1949 - Internal Revenue Service

1949 - Internal Revenue Service

1949 - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

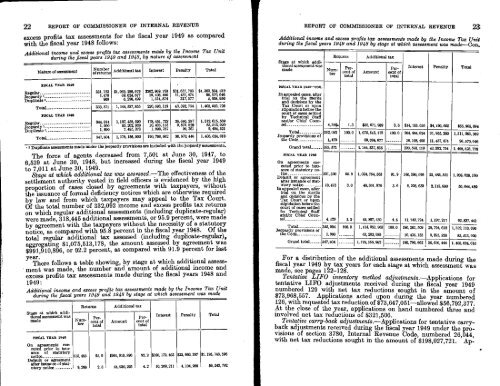

22 REPORT OF COMMISSIONER OF INTERNAL REVENUE<br />

excess profits tax assessments for the fiscal year <strong>1949</strong> as compared<br />

with the fiscal year 1948 follows:<br />

Additional income and excess profits tax assessments made by the Income Tax Unit<br />

during the fiscal years <strong>1949</strong> and 1948, by nature of assessment<br />

Nature of assessment<br />

FISCAL YEAR <strong>1949</strong><br />

Number<br />

of return<br />

Additional tax Interest Penalty Total<br />

Regular 331,123 $1, 069, 288, 679 202, 969, 750 $31, 637, 703 $1, 303, 894,132<br />

Jeopardy I 1, 479 69, 024,677 16, 108, 495 11, 437, 474 96, 570, 646<br />

Duplicate )<br />

969 6,226, 412 1,514,874 317, 577 8,058,950<br />

Total_<br />

333, 571 1, 144, 537, 855 220, 593, 119 43, 392, 754 1, 408, 523, 728<br />

FISCAL YEAR 1948<br />

Regular 344,014 1, 107, 458, 590 178,461, 722 26, 695, 257 1, 312, 615,509<br />

Jeopardy 1 1, 900 63, 202, 939 10, 435, 153 9, 875, 828 83, 513, 920<br />

Duplicate 1<br />

1, 890 7,495, 373 1, 899, 787 99, 361 9, 494, 521<br />

TotaL<br />

347, 804 1,178,156, 902 190,796,602 36, 670, 446 1, 405, 624, 010<br />

• 1 Duplicate paspasments made under the jeopardy provisions are included with e jeopady esaeamenta.<br />

The force of agents decreased from 7,501 at June 30, 1947, to<br />

6,539 at June 30, 1948, but increased during the fiscal year <strong>1949</strong><br />

to 7,011 at June 30, <strong>1949</strong>.<br />

Stage at which additional tax was assessed.-The effectiveness of the<br />

settlement authority vested in field officers is evidenced by the high<br />

proportion of cases closed by agreements with taxpayers, without<br />

the issuance of formal deficiency notices which are otherwise required<br />

by law and from which taxpayers may appeal to the Tax Court.<br />

Of the total number of 332,092 income and excess profits tax returns<br />

on which regular additional assessments (including duplicate-regular)<br />

were made, 318,445 additional assessments, or 95.9 percent, were made<br />

by agreement with the taxpayers without the necessity of a statutory<br />

notice, as compared with 95.8 percent in the fiscal year 1948. Of the<br />

total regular additional tax assessed (including duplicate-regular),<br />

aggregating $1,075,513,178, the amount assessed by agreement was<br />

$991,910,896, or 92.2 percent, as compared with 91.9 percent for last<br />

year.<br />

There follows a table showing, by stage at which additional assessment<br />

was made, the number and amount of additional income and<br />

excess profits tax assessments made during the fiscal years 1948 and<br />

<strong>1949</strong>:<br />

Additional income and excess profits tax assessments made by the Income Tax Unit<br />

during the fiscal years <strong>1949</strong> and 1948 by stage at which assessment was made<br />

Stage at which additional<br />

assessment was<br />

made<br />

FISCAL YEAR <strong>1949</strong><br />

Number<br />

On agreements executed<br />

prior to issuance<br />

of statutory<br />

notice<br />

318,455<br />

Default or agreement<br />

after Issuance of statntnn<br />

rm.-9n<br />

9 22<br />

Returns<br />

Percent<br />

of<br />

total<br />

95.9<br />

2.8<br />

Additional tax<br />

Amount<br />

291, 910,896<br />

44.930, 293<br />

Percent<br />

of<br />

total<br />

92.2 $180, 172, 403 $23, 660, 297<br />

4.2<br />

10, 209, 211<br />

4, 104,22<br />

1, 195, 743, 596<br />

59, 243, 792<br />

J<br />

REPORT OF COMMISSIONER OF INTERNAL REVENUE 23<br />

Additional income and excess profits tax assessments made by the Income Tax Unit<br />

during the fiscal years <strong>1949</strong> and 1948 by stage at which assessment was made-Con.<br />

Stage at which additional<br />

assessment was<br />

made<br />

FISCAL YEAR <strong>1949</strong>-00/1.<br />

In appealed cases, after<br />

trial on the merits<br />

and decisions by the<br />

Tax Court or upon<br />

stipulation before the<br />

court of eases settled<br />

by Technical Staff<br />

and/or Chief Counsel<br />

Total<br />

Feogear6lirdieffovisions of<br />

Number<br />

Returns<br />

Percent<br />

of<br />

total<br />

Additional tax<br />

Amount<br />

Percent<br />

of<br />

total<br />

Interest<br />

Penalty<br />

Total<br />

4, 349. 1.3 $38, 671, 989 3. 6 $14,103,010 $4, 190, 605 $56,965,694<br />

332,092 100.0 1, 075, 513,178 100.0 204,484, 624 31, 955, 280 1, 311, 953, 082<br />

1,479 69, 024, 677 16, 108, 495 11, 437,474 96, 570, 646<br />

Grand total 333, 571 1,144, 537, 855 220, 593,119 43, 392, 754 1, 408, 523, 728<br />

FISCAL YEAR 1948<br />

3n agreements executed<br />

prior to issuance<br />

of statutory notice<br />

331, 300<br />

Default or agreement<br />

95.8 1, 024, 754, 563 91.9 160, 390,076 2, 483, 521 1,204,628,159<br />

after issuance of statutory<br />

notice<br />

10, 475 3.0 40, 301, 970 3.6 8, 228, 639 2413, 880<br />

niga "olnedteltse'xis<br />

50, 644, 489<br />

and decisions by the<br />

Tax Court or upon<br />

stipulation before the<br />

court of cases settled<br />

by Technical Staff<br />

and/or Chief Counsel<br />

4,129 1.2' 49, 897, 430 4.5 11, 742, 794 1,197, 217 62, 837,441<br />

Total<br />

345,904<br />

egear621:drovisions of<br />

100.0 1, 114, 953, 963<br />

1, 900<br />

63, 202, 939<br />

100.0 180, 361, 509<br />

10, 435,153<br />

26, 794, 618<br />

9, 875, 828<br />

1, 322, 110, 090<br />

83, 513, 920<br />

Grand total 347, 804 1, 178,156, 900 190, 796, 662 36, 670, 446 1, 405, 624, 010<br />

For a distribution of the additional assessments made during the<br />

fiscal year <strong>1949</strong> by tax years for each stage at which assessment was<br />

made, see pages 122-128.<br />

Tentative LIFO inventory method adjustments.-Applications for<br />

tentative LIFO adjustments received during the fiscal year <strong>1949</strong><br />

numbered 129 with net tax reductions sought in the amount of<br />

$73,968,557. Applications acted upon during the year numbered<br />

126, with requested tax reduction of $73,647,051-allowed $56,792,377.<br />

At the close of the year, applications on hand numbered three and<br />

involved net tax reductions of $321,506.<br />

Tentative carry-back adjustments.-Applications for tentative carryback<br />

adjustments received during the fiscal year <strong>1949</strong> under the provisions<br />

of section 3780, <strong>Internal</strong> <strong>Revenue</strong> Code, numbered 26,044,<br />

with net tax reductions sought in the amount of $198,027,721. Ap-

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)