- Page 1 and 2: Stochastic Programming Second Editi

- Page 3 and 4: Contents Preface . . . . . . . . .

- Page 5 and 6: CONTENTS v 3.6 Simple Recourse . .

- Page 7 and 8: Preface Over the last few years, bo

- Page 9 and 10: PREFACE ix more explicitly with the

- Page 11 and 12: 1 Basic Concepts 1.1 Motivation By

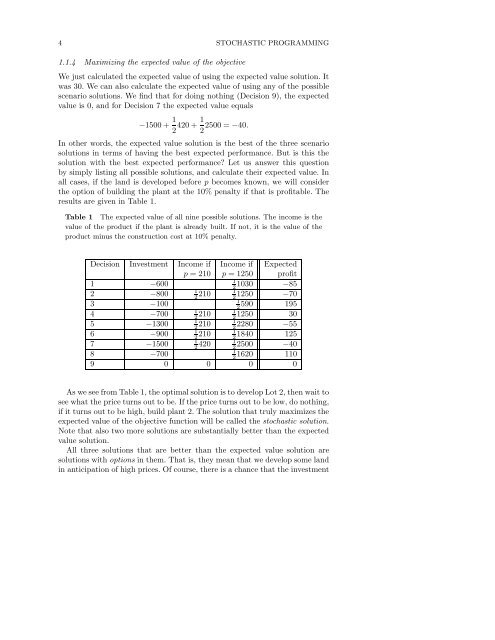

- Page 13: BASIC CONCEPTS 3 solutions. These a

- Page 17 and 18: BASIC CONCEPTS 7 1.2 Preliminaries

- Page 19 and 20: BASIC CONCEPTS 9 with center ˆx an

- Page 21 and 22: BASIC CONCEPTS 11 Figure 2 Determin

- Page 23 and 24: BASIC CONCEPTS 13 (except for U). S

- Page 25 and 26: BASIC CONCEPTS 15 may be wait-and-s

- Page 27 and 28: BASIC CONCEPTS 17 dual decompositio

- Page 29 and 30: BASIC CONCEPTS 19 and an empirical

- Page 31 and 32: BASIC CONCEPTS 21 1.4 Stochastic Pr

- Page 33 and 34: BASIC CONCEPTS 23 Figure 8 Measure

- Page 35 and 36: BASIC CONCEPTS 25 These properties

- Page 37 and 38: BASIC CONCEPTS 27 Figure 10 Classif

- Page 39 and 40: BASIC CONCEPTS 29 Figure 12 Integra

- Page 41 and 42: BASIC CONCEPTS 31 µ(A) =0alsoP (A)

- Page 43 and 44: BASIC CONCEPTS 33 Hence, taking int

- Page 45 and 46: BASIC CONCEPTS 35 Consequently, for

- Page 47 and 48: BASIC CONCEPTS 37 Proof For ˆx, ¯

- Page 49 and 50: BASIC CONCEPTS 39 Figure 13 Linear

- Page 51 and 52: BASIC CONCEPTS 41 Figure 15 Differe

- Page 53 and 54: BASIC CONCEPTS 43 However—for fin

- Page 55 and 56: BASIC CONCEPTS 45 Figure 17 Induced

- Page 57 and 58: BASIC CONCEPTS 47 Hence the feasibl

- Page 59 and 60: BASIC CONCEPTS 49 Figure 19 λ = 1

- Page 61 and 62: BASIC CONCEPTS 51 and hence P (λS

- Page 63 and 64: BASIC CONCEPTS 53 The sequence of s

- Page 65 and 66:

BASIC CONCEPTS 55 is satisfied. Giv

- Page 67 and 68:

BASIC CONCEPTS 57 Now either z is a

- Page 69 and 70:

BASIC CONCEPTS 59 Figure 22 Polyhed

- Page 71 and 72:

BASIC CONCEPTS 61 Figure 23 Polyhed

- Page 73 and 74:

BASIC CONCEPTS 63 Figure 25 LP: unb

- Page 75 and 76:

BASIC CONCEPTS 65 this case, the re

- Page 77 and 78:

BASIC CONCEPTS 67 Step 3 Exchange t

- Page 79 and 80:

BASIC CONCEPTS 69 bases for any lin

- Page 81 and 82:

BASIC CONCEPTS 71 ✷ Example 1.6 C

- Page 83 and 84:

BASIC CONCEPTS 73 which, observing

- Page 85 and 86:

BASIC CONCEPTS 75 is equal to the p

- Page 87 and 88:

BASIC CONCEPTS 77 solve the program

- Page 89 and 90:

BASIC CONCEPTS 79 {v | Wv =0,q T v0

- Page 91 and 92:

BASIC CONCEPTS 81 The feasible set

- Page 93 and 94:

BASIC CONCEPTS 83 1.8.1 The Kuhn-Tu

- Page 95 and 96:

BASIC CONCEPTS 85 Figure 28 Kuhn-Tu

- Page 97 and 98:

BASIC CONCEPTS 87 Figure 29 The Sla

- Page 99 and 100:

BASIC CONCEPTS 89 and observing tha

- Page 101 and 102:

BASIC CONCEPTS 91 where the bounded

- Page 103 and 104:

BASIC CONCEPTS 93 λŷ +(1− λ)ˆ

- Page 105 and 106:

BASIC CONCEPTS 95 “reasonable”

- Page 107 and 108:

BASIC CONCEPTS 97 1.8.2.3 Penalty m

- Page 109 and 110:

BASIC CONCEPTS 99 To simplify the d

- Page 111 and 112:

BASIC CONCEPTS 101 Now let us come

- Page 113 and 114:

BASIC CONCEPTS 103 Wait-and-see pro

- Page 115 and 116:

BASIC CONCEPTS 105 y ≤ e −x } f

- Page 117 and 118:

BASIC CONCEPTS 107 Optimization: No

- Page 119 and 120:

2 Dynamic Systems 2.1 The Bellman P

- Page 121 and 122:

112 STOCHASTIC PROGRAMMING purpose

- Page 123 and 124:

114 STOCHASTIC PROGRAMMING In this

- Page 125 and 126:

116 STOCHASTIC PROGRAMMING Proof Th

- Page 127 and 128:

118 STOCHASTIC PROGRAMMING A 10% fe

- Page 129 and 130:

120 STOCHASTIC PROGRAMMING Stage 0

- Page 131 and 132:

122 STOCHASTIC PROGRAMMING Stage 0

- Page 133 and 134:

124 STOCHASTIC PROGRAMMING Table 1

- Page 135 and 136:

126 STOCHASTIC PROGRAMMING Stage 0

- Page 137 and 138:

128 STOCHASTIC PROGRAMMING situatio

- Page 139 and 140:

130 STOCHASTIC PROGRAMMING 2.5 Stoc

- Page 141 and 142:

132 STOCHASTIC PROGRAMMING Using th

- Page 143 and 144:

134 STOCHASTIC PROGRAMMING 2.6 Scen

- Page 145 and 146:

136 STOCHASTIC PROGRAMMING Today Fi

- Page 147 and 148:

138 STOCHASTIC PROGRAMMING procedur

- Page 149 and 150:

140 STOCHASTIC PROGRAMMING the natu

- Page 151 and 152:

142 STOCHASTIC PROGRAMMING book, be

- Page 153 and 154:

144 STOCHASTIC PROGRAMMING • A tw

- Page 155 and 156:

146 STOCHASTIC PROGRAMMING Figu

- Page 157 and 158:

148 STOCHASTIC PROGRAMMING 2.8.1 A

- Page 159 and 160:

150 STOCHASTIC PROGRAMMING 2.8.2 Fu

- Page 161 and 162:

152 STOCHASTIC PROGRAMMING 2.9.2 De

- Page 163 and 164:

154 STOCHASTIC PROGRAMMING between

- Page 165 and 166:

156 STOCHASTIC PROGRAMMING an exerc

- Page 167 and 168:

158 STOCHASTIC PROGRAMMING

- Page 169 and 170:

160 STOCHASTIC PROGRAMMING

- Page 171 and 172:

162 STOCHASTIC PROGRAMMING Hξ pos

- Page 173 and 174:

164 STOCHASTIC PROGRAMMING pos W po

- Page 175 and 176:

166 STOCHASTIC PROGRAMMING Figure

- Page 177 and 178:

168 STOCHASTIC PROGRAMMING procedur

- Page 179 and 180:

170 STOCHASTIC PROGRAMMING procedur

- Page 181 and 182:

172 STOCHASTIC PROGRAMMING θ Q(x)

- Page 183 and 184:

174 STOCHASTIC PROGRAMMING • If t

- Page 185 and 186:

176 STOCHASTIC PROGRAMMING Figure 1

- Page 187 and 188:

178 STOCHASTIC PROGRAMMING is diffi

- Page 189 and 190:

180 STOCHASTIC PROGRAMMING lower-bo

- Page 191 and 192:

182 STOCHASTIC PROGRAMMING Edmundso

- Page 193 and 194:

184 STOCHASTIC PROGRAMMING Edmundso

- Page 195 and 196:

186 STOCHASTIC PROGRAMMING The goal

- Page 197 and 198:

188 STOCHASTIC PROGRAMMING which eq

- Page 199 and 200:

190 STOCHASTIC PROGRAMMING random v

- Page 201 and 202:

192 STOCHASTIC PROGRAMMING increase

- Page 203 and 204:

194 STOCHASTIC PROGRAMMING φ β α

- Page 205 and 206:

196 STOCHASTIC PROGRAMMING change i

- Page 207 and 208:

198 STOCHASTIC PROGRAMMING Figure 2

- Page 209 and 210:

200 STOCHASTIC PROGRAMMING The mini

- Page 211 and 212:

202 STOCHASTIC PROGRAMMING

- Page 213 and 214:

204 STOCHASTIC PROGRAMMING procedur

- Page 215 and 216:

206 STOCHASTIC PROGRAMMING Hence, w

- Page 217 and 218:

208 STOCHASTIC PROGRAMMING Figure 2

- Page 219 and 220:

210 STOCHASTIC PROGRAMMING since th

- Page 221 and 222:

212 STOCHASTIC PROGRAMMING or later

- Page 223 and 224:

214 STOCHASTIC PROGRAMMING problem

- Page 225 and 226:

216 STOCHASTIC PROGRAMMING procedur

- Page 227 and 228:

218 STOCHASTIC PROGRAMMING where

- Page 229 and 230:

220 STOCHASTIC PROGRAMMING Remember

- Page 231 and 232:

222 STOCHASTIC PROGRAMMING φ ( ) F

- Page 233 and 234:

224 STOCHASTIC PROGRAMMING

- Page 235 and 236:

226 STOCHASTIC PROGRAMMING By assum

- Page 237 and 238:

228 STOCHASTIC PROGRAMMING Figure 3

- Page 239 and 240:

230 STOCHASTIC PROGRAMMING work, wh

- Page 241 and 242:

232 STOCHASTIC PROGRAMMING problem.

- Page 243 and 244:

234 STOCHASTIC PROGRAMMING Madansky

- Page 245 and 246:

236 STOCHASTIC PROGRAMMING 5. Show

- Page 247 and 248:

238 STOCHASTIC PROGRAMMING [16] Dup

- Page 249 and 250:

240 STOCHASTIC PROGRAMMING J.-B. (e

- Page 251 and 252:

242 STOCHASTIC PROGRAMMING

- Page 253 and 254:

244 STOCHASTIC PROGRAMMING Proposit

- Page 255 and 256:

246 STOCHASTIC PROGRAMMING (f T ,g

- Page 257 and 258:

248 STOCHASTIC PROGRAMMING covarian

- Page 259 and 260:

250 STOCHASTIC PROGRAMMING With the

- Page 261 and 262:

252 STOCHASTIC PROGRAMMING It is st

- Page 263 and 264:

254 STOCHASTIC PROGRAMMING Hence we

- Page 265 and 266:

256 STOCHASTIC PROGRAMMING Taking t

- Page 267 and 268:

258 STOCHASTIC PROGRAMMING reader m

- Page 269 and 270:

260 STOCHASTIC PROGRAMMING

- Page 271 and 272:

262 STOCHASTIC PROGRAMMING procedur

- Page 273 and 274:

264 STOCHASTIC PROGRAMMING that is,

- Page 275 and 276:

266 STOCHASTIC PROGRAMMING pos W po

- Page 277 and 278:

268 STOCHASTIC PROGRAMMING procedur

- Page 279 and 280:

270 STOCHASTIC PROGRAMMING Figure 7

- Page 281 and 282:

272 STOCHASTIC PROGRAMMING min{2x r

- Page 283 and 284:

274 STOCHASTIC PROGRAMMING directio

- Page 285 and 286:

276 STOCHASTIC PROGRAMMING [5] Gree

- Page 287 and 288:

278 STOCHASTIC PROGRAMMING outlined

- Page 289 and 290:

280 STOCHASTIC PROGRAMMING since we

- Page 291 and 292:

282 STOCHASTIC PROGRAMMING 2 1 a b

- Page 293 and 294:

284 STOCHASTIC PROGRAMMING procedur

- Page 295 and 296:

286 STOCHASTIC PROGRAMMING 6.2.1 Th

- Page 297 and 298:

288 STOCHASTIC PROGRAMMING a soluti

- Page 299 and 300:

290 STOCHASTIC PROGRAMMING Since th

- Page 301 and 302:

292 STOCHASTIC PROGRAMMING It is no

- Page 303 and 304:

294 STOCHASTIC PROGRAMMING [-1,1] [

- Page 305 and 306:

296 STOCHASTIC PROGRAMMING for some

- Page 307 and 308:

298 STOCHASTIC PROGRAMMING +/- 1 1

- Page 309 and 310:

300 STOCHASTIC PROGRAMMING 1 (-1,0)

- Page 311 and 312:

302 STOCHASTIC PROGRAMMING with a g

- Page 313 and 314:

304 STOCHASTIC PROGRAMMING First, i

- Page 315 and 316:

306 STOCHASTIC PROGRAMMING Table 1

- Page 317 and 318:

308 STOCHASTIC PROGRAMMING Figure 2

- Page 319 and 320:

310 STOCHASTIC PROGRAMMING Universi

- Page 321 and 322:

312 STOCHASTIC PROGRAMMING

- Page 323 and 324:

314 STOCHASTIC PROGRAMMING duality

- Page 325 and 326:

316 STOCHASTIC PROGRAMMING best-so-