1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

118<br />

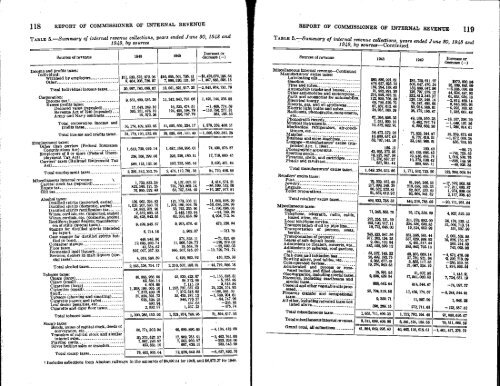

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

TABLE 5.—Summary of internal revenue collections, years ended June 80, 1948 and<br />

<strong>1949</strong>, by sources<br />

Sources of revenue 1948 <strong>1949</strong><br />

Increase or<br />

decrease (—)<br />

Income and profits taxes:<br />

Individual:<br />

Withheld by employers $11, 533, 576, 972.05 $10, 055, 501, 785.41 —41,478,075,186.64<br />

Other 9, 464, 203, 726.97 7, 996, 320, 131. 82 —1,467, 883, 595.15<br />

Total individual income taxes 20, 997, 780,699.02 18, 051, 891,917. 23 —Z 945, 958 781.79<br />

Corporation:<br />

Income tax i 9, 951, 499, 538 20 11, 342, 843, 793.08 1, 491, 144, 256.88<br />

Excess profits taxes:<br />

Declared value (repealed) 17, 693, 249.10 16, 233, 474. 51 —1, 909, 774.59<br />

<strong>Revenue</strong> Act of 1940 (repealed) _ _ _ 305, 251, 476.10 194,495, 198. 79 —110, 758, 277.31<br />

Army and Navy contracts 15, 572.28 298, 767.79 281,195. 53<br />

Total corporation income and<br />

profits taxes<br />

' 10,174, 409, 833.66 11, 553, 669, 234.17 1, 379, 259, 400. 51<br />

Total income and profits taxes 31, 172, 190, 532. 68 29, 605, 491, 151. 40 —1, 566, 699, 381.28<br />

Employment taxes:<br />

Other than carriers (Federal Insurance<br />

Contnbutions Act) 1,612, 720, 919.14 1, 687, 150,996. 01 74, 430, 076.87<br />

Employers of 8 or more (Federal Unemployment<br />

Tax Act) _ 208, 508, 299. 66 226, 228,180. 11 17, 719, 880. 95<br />

Carriers' taxes (Railroad Retirement Tax<br />

Act) 580, 113, 133. 96 562, 733, 585.44 2, 620, 451. 98<br />

Total employment taxes 2, 381, 342, 352.76 2, 476,112, 761.56 94, 770, 408. 80<br />

Miscellaneous internal revenue: \<br />

Capital stock tax (repealed) 1, 722, 833.38 6,137, 507.57 4, 414,674. 21<br />

Estate tax 822, 380. 121. 25 735, 780, 569.16 —86, 599, 552.09<br />

Gift tax 76, 965, 322. 40 60, 757, 344. 49 —16, 207, 977. 91<br />

Alcohol taxes:<br />

Distilled spirits (imported, excise)._ _ 109, 965, 294.82 121, 773, 303.11 11, 808, 008.29<br />

Distilled spirits (domestic, excise) 1, 326, 267, 593.75 1, 276,180, 994.76 —50, 086, 598.99<br />

Distilled spirits rectification tax 34, 983, 321.96 33, 793, 235, 90 —1,190, 086.06<br />

Wines, cordials, etc. (imported, excise). 2, 532, 893.18 2, 448,103. 94 —84, 789.24<br />

Wines, cordials, etc. (domestic, excise). 58, 428, 942.95 63, 333, 656. 89 4, 904, 713.94<br />

Rectifiers; liquor dealers; manufacturers<br />

of stills (special taxes) 9, 499, 845. 57 9, 973, 076. 41 473, 230. 84<br />

Stamps for distilled spirits intended<br />

for export 6, 714.16 5,.962.37 —751. 79<br />

Case stamps for distilled spirits bottled<br />

in bond 446, 948. 80 375, 323.11 —71, 625. 69<br />

Container stamps 12, 035, 803.74 11, 906, 524.72 —129, 279.02<br />

Floor taxes 42, 556.82 19, 564.79 —22, 992.03<br />

Fermented melt liquors 897, 097, 257. 83 686, 367, 516.09 —10, 729, 791.74<br />

Brewers; dealers in malt liquors (sPeoial<br />

taxes) 4, 019, 680.59 4, 429, 905. 02 410, 325.33<br />

Total alcohol taxes 2, 255, 326, 754. 17 2, 210, 607, 168. 01 —44, 719, 586. 16<br />

Tobacco taxes:<br />

Cigars (large) 46,685, 966. 98 45, 530, 478. 87 —1, 155, 538. 31<br />

Cigars (small) 65, 536.14 59, 372. 68 —6,163.46<br />

Cigarettes (large) 4,601.65 7, 115. 19 2, 513. 54<br />

Cigarettes (small) 1, 208,199, 005. 10 1, 232, 727, 657.03 24, 528, 551. 93<br />

Snuff 7, 372, 401.18 7, 272, 318.68 —100, 081. 50<br />

Tobacco (chewing and smoking) 37, 024, 391.73 35, 435, 187. 12 —1, 589, 209.61<br />

Cigarette papers and tubes 925, 594. 23 840, 776.27 —84, 747.96<br />

Leaf dealer penalties, etc 693. 94 457. 08<br />

Cigarette and cigar floor taxes 2, 032.97 1, 557. 23 — 475.74<br />

Total tobacco taxes 1, 309, 280, 152. 92 1, 321, 874, 769.95 21, 594, 617. 03<br />

Stamp taxes:<br />

Bonds, issues of capital stock, deeds of<br />

conveyance, etc 50, 771, 302.94 46, 668.890. 86 —4.104, 412.19<br />

Transfers of capital stock and similar<br />

interest sales 20, 373, 527.57 17, 909, 765. 91 —2, 463, 761.66<br />

Playing cards 7, 867, 223.97 7, 563, 960.97 —303, 263.00<br />

Silver bullion sales or transfers 453, 881.16 687, 425.15 233, 943.99<br />

Total stamp taxes 79, 465, 936.64 72, 826 042.88 —6, 637, 892.76<br />

Includes collections from Alaskan railways in the amounts of $6,097.61 for 1948, and $6,873.27 for <strong>1949</strong>.<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

119<br />

TABLE 5.—Summary of internal revenue collections, years ended June 80, 1948 and<br />

<strong>1949</strong>, by sources—Continued<br />

Sources of revenue 1948<br />

Miscellaneous internal revenue—Continued<br />

Manufacturers' excise taxes:<br />

Lubricating oils<br />

Gasoline<br />

Tires and tubes<br />

Automobile trucks and busses<br />

Other automobiles and motorcycles_<br />

Parts and accessories for automobiles_<br />

Electrical energy<br />

Electric, gas, and oil appliances<br />

Electric light bulbs and tubes<br />

Radio sets, phonographs, components,<br />

etc<br />

Phonograph records<br />

Musical instruments<br />

Mechanical refrigerators, air-conditioners,<br />

etc<br />

Matches<br />

Business and store machines<br />

Luggage—manufacturers' excise (suspended<br />

Apr. 1, 1944)<br />

Photographic apparatus<br />

Sporting goods<br />

Firearms, shells, and cartridges<br />

Pistols and revolvers<br />

Total manufacturers' excise taxes__ 1,649,239 052 56<br />

Retailers' excise taxes:<br />

Furs<br />

Jewelr y<br />

Luggage<br />

Toilet preparations<br />

Total retailers' excise taxes<br />

Miscellaneous taxes:<br />

Sugar<br />

Telephone, telegraph, radio, cable,<br />

leased wires, etc<br />

Local telephone service_<br />

Transportation of oil by Pipe line . .<br />

Transportation of persons, seats,<br />

berths<br />

Transportation of property<br />

Leases of safe deposit boxes<br />

Admissions to theaters, concerts, etc<br />

Admissions to cabarets, roof gardens,<br />

etc<br />

Club dues and initiation fees<br />

Bowling alleys, pool tables, etc<br />

Com-operated devices<br />

Adulterated and process or renovated<br />

butter, and filled cheese_ _<br />

Oleomargarine, including special taxes.<br />

Narcotics, including marihuana and<br />

special taxes<br />

Coconut and other vegetable oils processed<br />

Firearms transfer and occupational<br />

taxes<br />

All other, including repealed taxes not<br />

listed above<br />

$80, 886, 921.61<br />

478, 637, 625.15<br />

159, 284, 138. 65<br />

91, 962,891. 20<br />

27% 958, 392 21<br />

122, 950, 708 28<br />

69, 700, 529. 73<br />

87, 857, 612. 46<br />

29,935, 505. 39<br />

87,266,856 93<br />

7,531 905. 10<br />

10, 572, 882.91<br />

58, 473, 372. 22<br />

10609, 657.69<br />

32, 707,141. 16<br />

189.13<br />

43, 935, 373.05<br />

18, 827, 947. 98<br />

4, 276, 687.37<br />

857, 913.94<br />

79, 539, 152.90<br />

217, 899, 249.20<br />

80, 632, 323. 81<br />

91, 852 012. 92<br />

480, 922, 738 33<br />

71, 246,833. 78<br />

275, 255, 151. 59<br />

193, 520, 917. 11<br />

18,773,045.00<br />

246,323,047. 56<br />

317, 203, 134. 25<br />

9, 081, 102. 94<br />

385, 100,699.12<br />

53,145. 22<br />

25, 499, 192. 75<br />

4, 085, 677.01<br />

19, 270, OM 65<br />

19, 691.95<br />

9, 806, 429.34<br />

888,84264<br />

25, 704,319. 58<br />

9, 359.71<br />

396,289.15<br />

Total miscellaneous taxes 1, 655, 711, 499.33<br />

Total miscellaneous internal revenue 8,311, OM, 419.96<br />

Grand total, all collections 41, 889 592, 295.40<br />

<strong>1949</strong> Increase or<br />

decrease (—)<br />

$81, 759, 611. 97<br />

503,697, 970.24<br />

150, 899, 047.96<br />

136, 797, 379.13<br />

332812,34237<br />

120, 138, 240.14<br />

79,397, 495.68<br />

80, 934, 508 61<br />

26, 172,16%87<br />

99,159, 550.23<br />

6, 482, 797.74<br />

9, 292, 668.30<br />

77, 833, 244. 87<br />

8, 737, 618. 31<br />

33, 343, 900.01<br />

100.<br />

43,139, 668.42<br />

19, 846, 484. 74<br />

10, 378, 538.92 '<br />

806 888.11<br />

$872 690.36<br />

35,008, 896.09<br />

— 8, 385,090. 69<br />

44, 834, 487.93<br />

81, 853, 950.16<br />

—2, 812, 468. 19<br />

9, 846, 965. 93<br />

—6,923,103. 85<br />

1, 236, 661.48<br />

—18, 107, 306.70<br />

—1, 049, 107. 36<br />

—1, 280, 014.61<br />

19, 359, 872.65<br />

—I, 872, 039.38<br />

636, 75885<br />

—88 73<br />

—795, 705.53<br />

1, 018, 538.76<br />

—818,145.95<br />

—48, 025.33<br />

1, 771, 532, 722 50 122, 298, 86944<br />

61,946, MIL 55<br />

210,688, 165. 33<br />

82, 607, 133 49<br />

93, 969, 241.32<br />

- 509, 905.85<br />

—7, 211, 083.87<br />

1,979809.68<br />

2,117, 228. 40<br />

449,210, 786.69 —20, 711,951.84<br />

76,179, 356.09<br />

311, 379, 682.00<br />

229, 530, 630.85<br />

19, 329 552 99<br />

251,388, 581.94<br />

337, 039, 889.92<br />

9, 461, 317. 44<br />

385, 843, 793.10<br />

44 856 669.14<br />

27, 789, 911. 84<br />

3,805,117. 85<br />

21, 087, 539.19<br />

21, 037. 86<br />

17, 641,080. 53<br />

814, 544 87<br />

17, 459, 774.67<br />

11,007. 99<br />

272, 711.83<br />

4, 927, 522.33<br />

36, 124, 530. 41<br />

31, 009, 713. 74<br />

551, 507.99<br />

5, 065, 533. 88<br />

19, 826, 755.87<br />

380, 214.50<br />

743, 093.98<br />

—4,670, 478.08<br />

I, 290, 719.09<br />

—280, 559.16<br />

1, 816, 593.54<br />

1, 445. 91<br />

7, 734, 651.19<br />

—74, 097.77<br />

—8, 294, 544.91<br />

1, 848. 28<br />

—123, 567.52<br />

1, 752, 792, 194. 40 97, 080,695. 07<br />

8, 381, 521, 105. 65 70, 511, 695.88<br />

40, 463, 124 016 61 —1, 401, 417, 278.79

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)