1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

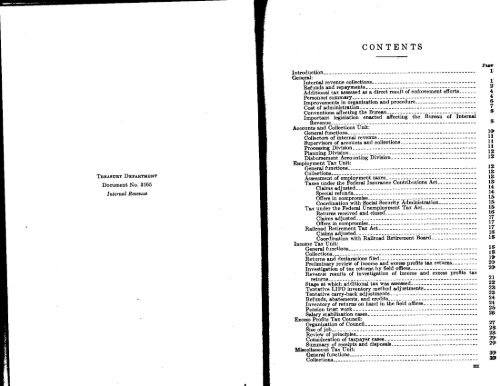

CONTENTS<br />

TREASURY DEPARTMENT<br />

Document No. 3165<br />

<strong>Internal</strong> <strong>Revenue</strong><br />

Introduction<br />

General:<br />

<strong>Internal</strong> revenue collections<br />

Refunds and repayments<br />

Additional tax assessed as a direct result of enforcement efforts<br />

Personnel summary<br />

Improvements in organization and procedure<br />

Cost of administration<br />

Conventions affecting the Bureau<br />

Important legislation enacted affecting the Bureau of <strong>Internal</strong><br />

<strong>Revenue</strong><br />

Accounts and Collections Unit:<br />

General functions<br />

Collectors of internal revenue<br />

Supervisors of accounts and collections<br />

Processing Division<br />

Planning Division<br />

Disbursement Accounting Division<br />

Employment Tax Unit:<br />

General functions<br />

Collections<br />

Assessment of employment taxes<br />

Taxes under the Federal Insurance Contributions Act<br />

Claims adjusted<br />

Special refunds<br />

Offers in compromise<br />

Coordination with Social Security Administration<br />

Tax under the Federal Unemployment Tax Act<br />

Returns received and closed<br />

Claims adjusted<br />

Offers in compromise<br />

Railroad Retirement Tax Act<br />

Claims adjusted<br />

Coordination with Railroad Retirement Board<br />

Income Tax Unit:<br />

General functions<br />

Collections<br />

Returns and declarations filed<br />

Preliminary review of income and excess profits tax returns<br />

Investigation of tax returns by field offices<br />

<strong>Revenue</strong> results of investigation of income and excess profits tax<br />

returns<br />

Stage at which additional tax was assessed<br />

Tentative LIFO inventory method adjustments<br />

Tentative carry-back adjustments<br />

Refunds, abatements, and credits<br />

Inventory of returns on hand in the field offices<br />

Pension trust work<br />

Salary stabilization cases<br />

Excess Profits Tax Council:<br />

Organization of Council<br />

Size of job<br />

Review of principles<br />

Consideration of taxpayer cases<br />

Summary of receipts and disposals<br />

Miscellaneous Tax Unit:<br />

General functions<br />

Collections<br />

nr<br />

Page<br />

1<br />

1<br />

2'<br />

4<br />

15<br />

7<br />

S<br />

&<br />

101<br />

11<br />

11<br />

11<br />

12<br />

12<br />

12<br />

13<br />

13<br />

13<br />

14<br />

14<br />

15<br />

15<br />

15<br />

16<br />

17<br />

17<br />

17<br />

113<br />

13<br />

15<br />

15<br />

19<br />

20<br />

29<br />

21<br />

22<br />

23<br />

23<br />

24<br />

24<br />

25<br />

26<br />

27<br />

2S<br />

25<br />

29'<br />

29)<br />

311<br />

39

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)