Annual Report 2005 - Chubb Group of Insurance Companies

Annual Report 2005 - Chubb Group of Insurance Companies

Annual Report 2005 - Chubb Group of Insurance Companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Earnings were at their<br />

highest level since <strong>Chubb</strong><br />

was incorporated in<br />

1967. Total shareholder<br />

return for <strong>2005</strong>, including<br />

stock price appreciation<br />

and dividends, was 30%,<br />

compared to 5% for the<br />

S&P 500 and 16% for<br />

the S&P Property and<br />

Casualty <strong>Insurance</strong> Index.<br />

Earnings were at their highest level since <strong>Chubb</strong> was incorporated in<br />

1967. In addition, the market price <strong>of</strong> our common stock closed at $98.13<br />

on November 14, <strong>2005</strong>, an all-time high closing price for <strong>Chubb</strong> shares.<br />

Total shareholder return for <strong>2005</strong>, including stock price appreciation and<br />

dividends, was 30%, compared to 5% for the S&P 500 and 16% for the<br />

S&P Property and Casualty <strong>Insurance</strong> Index.<br />

Net written premiums grew 2% to $12.3 billion. The combined loss<br />

and expense ratio was 92.3%, including 5.6 percentage points <strong>of</strong><br />

catastrophe losses. The expense ratio was 28.0%, 1.2 percentage points<br />

better than in 2004 and an all-time best for the corporation. Net loss<br />

reserves increased by $1.9 billion or 11%, bringing <strong>2005</strong> year-end net loss<br />

reserves to $18.7 billion.<br />

Property and casualty investment income after taxes for the year<br />

116%<br />

112%<br />

108%<br />

104%<br />

100%<br />

96%<br />

92%<br />

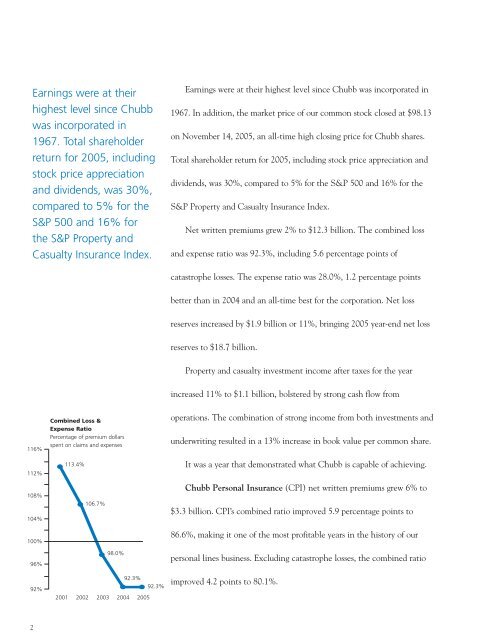

Combined Loss &<br />

Expense Ratio<br />

Percentage <strong>of</strong> premium dollars<br />

spent on claims and expenses<br />

113.4%<br />

106.7%<br />

98.0%<br />

92.3%<br />

2001 2002 2003 2004 <strong>2005</strong><br />

92.3%<br />

increased 11% to $1.1 billion, bolstered by strong cash flow from<br />

operations. The combination <strong>of</strong> strong income from both investments and<br />

underwriting resulted in a 13% increase in book value per common share.<br />

It was a year that demonstrated what <strong>Chubb</strong> is capable <strong>of</strong> achieving.<br />

<strong>Chubb</strong> Personal <strong>Insurance</strong> (CPI) net written premiums grew 6% to<br />

$3.3 billion. CPI’s combined ratio improved 5.9 percentage points to<br />

86.6%, making it one <strong>of</strong> the most pr<strong>of</strong>itable years in the history <strong>of</strong> our<br />

personal lines business. Excluding catastrophe losses, the combined ratio<br />

improved 4.2 points to 80.1%.<br />

2