1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

222<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

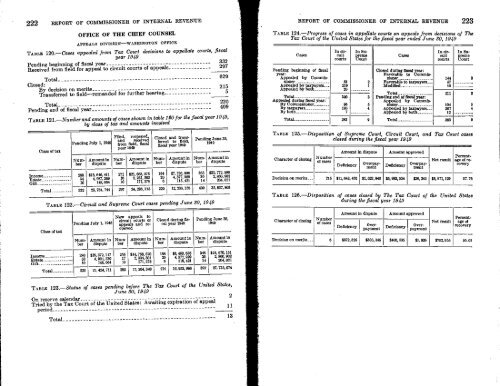

OFFICE OF THE CHIEF COUNSEL<br />

APPEALS DIVISION-WASHINGTON OFFICE<br />

TABLE<br />

120.-Cases appealed from Tax Court decisions to appellate courts, fiscal<br />

year <strong>1949</strong><br />

332<br />

Pending beginning of fiscal year<br />

Received from field for appeal to circuit courts of appeals<br />

297<br />

Total<br />

Closed:<br />

By decision on merits<br />

Transferred to field-remanded for further hearing<br />

Total<br />

Pending end of fiscal year<br />

TABLE 121.-Number and amounts of cases shown in table 120 for the fiscal year <strong>1949</strong>,<br />

by class of tax and amounts involved<br />

Income<br />

Estate<br />

Gift<br />

Class of tax<br />

Total<br />

TABLE<br />

Class of tax<br />

Pending Pending Sub' 1, 1948<br />

Number<br />

288<br />

34<br />

10<br />

Amount in<br />

dispute<br />

$18.646, 411<br />

4,987, 269<br />

148, 064<br />

Filed, reopened,<br />

and received<br />

fiscal<br />

year <strong>1949</strong><br />

Number<br />

271<br />

16<br />

10<br />

Amount in<br />

dispute<br />

$21, 863, 275<br />

2, 251, 562<br />

171, 378<br />

Closed<br />

and trans-<br />

`"'" to field,<br />

fiscal year <strong>1949</strong><br />

Number<br />

194<br />

20<br />

6<br />

Amount in<br />

dispute<br />

$7, 736, 806<br />

4, 377, 929<br />

115, 421<br />

Pending June 30,<br />

<strong>1949</strong><br />

Number<br />

365<br />

30<br />

14<br />

Amount in<br />

dispute<br />

$32, 772, 880<br />

2,860,902<br />

204,021<br />

332 23, 781, 744 297 24, 286, 215 220 12, 230,156 409 35, 837, 803<br />

122.-Circuit and Supreme Court cases pending June 30, <strong>1949</strong><br />

New appeals to<br />

n<br />

Pending InIP 1, 1948 circuit courts of<br />

appeals and reopened<br />

Number<br />

Amount in<br />

dispute<br />

Number<br />

Amount in<br />

dispute<br />

Closed during ftscal<br />

year <strong>1949</strong><br />

Number<br />

Amount in<br />

dispute<br />

Pending Tune 30,<br />

<strong>1949</strong><br />

Number<br />

629<br />

215<br />

5<br />

220<br />

409<br />

Amount in<br />

dispute<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 223<br />

TABLE 124.-Progress of cases in appella e courts on appeals from decisions of The<br />

Tax Court of the United States for the fiscal year ended June 30, <strong>1949</strong><br />

Cases<br />

In aircult<br />

courts<br />

In Supromo<br />

Court<br />

Cases<br />

In drcult<br />

courts<br />

Pending beginning of fiscal<br />

Closed during fiscal year<br />

year:<br />

Favorable to Commis-<br />

Appealed by Commis- !loner 144<br />

sioner 81 Favorable to taxpayers- 67<br />

Appealed by aYerS 219 Modified 10<br />

Appealed by both 20<br />

Total<br />

211<br />

Total<br />

320<br />

Pending end of fiscal year:<br />

Appealed during fiscal year:<br />

Appealed by Commis-<br />

By Commissioner 98 'loner 104<br />

By taxpayers 180 Appealed by taxpayers__ 267<br />

By both 7 Appealed by both 12<br />

te YO ,O<br />

In Supromo<br />

Court<br />

Total 283 Total 383 9<br />

TABLE 125.-Disposition of Supreme Court, Circuit Court, and Tax Court cases<br />

closed during the fiscal year <strong>1949</strong><br />

Character of closing<br />

Number<br />

of cases<br />

Amount in dispute<br />

Deficiency<br />

Amount approved<br />

Ovmeraly- Deficiency Ovmerr-<br />

Percent.<br />

Net result age of recovery<br />

Decision on merits.-- 215 $11,043,470 $1, 023, 840 85, 983, EH $36,245 $8, 971, 129 57.76<br />

TABLE 126.-Disposition of cases closed by The Tax Court of the United States<br />

during the fiscal year <strong>1949</strong><br />

Character of closing<br />

Number<br />

ei c e<br />

Amount in dispute<br />

Deficiency<br />

paOver-m t<br />

Amount approved<br />

Deficiency<br />

paOyver- t<br />

Net result<br />

CO<br />

.0<br />

Percentage<br />

of<br />

recovery<br />

Decision on merits__ 6 $972, 824 $303,346 $400,535 $1,826 $702,055 55.01<br />

Income<br />

Estate<br />

Gift<br />

Total<br />

I gia<br />

$16, 372,117<br />

4, 908, 530<br />

148,064<br />

256<br />

17<br />

10<br />

$14, 758, 670<br />

2,, 334 301<br />

171, 378<br />

Pc<br />

$6, 460, 636<br />

4,377,929<br />

116, 421<br />

348<br />

30<br />

14<br />

$24, 670,151<br />

2, 860,1:02<br />

204, 021<br />

323 21,424, 711 283 17, 264, 349 214 10, 953,986 392 27, 735, 074<br />

,<br />

TABLE<br />

123.-Status of cases pending before The Tax Court of the Uni ed States,<br />

June 80, <strong>1949</strong><br />

2<br />

On reserve calendar<br />

Tried by the Tax Court of the United States: Awaiting expiration of appeal<br />

11<br />

period<br />

13<br />

Total

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)