Connect - Schneider Electric

Connect - Schneider Electric

Connect - Schneider Electric

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

5 CONSOLIDATED FINANCIAL STATEMENTS<br />

NOTES TO THE CONSOLIDATED FINANCIAL<br />

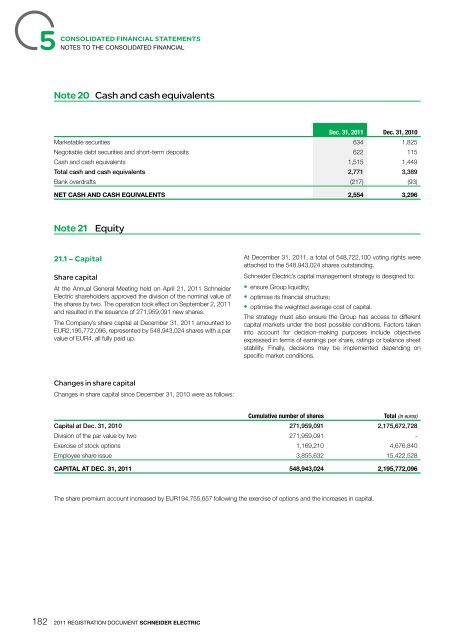

Note 20 Cash and cash equivalents<br />

182 2011 REGISTRATION DOCUMENT SCHNEIDER ELECTRIC<br />

Dec. 31, 2011 Dec. 31, 2010<br />

Marketable securities 634 1,825<br />

Negotiable debt securities and short-term deposits 622 115<br />

Cash and cash equivalents 1,515 1,449<br />

Total cash and cash equivalents 2,771 3,389<br />

Bank overdrafts (217) (93)<br />

NET CASH AND CASH EQUIVALENTS 2,554 3,296<br />

Note 21 Equity<br />

21.1 – Capital<br />

Share capital<br />

At the Annual General Meeting held on April 21, 2011 <strong>Schneider</strong><br />

<strong>Electric</strong> shareholders approved the division of the nominal value of<br />

the shares by two. The operation took effect on September 2, 2011<br />

and resulted in the issuance of 271,959,091 new shares.<br />

The Company’s share capital at December 31, 2011 amounted to<br />

EUR2,195,772,096, represented by 548,943,024 shares with a par<br />

value of EUR4, all fully paid up.<br />

Changes in share capital<br />

Changes in share capital since December 31, 2010 were as follows:<br />

At December 31, 2011, a total of 548,722,100 voting rights were<br />

attached to the 548,943,024 shares outstanding.<br />

<strong>Schneider</strong> <strong>Electric</strong>’s capital management strategy is designed to:<br />

• ensure Group liquidity;<br />

• optimise its fi nancial structure;<br />

• optimise the weighted average cost of capital.<br />

The strategy must also ensure the Group has access to different<br />

capital markets under the best possible conditions. Factors taken<br />

into account for decision-making purposes include objectives<br />

expressed in terms of earnings per share, ratings or balance sheet<br />

stability. Finally, decisions may be implemented depending on<br />

specifi c market conditions.<br />

Cumulative number of shares Total (in euros)<br />

Capital at Dec. 31, 2010 271,959,091 2,175,672,728<br />

Division of the par value by two 271,959,091 -<br />

Exercise of stock options 1,169,210 4,676,840<br />

Employee share issue 3,855,632 15,422,528<br />

CAPITAL AT DEC. 31, 2011 548,943,024 2,195,772,096<br />

The share premium account increased by EUR194,755,657 following the exercise of options and the increases in capital.