1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

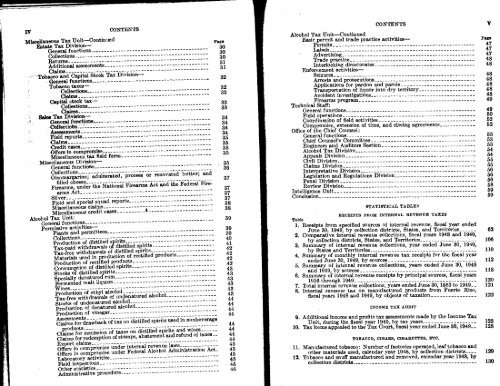

IV<br />

CONTENTS<br />

Miscellaneous Tax Unit—Continued<br />

Estate Tax Division—<br />

General functions<br />

Collections<br />

Returns<br />

Additional assessments<br />

Claims<br />

Tobacco and Capital Stock Tax Division—<br />

General functions<br />

Tobacco taxes—<br />

Collections<br />

Claims<br />

Capital stuck tax-<br />

Colleetions<br />

- Claims<br />

Sales Tax Division—<br />

General functions<br />

Collections "<br />

Assessments<br />

Field reports<br />

Claims<br />

Credit cases<br />

Off erain compromise<br />

Miscellaneous tax field force<br />

Miscellaneous Division—<br />

General functions<br />

Collections<br />

Oleomargarine; adulterated, process or renovated butter; and<br />

filled cheese<br />

Firearms, under the National Firearms Act and the Federal Firearms<br />

Act<br />

Silver<br />

Field and special squad reports<br />

Miscellaneous claims<br />

Miscellaneous credit cases<br />

Alcohol Tax Unit:<br />

General functions<br />

Permissive activities—<br />

Plants and permittees<br />

Collections<br />

Production of distilled spirits<br />

Tax-paid withdrawals of distilled spirits<br />

Tax-free withdrawals of distilled spirits<br />

Materials used in production of rectified products<br />

Production of rectified products<br />

Consumption of distilled spirits<br />

Stocks of distilled spirits<br />

Specially denatured rum<br />

Fermented malt liquors<br />

Wines<br />

Production of ethyl alcohol<br />

Tax-free withdrawals of undenatured alcohol<br />

Stocks of undenatured alcohol<br />

Production of denatured alcohol<br />

Production of vinegar<br />

Assessments<br />

Claims for drawback of tax on distilled spirits used in nonbeverage<br />

Page<br />

30<br />

30<br />

30<br />

31<br />

31<br />

44<br />

products<br />

Claims for remission of taxes on distilled spirits and wines 44<br />

Claims for redemption of stamps, abatement and refund of taxes 44<br />

44<br />

Export claims<br />

45<br />

Offers in compromise under internal revenue laws<br />

Offers in compromise under Federal Alcohol Administration Act_<br />

45<br />

45<br />

Laboratory activities<br />

45<br />

Field inspections 45<br />

Other statistics 46<br />

Administrative procedure<br />

32<br />

32<br />

33<br />

33<br />

33<br />

34<br />

34<br />

34<br />

34<br />

35<br />

35<br />

35<br />

35<br />

35<br />

36<br />

37<br />

37<br />

37<br />

37<br />

38<br />

38<br />

39<br />

39<br />

39<br />

40<br />

41<br />

42<br />

42<br />

42<br />

42<br />

43<br />

43<br />

43<br />

43<br />

43<br />

43<br />

44<br />

44<br />

44<br />

44<br />

CONTENTS<br />

Alcohol Tax Unit—Continued<br />

Basic permit and trade practice activities—<br />

Permits<br />

Labels<br />

Advertising<br />

Trade practice<br />

Interlocking directorates<br />

Enforcement activities—<br />

Seizures<br />

Arrests and prosecutions<br />

Applications for pardon and parole<br />

Transportation of liquor into dry territory<br />

Accident investigations<br />

Firearms program<br />

Technical Staff:<br />

General functions<br />

Field operations<br />

Coordination of field activities<br />

Compromise, extension of time and closing agreements<br />

Office of the Chief Counsel:<br />

General functions 53<br />

Chief Counsel's Committee 53<br />

Engineers and Auditors Section 53<br />

Alcohol Tax Division<br />

Appeals Division<br />

54<br />

Civil Division 55<br />

Claims Division 55<br />

Interpretative Division 56<br />

Legislation and Regulations Division 56<br />

Penal Division 56<br />

Review Division 58<br />

Intelligence Unit 59<br />

Conclusion 59<br />

STATISTICAL TABLES<br />

RECEIPTS FROM INTERNAL REVENUE TAXES<br />

Table<br />

1. Receipts from specified sources of internal revenue, fiscal year ended<br />

June 30, <strong>1949</strong>, by collection districts, States, and Territories<br />

2. Comparative internal revenue collections, fiscal years 1948 and <strong>1949</strong>,<br />

by collection districts, States, and Territories<br />

3. Summary of internal revenue collections, year ended June 30, <strong>1949</strong>,<br />

by States and Territories<br />

4. Summary of monthly internal revenue tax receipts for the fiscal year<br />

ended June 30, <strong>1949</strong>, by sources<br />

5. Summary of internal revenue collections, years ended June 30, 1948<br />

and <strong>1949</strong>, by sources<br />

6. Summary of internal revenue receipts by principal sources, fiscal years<br />

1916 through <strong>1949</strong><br />

7. Total internal revenue collections, years ended June 30, 1863 to <strong>1949</strong>_ _<br />

8. <strong>Internal</strong> revenue tax on manufactured products from Puerto Rico,<br />

fiscal years 1948 and <strong>1949</strong>, by objects of taxation<br />

INCOME TAX AUDIT<br />

9. Additional income and profits tax assessments made by the Income Tax<br />

Unit, during the fiscal year <strong>1949</strong>, by tax years 122<br />

10. Tax items appealed to the Tax Court, fiscal year ended June 30, <strong>1949</strong>_ _ 128<br />

TOBACCO, CIGARS, CIGARETTES, ETC.<br />

11. Manufactured tobacco: Number of factories operated, leaf tobacco and<br />

other materials used, calendar year 1948, by collection districts__ 129<br />

12. Tobacco and snuff manufactured and removed, calendar year 1948, by<br />

collection districts 130<br />

V<br />

Page<br />

47<br />

47<br />

47<br />

48<br />

48<br />

48<br />

48<br />

48<br />

48<br />

48<br />

49<br />

49<br />

50<br />

52<br />

52<br />

54<br />

62<br />

106<br />

110<br />

112<br />

118<br />

120<br />

121<br />

122

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)