Putting it to Work in Developing Countries - Nathan Associates

Putting it to Work in Developing Countries - Nathan Associates

Putting it to Work in Developing Countries - Nathan Associates

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Thailand, Vietnam, Philipp<strong>in</strong>es, and Indonesia<br />

make up most of the balance (see text box).<br />

While these ASEAN nations all experienced significant<br />

FDI <strong>in</strong>creases <strong>in</strong> the last couple of years,<br />

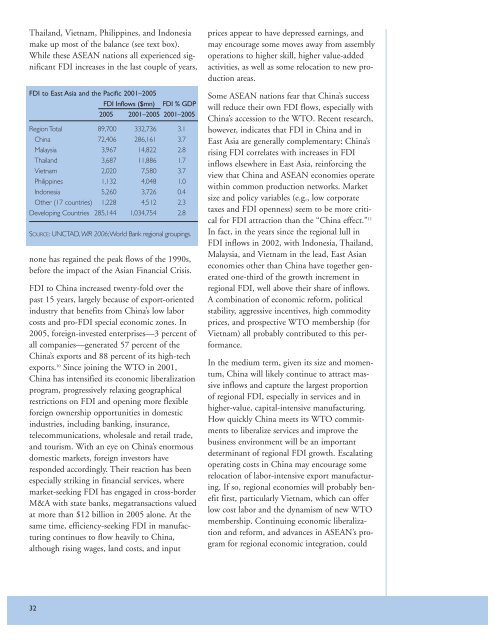

FDI <strong>to</strong> East Asia and the Pacific 2001–2005<br />

FDI Inflows ($mn) FDI % GDP<br />

2005 2001–2005 2001–2005<br />

Region Total 89,700 332,736 3.1<br />

Ch<strong>in</strong>a 72,406 286,161 3.7<br />

Malaysia 3,967 14,822 2.8<br />

Thailand 3,687 11,886 1.7<br />

Vietnam 2,020 7,580 3.7<br />

Philipp<strong>in</strong>es 1,132 4,048 1.0<br />

Indonesia 5,260 3,726 0.4<br />

Other (17 countries) 1,228 4,512 2.3<br />

Develop<strong>in</strong>g <strong>Countries</strong> 285,144 1,034,754 2.8<br />

SOURCE: UNCTAD, WIR 2006;World Bank regional group<strong>in</strong>gs.<br />

none has rega<strong>in</strong>ed the peak flows of the 1990s,<br />

before the impact of the Asian F<strong>in</strong>ancial Crisis.<br />

FDI <strong>to</strong> Ch<strong>in</strong>a <strong>in</strong>creased twenty-fold over the<br />

past 15 years, largely because of export-oriented<br />

<strong>in</strong>dustry that benef<strong>it</strong>s from Ch<strong>in</strong>a’s low labor<br />

costs and pro-FDI special economic zones. In<br />

2005, foreign-<strong>in</strong>vested enterprises—3 percent of<br />

all companies—generated 57 percent of the<br />

Ch<strong>in</strong>a’s exports and 88 percent of <strong>it</strong>s high-tech<br />

exports. 10 S<strong>in</strong>ce jo<strong>in</strong><strong>in</strong>g the WTO <strong>in</strong> 2001,<br />

Ch<strong>in</strong>a has <strong>in</strong>tensified <strong>it</strong>s economic liberalization<br />

program, progressively relax<strong>in</strong>g geographical<br />

restrictions on FDI and open<strong>in</strong>g more flexible<br />

foreign ownership opportun<strong>it</strong>ies <strong>in</strong> domestic<br />

<strong>in</strong>dustries, <strong>in</strong>clud<strong>in</strong>g bank<strong>in</strong>g, <strong>in</strong>surance,<br />

telecommunications, wholesale and retail trade,<br />

and <strong>to</strong>urism. W<strong>it</strong>h an eye on Ch<strong>in</strong>a’s enormous<br />

domestic markets, foreign <strong>in</strong>ves<strong>to</strong>rs have<br />

responded accord<strong>in</strong>gly. Their reaction has been<br />

especially strik<strong>in</strong>g <strong>in</strong> f<strong>in</strong>ancial services, where<br />

market-seek<strong>in</strong>g FDI has engaged <strong>in</strong> cross-border<br />

M&A w<strong>it</strong>h state banks, megatransactions valued<br />

at more than $12 billion <strong>in</strong> 2005 alone. At the<br />

same time, efficiency-seek<strong>in</strong>g FDI <strong>in</strong> manufactur<strong>in</strong>g<br />

cont<strong>in</strong>ues <strong>to</strong> flow heavily <strong>to</strong> Ch<strong>in</strong>a,<br />

although ris<strong>in</strong>g wages, land costs, and <strong>in</strong>put<br />

prices appear <strong>to</strong> have depressed earn<strong>in</strong>gs, and<br />

may encourage some moves away from assembly<br />

operations <strong>to</strong> higher skill, higher value-added<br />

activ<strong>it</strong>ies, as well as some relocation <strong>to</strong> new production<br />

areas.<br />

Some ASEAN nations fear that Ch<strong>in</strong>a’s success<br />

will reduce their own FDI flows, especially w<strong>it</strong>h<br />

Ch<strong>in</strong>a’s accession <strong>to</strong> the WTO. Recent research,<br />

however, <strong>in</strong>dicates that FDI <strong>in</strong> Ch<strong>in</strong>a and <strong>in</strong><br />

East Asia are generally complementary: Ch<strong>in</strong>a’s<br />

ris<strong>in</strong>g FDI correlates w<strong>it</strong>h <strong>in</strong>creases <strong>in</strong> FDI<br />

<strong>in</strong>flows elsewhere <strong>in</strong> East Asia, re<strong>in</strong>forc<strong>in</strong>g the<br />

view that Ch<strong>in</strong>a and ASEAN economies operate<br />

w<strong>it</strong>h<strong>in</strong> common production networks. Market<br />

size and policy variables (e.g., low corporate<br />

taxes and FDI openness) seem <strong>to</strong> be more cr<strong>it</strong>ical<br />

for FDI attraction than the “Ch<strong>in</strong>a effect.” 11<br />

In fact, <strong>in</strong> the years s<strong>in</strong>ce the regional lull <strong>in</strong><br />

FDI <strong>in</strong>flows <strong>in</strong> 2002, w<strong>it</strong>h Indonesia, Thailand,<br />

Malaysia, and Vietnam <strong>in</strong> the lead, East Asian<br />

economies other than Ch<strong>in</strong>a have <strong>to</strong>gether generated<br />

one-third of the growth <strong>in</strong>crement <strong>in</strong><br />

regional FDI, well above their share of <strong>in</strong>flows.<br />

A comb<strong>in</strong>ation of economic reform, pol<strong>it</strong>ical<br />

stabil<strong>it</strong>y, aggressive <strong>in</strong>centives, high commod<strong>it</strong>y<br />

prices, and prospective WTO membership (for<br />

Vietnam) all probably contributed <strong>to</strong> this performance.<br />

In the medium term, given <strong>it</strong>s size and momentum,<br />

Ch<strong>in</strong>a will likely cont<strong>in</strong>ue <strong>to</strong> attract massive<br />

<strong>in</strong>flows and capture the largest proportion<br />

of regional FDI, especially <strong>in</strong> services and <strong>in</strong><br />

higher-value, cap<strong>it</strong>al-<strong>in</strong>tensive manufactur<strong>in</strong>g.<br />

How quickly Ch<strong>in</strong>a meets <strong>it</strong>s WTO comm<strong>it</strong>ments<br />

<strong>to</strong> liberalize services and improve the<br />

bus<strong>in</strong>ess environment will be an important<br />

determ<strong>in</strong>ant of regional FDI growth. Escalat<strong>in</strong>g<br />

operat<strong>in</strong>g costs <strong>in</strong> Ch<strong>in</strong>a may encourage some<br />

relocation of labor-<strong>in</strong>tensive export manufactur<strong>in</strong>g.<br />

If so, regional economies will probably benef<strong>it</strong><br />

first, particularly Vietnam, which can offer<br />

low cost labor and the dynamism of new WTO<br />

membership. Cont<strong>in</strong>u<strong>in</strong>g economic liberalization<br />

and reform, and advances <strong>in</strong> ASEAN’s program<br />

for regional economic <strong>in</strong>tegration, could<br />

32