<br />

Dealers in specially denatured alcohol and rum<br />

Users of specially denatured alcohol and rum<br />

Reprocessors, rebottlers, etc., of specially denatured alcohol articles<br />

Users of tax-free alcohol<br />

Breweries<br />

Bonded wineries<br />

Bonded wine storerooms<br />

Bonded field warehouses<br />

Vinegar factories using vaporizing process<br />

Importers<br />

Wholesale liquor dealers<br />

Wholesale malt liquor dealers<br />

Retail liquor dealers<br />

Retail malt liquor dealers<br />

Manufacturers of nonbeverage products (drawback)<br />

Bottle manufacturers<br />

Carriers<br />

TABLE 38.-Basic perm is under the Federal Alcohol Administration Ad,<br />

fiscal year <strong>1949</strong><br />

•<br />

Number<br />

135<br />

132<br />

248<br />

2<br />

61<br />

199<br />

55<br />

76<br />

43<br />

33<br />

4, 310<br />

2, 088<br />

7, 307<br />

412<br />

763<br />

sa<br />

36<br />

9<br />

1,329<br />

7,669<br />

18,360<br />

294,147<br />

163,331<br />

1, 121<br />

72<br />

430<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

DEFINITIONS OP REPORTING UNITS<br />

The reporting units are proof gallons, wine gallons, tax gallons, barrels, half<br />

pints, and 100-grain gallons.<br />

The tax on distilled spirits is levied and collected at the prescribed legal rate on<br />

each proof gallon, or wine gallon when below proof, and a proportionate tax at<br />

a like rate on all fractional parts of such proof or wine gallon. (Sec. 2800, I. R. C.)<br />

In all sales of distilled spirits a proof gallon is held to be a gallon of proof spirits.<br />

Proof spirits are held to be that alcoholic liquor which contains one-half of its<br />

volume of alcohol of a specific gravity of seven thousand nine hundred and thirtynine<br />

ten-thousandths (0.7939) at 60° F. (Sec. 2809, I. R. C.)<br />

Proof gallon: A standard proof gallon is a wine gallon of an alcoholic mixture<br />

containing 50 percent of ethyl alcohol by volume. In a wine gallon containing<br />

more or less than 50 percent of ethyl alcohol by volume, the number of proof<br />

gallons is proportionately greater or smaller than 1 proof gallon. (Theproof<br />

of spirits is twice the percent of the content, by volume, of ethyl alcohol. Accordingly<br />

the standard proof gallon is 100 proof.)<br />

Standard United States gallon: A standard United States gallon contains<br />

231 cubic inches.<br />

Wine gallon: A wine gallon is a standard United States gallon.<br />

Tax gallon: A tax gallon for spirits of 100 proof or over is equivalent to the<br />

proof gallon. For spirits of less than 100 proof the tax gallon is equivalent to<br />

the wine gallon.<br />

Barrel: A barrel represents 31 wine gallons.<br />

Half pint: The half-pint reporting unit is the taxable unit for reporting sparkling<br />

wines and certain cordials and liqueurs. The tax is payable on each onehalf<br />

pint or fraction thereof in each bottle or other container.<br />

100-grain gallon: A wine gallon of vinegar which contains 10 percent acetic<br />

acid by weight is equivalent to one 100-grain gallon. In a wine gallon of vinegar<br />

which contains more or less than 10 percent acetic acid by weight, the number of<br />

100-grain gallons is proportionately greater or smaller than one. The 100-grain<br />

gallon is equivalent to the 10 percent gallon.<br />

II. ETHYL ALCOHOL<br />

(Relates to ethyl alcohol produced by industrial alcohol plants]<br />

TABLE 39.-Materials: I Used at industrial alcohol plants in production of untienatured<br />

ethyl alcohol, by kinds and by months, fiscal year <strong>1949</strong><br />

159<br />

DRtillers<br />

Warehoeshag<br />

and<br />

bottling<br />

Beelifters<br />

Wine<br />

Pro'<br />

ducers<br />

and<br />

blend.<br />

ere<br />

Wine<br />

build<br />

- ., -<br />

cr"<br />

41<br />

Wholesalers<br />

Month<br />

Corn Malt Wheat<br />

Grain and grain products<br />

Sorghum<br />

grain<br />

Rye<br />

Total<br />

Potatoell<br />

Ineflect JulY 1. 1948- 422 77<br />

18,912<br />

Issued 45 21 3,529<br />

Terminated 73 15 3,574<br />

Revoked 17<br />

Annulled<br />

a<br />

Voluntarily surrendered 56 8 2,078<br />

Automatically terminated 17<br />

7 1,474<br />

In effect June 30. <strong>1949</strong> 894 83 18, 858<br />

Amended 32 11 2, 074<br />

Suspended 7<br />

Reinstated after ruspenslon_ 7<br />

In suspension Jane 30, 1999<br />

.0<br />

CV<br />

10<br />

I m F1N Ui m m<br />

July<br />

August<br />

September<br />

October<br />

November<br />

December<br />

January<br />

February<br />

March<br />

e<br />

may<br />

June<br />

Pounds<br />

410,153<br />

6, 170, 139<br />

4,420,038<br />

6, 468,423<br />

6,822,556<br />

2,165, 721<br />

1,802, 564<br />

1, 660,799<br />

7,824,172<br />

6,673, 376<br />

5,998, 974<br />

6,348, 571<br />

Pounds<br />

2,152, 200<br />

2, 789, 569<br />

4,669,083<br />

4,375,847<br />

3,814,286<br />

1,651, 008<br />

513,414<br />

178, 224<br />

691,005<br />

720,180<br />

539, 325<br />

500,659<br />

Pounds<br />

791<br />

2,471<br />

11,480<br />

10,728<br />

11,120<br />

9, 705<br />

36,040<br />

382,910<br />

924,398<br />

82,804<br />

Pounds<br />

3,053,325<br />

8,056, 890<br />

10, 289,876<br />

11,389, 159<br />

7,007, 524<br />

6,995,350<br />

5,328, 375<br />

1,300, 070<br />

1,339, 700<br />

1,327,940<br />

57,470<br />

Pounds<br />

17,196<br />

Pounds<br />

7,616, 469<br />

17,014,069<br />

19, 390,477<br />

22, 243, 957<br />

17,672, 722<br />

10, 812, 284<br />

7,644,353<br />

3,136,093<br />

9,890, 917<br />

9,103, 908<br />

7, 520,167<br />

6,932,034<br />

Pounds<br />

93, 724,298<br />

132,613,112<br />

280, 956, 997<br />

250,014, 128<br />

215,542,023<br />

188,502,187<br />

1,441,691<br />

4,024,486<br />

12,819,525<br />

17,312,875<br />

Total B6,756,986 22, 536,600 1 1, 472, 447 58,145, 679 17, 236 138, 977,448 1, 126, 1151, GIS<br />

See footnotes at end of table.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)