1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

Public Law 137, approved June 28, <strong>1949</strong>, amends sections 403(d)(3)<br />

and 452(c) of the <strong>Revenue</strong> Act of 1942 by extending to July 1, 1950,<br />

the period for releasing certain powers of appointment free of estate or<br />

t tax. It also amends section 283 of title 18 of the United States<br />

Code to provide that retired officers of the armed forces of the United<br />

States, while not on active duty, shall not by reason of their status be<br />

subject to such section,. which provides criminal penalties for the<br />

prosecution of claims against the United States by officers or employees<br />

thereof.<br />

ACCOUNTS AND COLLECTIONS UNIT<br />

The Accounts and Collections Unit is the central administrative<br />

organization for the 64 internal revenue collection districts and makes<br />

the administrative audit of all expenditures for the <strong>Internal</strong> <strong>Revenue</strong><br />

<strong>Service</strong>.<br />

There were 92,841,730 tax returns filed in collectors' offices during<br />

the fiscal year <strong>1949</strong>, as compared with 93,810,164 returns filed during<br />

the preceding year. Of the total returns filed, 72,247,919 were income<br />

tax and excess profits tax returns and declarations, as compared with<br />

74,410,722 in the preceding year.<br />

A total of 20,707,066,479 revenue stamps, valued at $3,631,121,654,<br />

was issued to collectors of internal revenue and to the Postmaster<br />

General, compared with 20,765,825,608 stamps, valued at $3,735,-<br />

387,804, issued during 1948.<br />

The face value of revenue stamps returned by collectors of internal<br />

revenue and by the Postmaster General and credited to their accounts<br />

amounted to $777,740,366. There were 31 applications allowed for<br />

restamping packages from which the original stamps had been lost,<br />

mutilated, or destroyed, compared with 39 applications in the preceding<br />

year.<br />

During the year, 785,711 individual income tax, 75,175 withholding<br />

tax, 91,590 miscellaneous tax, and 69,518 employment tax returns<br />

were verified by field deputy collectors. The total number of individual<br />

income tax returns disposed of by collectors' offices was approximately<br />

53 million, comprised of over 2 million returns which<br />

received office audit or field investigation, and 51 million returns closed<br />

after survey, without detailed investigation. At the close of the<br />

year, more than 70 million returns remained on hand for survey and<br />

possible audit action.<br />

The additional taxes, interest, and penalties collected or reported<br />

for assessment during the year as the result of collectors' investigative<br />

operations totaled $340,168,000. Of this total $289,760,000 involved<br />

income and withholding taxes while the balance related to<br />

employment taxes, alcohol taxes, and other internal revenue taxes.<br />

These amounts reflect an increase as compared with the preceding<br />

year when the corresponding total was $330,991,000, of which $281,-<br />

218,000 represented income and withholding taxes. For both periods,<br />

the figures are exclusive of amounts collected upon warrants for<br />

distraint (see following paragraph)•<br />

In enforcing the collections of overdue taxes, collectors of internal<br />

revenue issued 2,086,118 warrants for distraint during the year as compared<br />

with 1,752,449 warrants issued in the preceding year. The<br />

amount collected by field deputy collectors as a result of the issuance<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 11<br />

of warrants for distraint totaled $346,509,480 for the fiscal year <strong>1949</strong>,<br />

representing a substantial increase over the 1948 total of $280,183,603.<br />

There were 1,010,810 warrants for distraint in custody of the collectors'<br />

field forces on June 30, <strong>1949</strong>, as compared with 815,257 on hand June<br />

30, 1948.<br />

An average of 8,451 deputy collectors made a total of 3,252,330<br />

revenue-producing investigations, including the serving of warrants<br />

for distraint, as compared with 2,892,965 revenue-producing investgations<br />

made by an average of 8,228 field deputy collectors in the<br />

preceding fiscal year.<br />

The total amount collected and reported for assessment by deputy<br />

collectors was $608,368,524 as compared with $554,578,717 in the<br />

preceding year. The average number of investigations made per<br />

deputy and the average amount of tax collected and reported for<br />

assessment were 385 and $71,988, respectively, compared with 352<br />

and $67,401, respectively, in 1948.<br />

Collectors of internal revenue, after having taken the necessary<br />

administrative action, transmitted to the Bureau or otherwise disposed<br />

of 693,291 claims, as compared with 787,900 claims in 1948, a<br />

decrease of 94,609. The number of claims on hand in collectors'<br />

offices at the end of the fiscal year was 156,721, compared with 128,537<br />

at the close of the preceding fiscal year.<br />

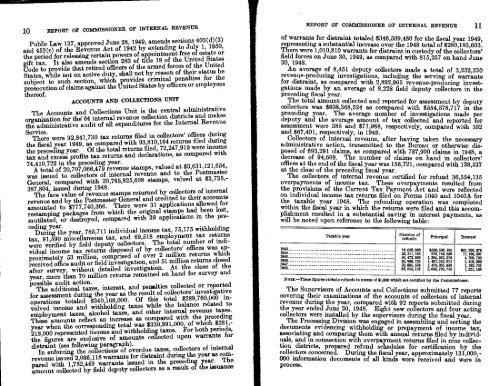

The collectors of internal revenue certified for refund 36,554,135<br />

overpayments of income tax. These overpayments resulted from<br />

the provisions of the Current Tax Payment Act and were reflected<br />

on individual income tax returns filed on Forms 1040 and 1040A for<br />

the taxable year 1948. The refunding operation was completed<br />

within the fiscal year in which the returns were filed and this accomplishment<br />

resulted in a substantial saving in interest payments, as<br />

will be noted upon reference to the following table:<br />

1943<br />

1944<br />

1945<br />

1946<br />

1947<br />

1948<br />

Taxable year<br />

Number of<br />

refunds Principal Interest<br />

16,059,028<br />

22, 211, 755<br />

30,472,926<br />

30, 996, 723<br />

3h 865, 584<br />

36, 554, 135<br />

$586, 596, 165<br />

979,746,659<br />

1, 384, 293, 318<br />

1, 407,052, 911<br />

1,476, 285,843<br />

2,035, 793,715<br />

Nom—These figures exclude refunds in excess of $1,000 which are certified by the Commissioner.<br />

$21,926, 678<br />

17,186,337<br />

4,708, 759<br />

1,419,296<br />

1,182,703<br />

1,221,156<br />

The Supervisors of Accounts and Collections submitted 77 reports<br />

covering their examinations of the accounts of collectors of internal<br />

revenue during the year, compared with 92 reports submitted during<br />

the year ended June 30, 1948. Eight new collectors and four acting<br />

collectors were installed by the supervisors during the fiscal year.<br />

The Processing Division was engaged in assembling and sorting the<br />

documents evidencing withholding or prepayment of income tax,<br />

associating and comparing them with annual returns filed by individuals,<br />

and in connection with overpayment returns filed in nine collection<br />

districts, prepared refund schedules for certification by the<br />

collectors concerned. During the fiscal year, approximately 131,000,-<br />

000 information documents of all kinds were received and were in<br />

process.

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)