1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

classes, calendar y ear 1948, by collection<br />

134 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

Class G (manufactured<br />

to retail<br />

at more than 20<br />

cents each)—tax,<br />

$20 per thousand<br />

Class F (manufactured<br />

to retail<br />

at more than 15<br />

cents each and<br />

not more than 20<br />

cents each)—tar,<br />

$15 per thousand<br />

Class E (manufactured<br />

to retail<br />

at more than 8<br />

cents each and<br />

not more than 15<br />

cents each)—tax,<br />

$10 per thousand<br />

Class D (manufactured<br />

to retail<br />

at more than 6<br />

cents each and<br />

not more than 8<br />

cents each)—tax,<br />

$7 per thousand<br />

Class C (manufactured<br />

to retail<br />

at more than 4<br />

cents each and<br />

not more than 6<br />

cents each)—tiar<br />

$4 per thousand<br />

Class B (manufactured<br />

to retail<br />

at more than 21/2<br />

cents each and<br />

not more than 4<br />

cents each)—tax,<br />

$3 per thousand<br />

EEME8MEE 8 g0n§030WM<br />

tqlgtalggEleig'n'iig<br />

-c4<br />

--. .<br />

4 c:W-4<br />

.<br />

em-N^1<br />

....<br />

.%,°. g 42<br />

-<br />

Upg<br />

t ggg<br />

i''<br />

! Mg<br />

,F.f<br />

arai<br />

§P.Mili pt<br />

.1<br />

^<br />

Rt- . . .<br />

IL-.<br />

F-3<br />

cb<br />

,0<br />

o f<br />

HgEgEgggAggggg<br />

F.Vig<br />

MI ,f<br />

Vagg griggrgigg<br />

dgi 0- sg g 2- '5 g C.<br />

:1 .7 -I<br />

§A§§AUMPUELM .AEt<br />

giit°6q 171 Ill 4-Welgli<br />

Z "<br />

- et.. R -mm --c4-<br />

5, .587, 505, 663<br />

5, 460, 106, 364<br />

77, 778, 785<br />

BO, 173, 173<br />

116, 501, 919<br />

108, 037, 798<br />

2, 955, 069, 879<br />

3, 059, 249, 675<br />

689 'co '949<br />

VIL 5149<br />

eoe root stzt<br />

151 894'8<br />

888 162 E<br />

968'841 'KIT<br />

514 '620 'ILZ<br />

0<br />

z<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 135<br />

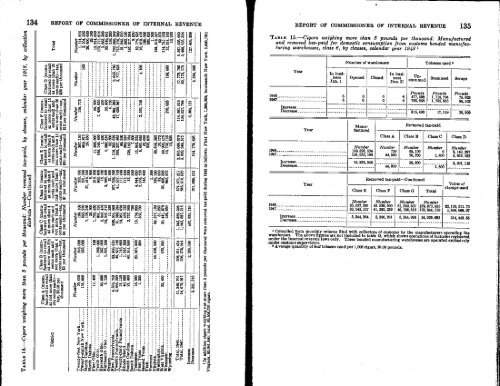

TABLE 15.-Cigars weighing more than 8 pounds per thousand: Manufactured<br />

and removed tax-paid for domestic consumption from customs bonded manufacturing<br />

warehouses, class 6, by classes, calendar year 1948 1<br />

1948<br />

1947<br />

1948<br />

1947<br />

1948<br />

1947<br />

Year<br />

Increase<br />

Decrease<br />

Increase<br />

Decrease<br />

Increase<br />

Decrease<br />

Year<br />

Year<br />

In bust.<br />

ness<br />

Jan. 1<br />

Number of warehouses<br />

Opened<br />

6 0<br />

6 0<br />

Mannfeatured<br />

Number<br />

142, 893, 534<br />

124, 055,188<br />

18, 838, 346<br />

Closed<br />

0<br />

0<br />

In business<br />

Dec. 31<br />

6<br />

6<br />

U<br />

stemmed<br />

Pound,<br />

477, 598<br />

793,088<br />

Tobacco used I<br />

Stemmed<br />

Pound,<br />

1, 718, 794<br />

1, 735, 953<br />

Scraps<br />

Pound*<br />

75,623<br />

96,522<br />

315,490 17,159 20,899<br />

Removed tax-paid<br />

Class A Class B Class C Class D<br />

Number<br />

750<br />

94,800<br />

44, 050<br />

Number<br />

65,100<br />

26, 200<br />

38,900<br />

Removed tax-paid-Continued<br />

Class E Class F Class G Total<br />

Number<br />

35, 687,381<br />

30, 343, 117<br />

Number<br />

43.629, 500<br />

41,383, 239<br />

Number<br />

51, 350, 807<br />

46,105, 812<br />

Number<br />

0<br />

1, 800<br />

1, 800<br />

Number<br />

139, 873,835<br />

123,849,150<br />

Number<br />

9, 140, 297<br />

5, 939,182<br />

3, 281, 115<br />

Val of<br />

stamps ue used<br />

$2,102, 511. 70<br />

1, 888,068. 07<br />

5,344, 264 2,246, 261 5, 244, 905 16, 029,685 214,443,63<br />

I Compiled from monthly returns filed with Wien ors of customs by the manufacturer operating the<br />

warehouses. The above figures are not included in table 13, which shows operations of factories registered<br />

under the <strong>Internal</strong> revenue laws only. These bonded manufacturing warehouses are operated exclusively<br />

.under customs supervision.<br />

3 Average quantity of leaf tobacco used per 1,000 cigars, 20.09 pounds.<br />

District<br />

Class A (manufactured<br />

to retail<br />

at not more than<br />

21/2 cents each)—<br />

tax, $2.50 per<br />

thousand<br />

Nu mber<br />

29, 000<br />

151, 000<br />

400<br />

30, 000<br />

3, 150<br />

4, 336, 750<br />

2, 686, 550<br />

3 1, 150<br />

40, 000<br />

21, 400<br />

17,<br />

300<br />

1, 300<br />

18,<br />

25, 450

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)