1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

The Planning Division was expanded with a view to more nearly<br />

conforming its size to the increasing responsibilities devolving upon it<br />

in connection with the decentralization program and the implementation<br />

of the recommendations made by the management engineering<br />

firm which surveyed a number of representative collectors' offices<br />

during the year. Successful pilot installations conducted under the<br />

direction of the division led to the delegation to all collectors of<br />

responsibility for adjusting special employment tax refund claims not<br />

in excess of $1,000, and paved the way for adoption on a national scale,<br />

effective with the quarter beginning January 1, 1950, of a combined<br />

return form for use in reporting both income tax collected at source<br />

on wages and taxes under the Federal Insurance Contributions Act.<br />

Other tests, stemming from the engineers' recommendations, will be<br />

undertaken on a wide scale beginning January 1, 1950. One of these<br />

experiments which will be viewed with particular interest will be to<br />

determine the feasibility of using ledger cards in lieu of assessment<br />

sheets to permit the grouping of all tax accounts receivable of the<br />

same taxpayer. A number of different types of remittance control<br />

machines, cash registering devices, and other labor-saving equipment<br />

endorsed by the engineers also will be tested and a further trial of<br />

tabulating procedures and equipment will be conducted. Other<br />

recommendations of the engineers with respect to forms design,<br />

staffing standards, verification of income and prepayment credits, and<br />

taxpayer education are receiving continuing study.<br />

In administering the personnel of the several collection districts,<br />

the provisions of the Classification Act of 1923 and amendatory Acts,<br />

and decisions of the Comptroller General relating thereto, have been<br />

closely adhered to. The policy has been continued of making such<br />

appointments as have been authorized in the field collection service at<br />

the minimum salary rate of the appropriate grade, and all applications<br />

for positions have been carefully scrutinized and investigated with a<br />

view of maintaining the usual high standard of requirement for<br />

employment.<br />

The Disbursement Accounting Division administratively examined<br />

and recorded 1,568 monthly accounts of the collectors of internal<br />

revenue, internal revenue agents in charge, district supervisors, heads<br />

of Technical Staff Divisions, foreign account (Paris, France), including<br />

the San Juan, Puerto Rico Branch of the District of Maryland, comprising<br />

a total of 145,350 vouchers. In addition, 12,514 travel expense<br />

vouchers of employees and 23,295 vouchers covering passenger and<br />

freight transportation and miscellaneous expenses were audited and<br />

passed to the Chief Disbursing Officer, Treasury Department, or to<br />

the General Accounting Office for payment, making a total of 181,159<br />

vouchers handled during the <strong>1949</strong> fiscal year.<br />

EMPLOYMENT TAX UNIT<br />

The Employment Tax Unit administers the employment taxes<br />

imposed under Subchapters A, B, and C of Chapter 9 of the <strong>Internal</strong><br />

<strong>Revenue</strong> Code. Subchapter A (Federal Insurance Contributions<br />

Act) relates to the taxes with respect to employment by persons other<br />

than carriers; Subchapter B (Railroad Retirement Tax Act) relates to<br />

the taxes with respect to employment by carriers; and Subchapter C<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 13<br />

(Federal Unemployment Tax Act) relates to the tax on employers<br />

(other than carriers) of eight or more individuals. These provisions<br />

of law were formerly Titles VIII and IX of the Social Security Act and<br />

the Carriers Taxing Act of 1937.<br />

Collections of employment taxes for the fiscal year <strong>1949</strong> were<br />

$2,476,112,762, an increase of $94,770,409 compared with collections<br />

for the preceding year.<br />

Assessments of employment taxes.—During the year, 5,617 assessment<br />

lists, consisting of 13,617,219 items totaling $3,125,026,287, an<br />

increase of $1,021,937,308 over the previous year, were approved by<br />

the Commissioner. These lists included original and additional<br />

assessments of employment taxes. Included in this total were 2,114<br />

lists prepared by the collectors' offices and adjusted by the Bureau,<br />

consisting of 13,583,302 items totaling $3,118,479,816, and 3,503 lists<br />

prepared in the Bureau, consisting of 33,917 items totaling $6,546,471,<br />

as further analyzed in the following tabulations:<br />

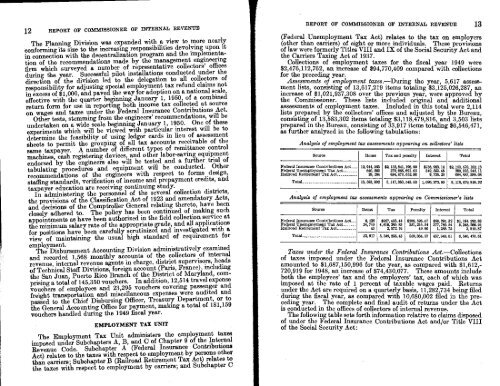

Analysis of employment tax assessments appearing on collectors' lists<br />

Source Items Tax and penalty Interest Total<br />

Federal Insurance Contributions Act___<br />

Federal Unemployment Tax Act<br />

Railroad Retirement Tax Act<br />

Total<br />

12, 914, 563<br />

940, 555<br />

28,184<br />

22, 152,841, 198. 99<br />

279,668,691. 65<br />

684, 873,652.88<br />

2736,943. 14<br />

319, 553.46<br />

9, 736.20<br />

$2, 153, 678, 182. 13<br />

280,018, 245.11<br />

684, 883,389.08<br />

13, 583, 302 3, 117,383, 543. 52 1, 096, 272.80 3, 118,479, 816.32<br />

Analysis of employment tax assessments appearing on Commissioner's lists<br />

Source Items Tax Penalty Interest Total<br />

Federal Insurance Contributions Act__ 9,125 $927, 403.44 $203, 598.07 $58, 291.32 $1,194. 292.83<br />

Federal Unemployment Tax Act 24, 749 4,619,280. 83 351,216. 54 377, 769.54 5,348, 266.91<br />

Railroad Retirement Tax Act 43 2, 572.16 49.96 1, 288. 75 3, 910.87<br />

Total 33, 917 5, 549, 256.43 569,864. 57 437,349.61 6, 546, 470.61<br />

Taxes under the Federal Insurance Contributions Act.—Collections<br />

of taxes imposed under the Federal Insurance Contributions Act<br />

amounted to $1,687,150,996 for the year, as compared with $1,612,-<br />

720,919 for 1948, an increase of $74,430,077. These amounts include<br />

both the employees' tax and the employers' tax, each of which was<br />

imposed at the rate of 1 percent of taxable wages paid. Returns<br />

under the Act are required on a quarterly basis, 11,282,734 being filed<br />

during the fiscal year, as compared with 10,680,002 filed in the preceding<br />

year. The complete and final audit of returns under the Act<br />

is conducted in the offices of collectors of internal revenue.<br />

The following table sets forth information relative to claims disposed<br />

of under the Federal Insurance Contributions Act and/or Title VIII<br />

of the Social Security Act:

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)