1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

I<br />

I<br />

38 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

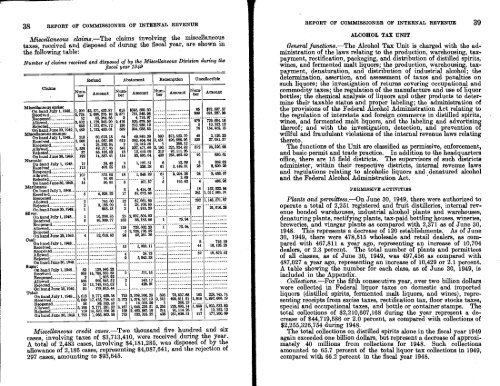

Miscellaneous claims.—The claims involving the miscellaneous<br />

taxes, received and disposed of during the fiscal year, are shown in<br />

the following table:<br />

Number of claims received and disposed of by the Miscellaneous Division during the<br />

fiscal year <strong>1949</strong><br />

Claims<br />

Miscellaneous excise:<br />

On band July 1,1948_.<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On band Jtme 30, <strong>1949</strong><br />

Miscellaneous stamps:<br />

On band July 1, 1948_<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On hand June 30, <strong>1949</strong>.<br />

Narcotic:<br />

On band July 1, 1948_<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On hand June 30, <strong>1949</strong>_<br />

Marihuana:<br />

On hand July 1,1948<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On bandJune 30, <strong>1949</strong>.<br />

Silver:<br />

On hand July 1, 1948._<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On hand June 30,<strong>1949</strong>_<br />

Coal:<br />

On hand July 1, 1948<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On band Tune 30,<strong>1949</strong>_<br />

Sugar:<br />

On hand July 1, 1948._<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

Onband June 30, <strong>1949</strong>_<br />

Total:<br />

On handJuly 1,1948._<br />

Received<br />

Reopened<br />

Allowed<br />

Rejected<br />

On band June 30,<strong>1949</strong>-<br />

1<br />

1, 200<br />

3 724<br />

52<br />

2,832<br />

655<br />

, 489<br />

218<br />

1,566<br />

4<br />

559<br />

37<br />

192<br />

12<br />

113<br />

107<br />

4<br />

14<br />

5<br />

2<br />

2<br />

1<br />

I<br />

3<br />

4<br />

82<br />

638<br />

2<br />

608<br />

21<br />

95<br />

1, 613<br />

6, 049<br />

58<br />

5 106<br />

719<br />

1, 795<br />

Refund Abatement Redemption Uncollectible<br />

Amount<br />

$2, 571, 433.87<br />

2, 600, 275.10<br />

63,364. 66<br />

1, 729, 948.90<br />

1, 752, 67472<br />

1, 752, 450..01<br />

60,016.18<br />

44,987.98<br />

24,382. 84<br />

49,317. 05<br />

65, 182. 52<br />

14,887. 41<br />

24.45<br />

403.55<br />

375.05<br />

16.00<br />

36.95<br />

4, 928.22<br />

745.00<br />

3, 188. 09<br />

995.13<br />

16,308. 85<br />

16,309. 77<br />

32,618. 62<br />

129,646.23<br />

14, 788, 853.83<br />

1, 805. 92<br />

990, 845.52<br />

13, 749, 645.02<br />

179,815.44<br />

2, 777, 429.58<br />

17, 455, 758.43<br />

89, 553. 42<br />

2,771,231.52<br />

15, 570, 706. 35<br />

1,980, 803.56<br />

815<br />

2, 577<br />

3<br />

2,476<br />

130<br />

589<br />

64<br />

612<br />

2<br />

546<br />

18<br />

114<br />

3<br />

18<br />

18<br />

3<br />

3<br />

17<br />

12<br />

5<br />

3<br />

25<br />

133<br />

129<br />

5<br />

24<br />

13<br />

4<br />

9<br />

3<br />

2<br />

1<br />

710<br />

3,373<br />

5<br />

3,187<br />

168<br />

733<br />

Amount<br />

$395, 580.30<br />

731, 346.98<br />

4,719.97<br />

526,678. 58<br />

210,930.12<br />

394,038. 55<br />

49,840.39<br />

363, 464.04<br />

13, 312.59<br />

327, 471.69<br />

15,449. 69<br />

83, 695.64<br />

1,727.51<br />

228.28<br />

1, 848. 22<br />

107.57<br />

4,414.01<br />

87,672.68<br />

67,061. 89<br />

23, 109. 60<br />

1,915.20<br />

2,907,804.02<br />

86, 185. 86<br />

723, 002. 23<br />

2, 228, 726.39<br />

42,261. 26<br />

5,068.11<br />

24.73<br />

5,043.38<br />

571.18<br />

143.17<br />

428.01<br />

3,359,366. 23<br />

1, 274, 537.13<br />

18, 032.56<br />

1,646,230.51<br />

2,483, 687. 19<br />

522, 018.22<br />

Num<br />

ber<br />

380<br />

3, 451<br />

5<br />

3<br />

•<br />

193<br />

213<br />

430<br />

6<br />

61<br />

61<br />

1<br />

5<br />

1<br />

1<br />

386<br />

3, 513<br />

5<br />

3,255<br />

214<br />

435<br />

Amount<br />

$75,523.79<br />

496, 086.96<br />

288.12<br />

225,324.92<br />

95, Ill. 26<br />

251,462.69<br />

13.89<br />

3, 449.01<br />

3,294.28<br />

3.00<br />

166.62<br />

75.94<br />

76.94<br />

75,537.68<br />

499, 611. 91<br />

288.12<br />

228,695.14<br />

95, 114. 26<br />

251,628.31<br />

Num -<br />

ber<br />

85<br />

969<br />

979<br />

5<br />

70<br />

49<br />

539<br />

572<br />

16<br />

8<br />

25<br />

24<br />

4<br />

18<br />

241<br />

232<br />

27<br />

8<br />

44<br />

52<br />

163<br />

1,818<br />

1,859<br />

5<br />

117<br />

Amount<br />

$73, 587.37<br />

821, 227.08<br />

729,604.18<br />

10, 252.12<br />

154, 958.15<br />

2, 120. 22<br />

27, 081.37<br />

28,320.98<br />

880.61<br />

269.32<br />

8, 600.20<br />

8,463.57<br />

405.95<br />

1E2, 022. 64<br />

1, 017, 565.31<br />

1,148,871.67<br />

21,016.28<br />

746.19<br />

18, 126. 23<br />

18, 872.42<br />

228, 745.74<br />

1, 892, 600.19<br />

1,933,832.82<br />

10, 252. 12<br />

177,260.99<br />

Miscellaneous credit cases.—Two thousand five hundred and six<br />

cases, involving taxes of $3,713,410, were received during the year.<br />

A total of 2,483 cases, involving $4,181,285, was disposed of by the<br />

allowance of 2,186 cases, representing $4,087,641, and the rejection of<br />

297 cases, amounting to $93,645.<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 39<br />

ALCOHOL TAX UNIT<br />

General functions.—The Alcohol Tax Unit is charged with the administration<br />

of the laws relating to the production, warehousing, taxpayment,<br />

rectification, packaging, and distribution of distilled spirits,<br />

wines, and fermented malt liquors; the production, warehousing, taxpayment,<br />

denaturation, and distribution of industrial alcohol; the<br />

determination, assertion, and assessment of taxes and penalties on<br />

such liquors; the investigation of returns covering occupational and<br />

commodity taxes; the regulation of the manufacture and use of liquor<br />

bottles; the chemical analysis of liquors and other products to determine<br />

their taxable status and proper labeling; the administration of<br />

the provisions of the Federal Alcohol Administration Act relating to<br />

the regulation of interstate and foreign commerce in distilled spirits,<br />

wines, and fermented malt liquors, and the labeling and advertising<br />

thereof; and with the investigation, detection, and prevention of<br />

willful and fraudulent violations of the internal revenue laws relating<br />

thereto.<br />

The functions of the Unit are classified as permissive, enforcement,<br />

and basic permit and trade practice. In addition to the headquarters<br />

office, there are 15 field districts. The supervisors of such districts<br />

administer, within their respective districts, internal revenue laws<br />

and regulations relating to alcoholic liquors and denatured alcohol<br />

and the Federal Alcohol Administration Act.<br />

PERMISSIVE ACTIVITIES<br />

Plants and permittees.—On June 30, <strong>1949</strong>, there were authorized to<br />

operate a total of 2,251 registered and fruit distilleries, internal revenue<br />

bonded warehouses, industrial alcohol plants and warehouses,<br />

denaturing plants, rectifying plants, tax-paid bottling houses, wineries,<br />

breweries, and vinegar plants as compared with 2,371 as of June 30,<br />

1948. This represents a decrease of 120 establishments. As of June<br />

30, <strong>1949</strong>, there were 478,515 wholesale and retail dealers, as compared<br />

with 467,811 a year ago, representing an increase of 10,704<br />

dealers, or 2.3 percent. The total number of plants and permittees<br />

of all classes, as of June 30, <strong>1949</strong>, was 497,456 as compared with<br />

487,027 a year ago, representing an increase of 10,429 or 2.1 percent.<br />

A table showing the number for each class, as of June 30, <strong>1949</strong>, is<br />

included in the Appendix.<br />

Collections.—For the fifth consecutive year, over two billion dollars<br />

were collected in Federal liquor taxes on domestic and imported<br />

liquors (distilled spirits, fermented malt liquors, and wines), representing<br />

receipts from excise taxes, rectification tax, floor stocks taxes,<br />

special and occupational taxes, and bottle or container stamps. The<br />

total collections of $2,210,607,168 during the year represent a decrease<br />

of $44,719,586 or 2.0 percent, as compared with collections of<br />

$2,255,326,754 during 1948.<br />

The total collections on distilled spirits alone in the fiscal year <strong>1949</strong><br />

again exceeded one billion dollars, but represent a decrease of approximately<br />

40 millions from collections for 1948. Such collections<br />

amounted to 65.7 percent of the total liquor tax collections in <strong>1949</strong>,<br />

compared with 66.2 percent in the fiscal year 1948.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)