Annual Report 2005 - Chubb Group of Insurance Companies

Annual Report 2005 - Chubb Group of Insurance Companies

Annual Report 2005 - Chubb Group of Insurance Companies

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

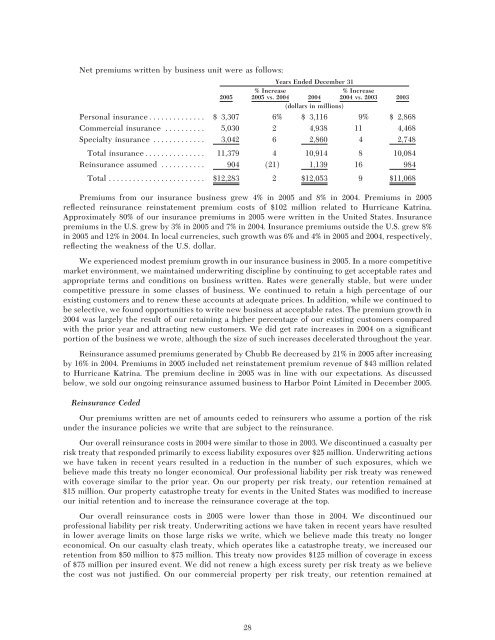

Net premiums written by business unit were as follows:<br />

Years Ended December 31<br />

% Increase % Increase<br />

<strong>2005</strong> <strong>2005</strong> vs. 2004 2004 2004 vs. 2003 2003<br />

(dollars in millions)<br />

Personal insuranceÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $3,307 6% $3,116 9% $2,868<br />

Commercial insurance ÏÏÏÏÏÏÏÏÏÏ 5,030 2 4,938 11 4,468<br />

Specialty insurance ÏÏÏÏÏÏÏÏÏÏÏÏÏ 3,042 6 2,860 4 2,748<br />

Total insuranceÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 11,379 4 10,914 8 10,084<br />

Reinsurance assumed ÏÏÏÏÏÏÏÏÏÏÏ 904 (21) 1,139 16 984<br />

Total ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $12,283 2 $12,053 9 $11,068<br />

Premiums from our insurance business grew 4% in <strong>2005</strong> and 8% in 2004. Premiums in <strong>2005</strong><br />

reÖected reinsurance reinstatement premium costs <strong>of</strong> $102 million related to Hurricane Katrina.<br />

Approximately 80% <strong>of</strong> our insurance premiums in <strong>2005</strong> were written in the United States. <strong>Insurance</strong><br />

premiums in the U.S. grew by 3% in <strong>2005</strong> and 7% in 2004. <strong>Insurance</strong> premiums outside the U.S. grew 8%<br />

in <strong>2005</strong> and 12% in 2004. In local currencies, such growth was 6% and 4% in <strong>2005</strong> and 2004, respectively,<br />

reÖecting the weakness <strong>of</strong> the U.S. dollar.<br />

We experienced modest premium growth in our insurance business in <strong>2005</strong>. In a more competitive<br />

market environment, we maintained underwriting discipline by continuing to get acceptable rates and<br />

appropriate terms and conditions on business written. Rates were generally stable, but were under<br />

competitive pressure in some classes <strong>of</strong> business. We continued to retain a high percentage <strong>of</strong> our<br />

existing customers and to renew these accounts at adequate prices. In addition, while we continued to<br />

be selective, we found opportunities to write new business at acceptable rates. The premium growth in<br />

2004 was largely the result <strong>of</strong> our retaining a higher percentage <strong>of</strong> our existing customers compared<br />

with the prior year and attracting new customers. We did get rate increases in 2004 on a signiÑcant<br />

portion <strong>of</strong> the business we wrote, although the size <strong>of</strong> such increases decelerated throughout the year.<br />

Reinsurance assumed premiums generated by <strong>Chubb</strong> Re decreased by 21% in <strong>2005</strong> after increasing<br />

by 16% in 2004. Premiums in <strong>2005</strong> included net reinstatement premium revenue <strong>of</strong> $43 million related<br />

to Hurricane Katrina. The premium decline in <strong>2005</strong> was in line with our expectations. As discussed<br />

below, we sold our ongoing reinsurance assumed business to Harbor Point Limited in December <strong>2005</strong>.<br />

Reinsurance Ceded<br />

Our premiums written are net <strong>of</strong> amounts ceded to reinsurers who assume a portion <strong>of</strong> the risk<br />

under the insurance policies we write that are subject to the reinsurance.<br />

Our overall reinsurance costs in 2004 were similar to those in 2003. We discontinued a casualty per<br />

risk treaty that responded primarily to excess liability exposures over $25 million. Underwriting actions<br />

we have taken in recent years resulted in a reduction in the number <strong>of</strong> such exposures, which we<br />

believe made this treaty no longer economical. Our pr<strong>of</strong>essional liability per risk treaty was renewed<br />

with coverage similar to the prior year. On our property per risk treaty, our retention remained at<br />

$15 million. Our property catastrophe treaty for events in the United States was modiÑed to increase<br />

our initial retention and to increase the reinsurance coverage at the top.<br />

Our overall reinsurance costs in <strong>2005</strong> were lower than those in 2004. We discontinued our<br />

pr<strong>of</strong>essional liability per risk treaty. Underwriting actions we have taken in recent years have resulted<br />

in lower average limits on those large risks we write, which we believe made this treaty no longer<br />

economical. On our casualty clash treaty, which operates like a catastrophe treaty, we increased our<br />

retention from $50 million to $75 million. This treaty now provides $125 million <strong>of</strong> coverage in excess<br />

<strong>of</strong> $75 million per insured event. We did not renew a high excess surety per risk treaty as we believe<br />

the cost was not justiÑed. On our commercial property per risk treaty, our retention remained at<br />

28