1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

plications acted upon during the year numbered 25,491, with requested<br />

tax reduction of $215,706,693. Of this number, 22,116<br />

applications with requests for $180,650,257 in tax reductions were<br />

allowed in full, the net amount allowed being $181,945,342. Partial<br />

allowance was made in 1,836 cases, with $20,873,101 allowed as compared<br />

with $24,097,386 requested. There were 1,539 applications<br />

requesting tax reductions aggregating $10,959,050 that were disallowed.<br />

At the close of the year, applications on hand numbered<br />

2,958 and involved net tax reductions of $14,990,513.<br />

Refunds, abatements, and credits.-The amount involved in income<br />

and profits tax overassessments of all types for <strong>1949</strong>, including cases<br />

settled in the collectors' offices as well as in the Income Tax Unit,<br />

was $3,512,818,931 as compared with $2,953,437,943 for the preceding<br />

year. The following table shows the amounts of abatement, credit,<br />

refund, and interest comprising these totals.<br />

Amounts -of overassessment, by method of settlement, and interest allowed on income<br />

andtexeess profits tax cases closed during the fiscal years 1948 and <strong>1949</strong><br />

Fiscal year<br />

1948 <strong>1949</strong><br />

Overassessments settled by-<br />

Abatements: $184,173,365 $207, 576,323<br />

Regular 24, 484, Geo 34,086, 295<br />

Duplicate 512, 044, 238 448,620, 499<br />

Credit' 2,178,587,335 2, 738, 995,082<br />

Refund<br />

2,899, 249,871 3, 429, 778,199<br />

Total 54,188, 072 83,540, 732<br />

Interest<br />

2, 953,437, 943 3,512,818,931<br />

Grand total<br />

Excludes individual income tax credits of $1,000 or less resulting from excessive prepayments.<br />

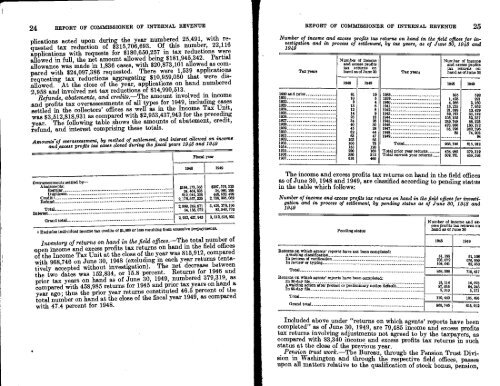

Inventory of returns on hand in the field offices.-The total number of<br />

open income and excess profits tax returns on hand in the field offices<br />

of the Income Tax Unit at the close of the year was 815,912, compared<br />

with 968,746 on June 30, 1948 (excluding in each year returns tentatively<br />

accepted without investigation). The net decrease between<br />

the two dates was 152,834, or 15.8 percent. Returns for 1946 and<br />

prior tax years on hand as of June 30, <strong>1949</strong>, numbered 379,319, as<br />

compared with 458,985 returns for 1945 and prior tax years on hand a<br />

year ago; thus the prior year returns constituted 46.5 percent of the<br />

total number on hand at the close of the fiscal year <strong>1949</strong>, as compared<br />

with 47.4 percent for 1948.<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 25<br />

Number of income and excess profits tax returns on hand in the field offices for investigation<br />

and in process of settlemen , by tax years, as of June 80, 1948 and<br />

<strong>1949</strong><br />

Tax years<br />

Number of income<br />

and excess profits<br />

tax ieturns on<br />

hand as of June 30<br />

Tax years<br />

Number of income<br />

and excess profits<br />

tax returns on<br />

hand as ofJune 30<br />

1948 <strong>1949</strong> 1948 <strong>1949</strong><br />

,C.' """° °34*.£8 5 4 4:-.2VH`r:t<br />

1938 835 692<br />

1939 1,428 921<br />

1940 4,986 3,160<br />

1941 13,225 7,952<br />

1942 21,899 13,429<br />

1943 69, 791 33,112<br />

1944 105, 105 52,337<br />

1946 249,748 86,225<br />

1948 470,880 180,132<br />

1947 38,796 362,296<br />

1948 85 74,203<br />

<strong>1949</strong> 94<br />

Total 968, 746 815, 912<br />

Total prior year returns 458,985 379,319<br />

Total current year returns_._ 609, 761 436,593<br />

The income and excess profits tax returns on hand in the field offices<br />

as of June 30, 1948 and <strong>1949</strong>, are classified according to pending status<br />

in the table which follows:<br />

Number of income and excess profits tax returns on hand in the field offices for investigation<br />

and in process of settlement, by pending status as of June 80, 1948 and<br />

/ 949<br />

Pending status<br />

Returns on which agents' reports have not been completed:<br />

Awaiting classification<br />

In process of verification<br />

In review or typing._<br />

Total<br />

Returns on which agents' reports have been completed:<br />

In 30-day file<br />

Awaiting action after protest or preliminary notice default<br />

In 90-day file<br />

Total<br />

Grand total<br />

Number of income and excess<br />

profits tax returns on<br />

hand es of June 30<br />

1948 <strong>1949</strong><br />

61,103<br />

703, 072<br />

104, 041<br />

51,108<br />

576, 959<br />

82, 350<br />

858,306 710, 417<br />

18,114<br />

87, 016<br />

5, 310<br />

16, 078<br />

84, 248<br />

5,171<br />

110, 440 105, 495<br />

968,746 815, 912<br />

Included above under "returns on which agents reports have been<br />

completed" as of June 30, <strong>1949</strong>, are 79,485 income and excess profits<br />

tax returns involving adjustments not agreed to by the taxpayers, as<br />

compared with 83,340 income and excess profits tax returns in such<br />

status at the close of the previous year.<br />

Pension trust work.-The Bureau, through the Pension Trust Divi- .<br />

sion in Washington and through the respective field offices, passes ,<br />

upon all matters relative to the qualification of stock bonus, pension,

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)