Putting it to Work in Developing Countries - Nathan Associates

Putting it to Work in Developing Countries - Nathan Associates

Putting it to Work in Developing Countries - Nathan Associates

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

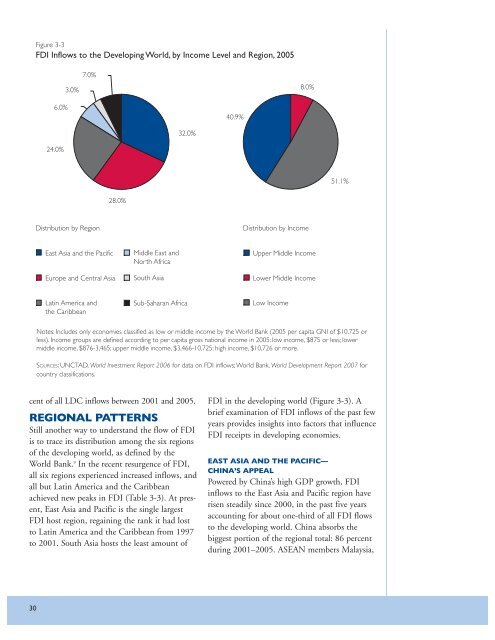

Figure 3-3<br />

FDI Inflows <strong>to</strong> the Develop<strong>in</strong>g World, by Income Level and Region, 2005<br />

3.0%<br />

7.0%<br />

8.0%<br />

6.0%<br />

40.9%<br />

32.0%<br />

24.0%<br />

51.1%<br />

28.0%<br />

Distribution by Region<br />

Distribution by Income<br />

East Asia and the Pacific<br />

Europe and Central Asia<br />

Middle East and<br />

North Africa<br />

South Asia<br />

Upper Middle Income<br />

Lower Middle Income<br />

Lat<strong>in</strong> America and<br />

the Caribbean<br />

Sub-Saharan Africa<br />

Low Income<br />

Notes: Includes only economies classified as low or middle <strong>in</strong>come by the World Bank (2005 per cap<strong>it</strong>a GNI of $10,725 or<br />

less). Income groups are def<strong>in</strong>ed accord<strong>in</strong>g <strong>to</strong> per cap<strong>it</strong>a gross national <strong>in</strong>come <strong>in</strong> 2005: low <strong>in</strong>come, $875 or less; lower<br />

middle <strong>in</strong>come, $876-3,465; upper middle <strong>in</strong>come, $3,466-10,725; high <strong>in</strong>come, $10,726 or more.<br />

SOURCES: UNCTAD, World Investment Report 2006 for data on FDI <strong>in</strong>flows; World Bank, World Development Report 2007 for<br />

country classifications.<br />

cent of all LDC <strong>in</strong>flows between 2001 and 2005.<br />

REGIONAL PATTERNS<br />

Still another way <strong>to</strong> understand the flow of FDI<br />

is <strong>to</strong> trace <strong>it</strong>s distribution among the six regions<br />

of the develop<strong>in</strong>g world, as def<strong>in</strong>ed by the<br />

World Bank. 9 In the recent resurgence of FDI,<br />

all six regions experienced <strong>in</strong>creased <strong>in</strong>flows, and<br />

all but Lat<strong>in</strong> America and the Caribbean<br />

achieved new peaks <strong>in</strong> FDI (Table 3-3). At present,<br />

East Asia and Pacific is the s<strong>in</strong>gle largest<br />

FDI host region, rega<strong>in</strong><strong>in</strong>g the rank <strong>it</strong> had lost<br />

<strong>to</strong> Lat<strong>in</strong> America and the Caribbean from 1997<br />

<strong>to</strong> 2001. South Asia hosts the least amount of<br />

FDI <strong>in</strong> the develop<strong>in</strong>g world (Figure 3-3). A<br />

brief exam<strong>in</strong>ation of FDI <strong>in</strong>flows of the past few<br />

years provides <strong>in</strong>sights <strong>in</strong><strong>to</strong> fac<strong>to</strong>rs that <strong>in</strong>fluence<br />

FDI receipts <strong>in</strong> develop<strong>in</strong>g economies.<br />

EAST ASIA AND THE PACIFIC—<br />

CHINA’S APPEAL<br />

Powered by Ch<strong>in</strong>a’s high GDP growth, FDI<br />

<strong>in</strong>flows <strong>to</strong> the East Asia and Pacific region have<br />

risen steadily s<strong>in</strong>ce 2000, <strong>in</strong> the past five years<br />

account<strong>in</strong>g for about one-third of all FDI flows<br />

<strong>to</strong> the develop<strong>in</strong>g world. Ch<strong>in</strong>a absorbs the<br />

biggest portion of the regional <strong>to</strong>tal: 86 percent<br />

dur<strong>in</strong>g 2001–2005. ASEAN members Malaysia,<br />

30