1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

Preliminary review of income and excess profits tax returns.—Of the<br />

returns filed during the year <strong>1949</strong>, as shown in the preceding table,<br />

3,989,011 consisted of returns of individuals and partnerships reporting<br />

income of substantial amounts or involving complex transactions,'<br />

taxable returns of fiduciaries, returns of withholding agents, corporation<br />

income and excess profits tax returns, personal holding company<br />

returns, and returns of exempt organizations.<br />

During the year <strong>1949</strong> the Bureau revised the procedure with respect<br />

to the preliminary review of individual returns included in the above<br />

classification, so that such returns for taxable years beginning after<br />

December 31, 1947, are now reviewed and classified by revenue agents<br />

in the field offices, instead of the Washington office. The preliminary<br />

review of returns , other than individual returns, continues in the<br />

Income Tax Unit in Washington, as under the procedure prior to<br />

revision.<br />

Upon initial review of those returns forwarded to Washington<br />

(including those on hand in Washington July 1, 1948, relating to<br />

previous taxable years), 1,814,382 were closed and 603,119 were found<br />

to require further consideration and investigation by the field offices<br />

of the Income Tax Unit. A comparative analysis of the results of<br />

this initial reviewing operation is as follows:<br />

Corporation<br />

Individual<br />

Fiduciary<br />

Total<br />

Type of return<br />

164, 646<br />

I 426, 121<br />

12,352<br />

I Figures for the individual returns initially reviewed in the field offices after the change in procedure<br />

above referred to, are not presently available. Accordingly the number of return constituting the work<br />

load of the field offices for the coming year is somewhat greater than is indicated by the number of field<br />

returns shown.<br />

There was also inaugurated during the year <strong>1949</strong>, a method whereby<br />

representative samples of individual income tax returns, including<br />

many which might not have been selected for field investigation under<br />

previously existing classification procedure, are automatically selected<br />

by the Statistical Division in Washington, for intensive investigation<br />

as a "sample audit." The figures pertaining to field returns do not<br />

include this random sample.<br />

Investigation of tax returns by field offices .—The number of income and<br />

excess profits tax returns investigated during the year <strong>1949</strong> was 614,323,<br />

as compared with 595,729 for 1948. These figures include all returns<br />

for which the examiners' reports have been submitted, whether or<br />

not the cases have been finally released by reviewing officers.<br />

Estate and gift tax returns investigated by the field offices during the<br />

year numbered 18,624, as compared with 18,185 for 1948.<br />

The total number of income and excess profits tax returns on which<br />

action was completed by the field offices during the year was 2,097,122,<br />

I The collectors retained for audit all returns on Form 1040-A, together with returns on Form 1040 which<br />

show adjusted gross income of under $7,000 (provided total receipts from business or profession were not in<br />

excess of 425,000). During the year <strong>1949</strong>, the number of Forms 1040 filed equaled 33,600,363, of which<br />

30,660,554 were retained for audit by collectors under this rule.<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 21<br />

consisting of 2,023,706 income tax returns and 73,416 excess profits<br />

tax returns. In addition, the field offices completed their work on<br />

29,299 estate and gift tax returns. The results shown include returns<br />

which required investigation as well as returns for which investigations<br />

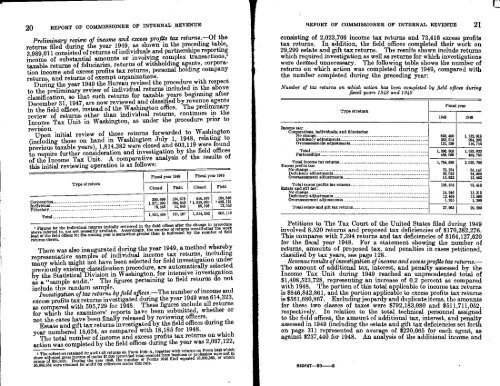

were deemed unnecessary. The following table shows the number of<br />

returns on which action was completed during <strong>1949</strong>, compared with<br />

the number completed during the preceding year:<br />

Number of tax returns on which action has been completed by field offices during<br />

fiscal years 1948 and <strong>1949</strong><br />

Type of return<br />

Income tax:<br />

Corporations, individuals, and fiduciaries:<br />

No change<br />

Deficiency adjustments<br />

Overassessment adjustments<br />

Total<br />

Partnerships<br />

Fiscal year<br />

1948 <strong>1949</strong><br />

893,450<br />

28A 914<br />

121,139<br />

1,298, 503<br />

486, 006<br />

1, 132,918<br />

244, 295<br />

116,719<br />

1,533,923<br />

489, 783<br />

Total income tax returns 1,784,539 2,023, 706<br />

Excess profits tax:<br />

No change 73, 274 35, 147<br />

Deficiency adjustments 36,012 24,808<br />

Overassessment adjustments 15,932 13, 463<br />

Total excess profits tax returns 125, 218 73, 416<br />

Estate and gift tax:<br />

No change 14,246 15,313<br />

Deficiency adjustments 12, 463 12, 590<br />

Overassessment adjustments 1, 255 1,396<br />

Total estate and gift tax returns 27,963 29,299<br />

Petitions to The Tax Court of the United States filed during <strong>1949</strong><br />

involved 8,520 returns and proposed tax deficiencies of $170,382,276.<br />

This compares with 7,394 returns and tax deficiencies of $164,127,620<br />

for the fiscal year 1948. For a statement showing the number of<br />

returns, amounts of proposed tax, and penalties in cases petitioned,<br />

classified by tax years, see page 128.<br />

<strong>Revenue</strong> results of investigation of income and excess profits tax returns.—<br />

The amount of additional tax, interest, and penalty assessed by the<br />

Income Tax Unit during <strong>1949</strong> reached an unprecedented total of<br />

$1,408,523,728, representing an increase of 0.2 percent as compared<br />

with 1948. The portion of this total applicable to income tax returns<br />

is $846,842,861, and the portion applicable to excess profits tax returns<br />

is $561,680,867. Excluding jeopardy and duplicate items, the amounts<br />

for these two classes of taxes were $792,183,080 and $511,711,052,<br />

respectively. In relation to the total technical personnel assigned<br />

to the field offices, the amount of additional tax, interest, and penalty<br />

assessed in <strong>1949</strong> (including the estate and gift tax deficiencies set forth<br />

on page 31) represented an average of $220,065 for each agent, as<br />

against $237,440 for 1948. An analysis of the additional income and<br />

880847-50-8

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)