1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

50 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

concurrence of the Council. (Paragraphs 3 and 11 of mimeograph,<br />

R. A. No. 1529, T. S. No. 454, dated July 31, 1946.)<br />

Field operations.—The operations of the Staff field divisions fall into<br />

two main classifications: (1) contested income, profits, estate, and<br />

gift tax cases not docketed by The Tax Court Of the United States,<br />

including cases in the pre-90-day status, cases in the 90-day status, and<br />

cases involving overassessments and claims; and (2) cases docketed<br />

and pending before the Tax Court. The statistical data summarizing<br />

the work accomplished by the Staff field divisions are contained in<br />

tables 117-119 on pages 219-221.<br />

With respect to contested cases not docketed before The Tax Court<br />

of the United States, there were 7,214 on hand July 1, 1948, awaiting<br />

Staff action, and 710 awaiting action by taxpayers on statutory<br />

deficiency notices directed or sustained by the Staff, or a total of 7,924<br />

nondocketed cases. Receipts and dispositions during the year were<br />

as follows:<br />

On hand July 1, 1948<br />

Received<br />

7,924<br />

8,710<br />

Total<br />

16,634<br />

Dispositions:<br />

Settled by agreement<br />

3,760<br />

Defaulted after statutory notice<br />

732<br />

Petitions filed after statutory notice<br />

1,267<br />

Unagreed overassessments and claim rejections<br />

349<br />

Returned to internal revenue agents in charge, without action_<br />

Transferred to other Bureau agencies (bankruptcy, etc.) 472<br />

6, 782<br />

On hand at the close of June 30, <strong>1949</strong> 9, 852<br />

Of the number on hand at the close of the year, 9,017 were awaiting<br />

Staff action and 835 action by taxpayers on deficiency notices. In<br />

addition to the above dispositions, 1,006 subsidiary cases were closed in<br />

accordance with the action taken in the respective basic cases. Receipts<br />

of nondocketed cases in <strong>1949</strong> exceeded those of 1948 by 960. Dispositions,<br />

exclusive of transfers and cases returned to revenue agents in<br />

charge without action, exceeded those of 1948 by 635.<br />

During the fiscal year ended June 30, <strong>1949</strong>, the Staff field divisions<br />

directed the issuance of statutory deficiency notices in 1,961 cases. In<br />

39.ff percent of these cases the taxpayer did not take an appeal to<br />

the Tax Court. The comparable percentage for the preceding 8-year<br />

period, 1941 to 1948, inclusive, was 34.7.<br />

During the year 513 so-called 90-day cases in which the statutory<br />

notice was issued direct by the internal revenue agents in charge were<br />

considered to a conclusion by the field divisions of the Staff. The<br />

revenue agent was sustained in 261 of these cases without an agreement<br />

being received from the taxpayer and 252 were settled. With respect<br />

to the 261 statutory notices which were sustained, the taxpayers filed<br />

petitions with the Tax Court in 142 cases and defaulted in the,<br />

remaining 119.<br />

On July 1, 1948, there were 4,991 docketed cases on hand in the<br />

Staff field divisions and 4,624 dockets were received during the year.<br />

Of these docketed cases, 3,125 were settled by stipulated agreement,<br />

413 were dismissed for various reasons by the Tax Court, and 946<br />

were submitted to the Tax Court on the merits, leaving a balance<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

51<br />

of 5,131 on hand June 30, <strong>1949</strong>. In addition to the dispositions<br />

summarized above, action was taken on 476 subsidiary cases which<br />

were closed in accordance with the closing of the respective basic cases.<br />

Receipts of docketed cases during <strong>1949</strong> exceeded receipts of 1948<br />

by 26. Dispositions, excluding cases submitted to the Tax Court,<br />

exceeded those of 1948 by 608. More cases were disposed of by<br />

stipulation in <strong>1949</strong> than in any year since 1940 and the cases dismissed<br />

amounted to 413 as compared with 458 in 1948 which was the largest<br />

number dismissed in any year since decentralization.<br />

For the 10-year period (fiscal years 1940 to <strong>1949</strong>, inclusive), Staff<br />

reports show decisions handed down by the Tax Court, in 10,167<br />

docketed cases. Analyses of these decisions, made currently as they<br />

were received, show a total of 3,973, or 39 percent, in which the<br />

Bureau's position was wholly sustained; 3,956, or 39 percent, in which<br />

the Bureau's position was partly sustained and partly reversed; and<br />

2,238, or 22 percent, in which the Bureau's position was wholly<br />

reversed. The percentages for the fiscal year <strong>1949</strong>, during which the<br />

court handed down 828 decisions, were 39 percent wholly sustained,<br />

42 percent partly sustained and partly reversed, and 19 percent<br />

wholly reversed.<br />

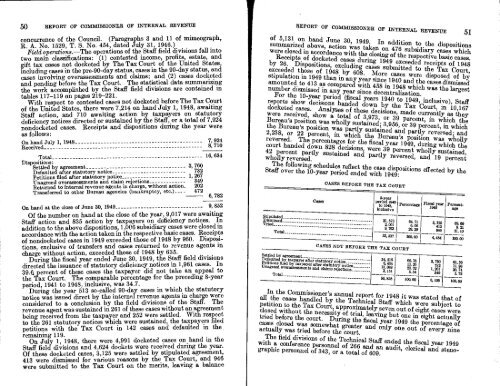

The following schedules reflect the case dispositions effected by the<br />

Staff over the 10-year period ended with <strong>1949</strong>:<br />

Stipulated<br />

Dismissed<br />

Tried<br />

Total<br />

Settled by agreement<br />

Defaulted by taxpayer after statutory notice<br />

Petitions filed by taxpayer after statutory notice<br />

Unagreed overassessments and claims rejections<br />

Total<br />

Cases<br />

CASES BEFORE THE TAX COURT<br />

9-year<br />

Period 1940<br />

to 1018,<br />

inclusive<br />

21, 573<br />

2,001<br />

9,703<br />

CASES NOT BEFORE THE TAX COURT<br />

34, 215<br />

6, 404<br />

13, 088<br />

3, 151<br />

56, 858<br />

Percentage Fiscal year<br />

<strong>1949</strong><br />

64.71<br />

II 00<br />

29.29<br />

60.18<br />

11.26<br />

23.02<br />

5.54<br />

100. 00<br />

Percentage<br />

8, 125 69.69<br />

413 9.21<br />

946 21.10<br />

33, 337 100.00 4, 484 100.00<br />

I<br />

3, 760 61. 56<br />

732 11.98<br />

1,267 20.74<br />

349 5. 72<br />

6, 108 100.00<br />

In the Commissioner's annual report for 1948 it was stated that of<br />

all the cases handled by the Technical Staff which were subject to<br />

petition to the Tax Court, approximately seven out of eight cases were<br />

closed without the necessity of trial, leaving but one in eight actually<br />

tried before the court. During the fiscal year <strong>1949</strong> the percentage of<br />

cases closed was somewhat greater and only one out of every nine<br />

actually was tried before the court.<br />

The field divisions of the Technical Staff ended the fiscal year <strong>1949</strong><br />

with a conference personnel of 266 and an audit, clerical and stenographic<br />

personnel of 343, or a total of 609.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)