COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

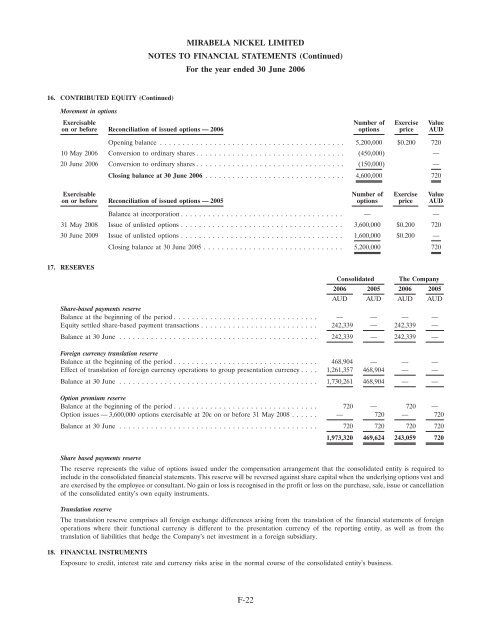

16. CONTRIBUTED EQUITY (Continued)<br />

Movement in options<br />

Exercisable Number of Exercise Value<br />

on or before Reconciliation of issued options — 2006 options price AUD<br />

Opening balance ......................................... 5,200,000 $0.200 720<br />

10 May 2006 Conversion to ordinary shares ................................. (450,000) —<br />

20 June 2006 Conversion to ordinary shares ................................. (150,000) —<br />

Closing balance at 30 June 2006 ............................... 4,600,000 720<br />

Exercisable Number of Exercise Value<br />

on or before Reconciliation of issued options — 2005 options price AUD<br />

Balance at incorporation .................................... — —<br />

31 May 2008 Issue of unlisted options .................................... 3,600,000 $0.200 720<br />

30 June 2009 Issue of unlisted options .................................... 1,600,000 $0.200 —<br />

Closing balance at 30 June 2005 ............................... 5,200,000 720<br />

17. RESERVES<br />

Consolidated The Company<br />

2006 2005 2006 2005<br />

AUD AUD AUD AUD<br />

Share-based payments reserve<br />

Balance at the beginning of the period ................................ — — — —<br />

Equity settled share-based payment transactions .......................... 242,339 — 242,339 —<br />

Balance at 30 June ............................................ 242,339 — 242,339 —<br />

Foreign currency translation reserve<br />

Balance at the beginning of the period ................................ 468,904 — — —<br />

Effect of translation of foreign currency operations to group presentation currency .... 1,261,357 468,904 — —<br />

Balance at 30 June ............................................ 1,730,261 468,904 — —<br />

Option premium reserve<br />

Balance at the beginning of the period ................................ 720 — 720 —<br />

Option issues — 3,600,000 options exercisable at 20c on or before 31 May 2008 ...... — 720 — 720<br />

Balance at 30 June ............................................ 720 720 720 720<br />

1,973,320 469,624 243,059 720<br />

Share based payments reserve<br />

The reserve represents the value of options issued under the compensation arrangement that the consolidated entity is required to<br />

include in the consolidated financial statements. This reserve will be reversed against share capital when the underlying options vest and<br />

are exercised by the employee or consultant. No gain or loss is recognised in the profit or loss on the purchase, sale, issue or cancellation<br />

of the consolidated entity’s own equity instruments.<br />

Translation reserve<br />

The translation reserve comprises all foreign exchange differences arising from the translation of the financial statements of foreign<br />

operations where their functional currency is different to the presentation currency of the reporting entity, as well as from the<br />

translation of liabilities that hedge the Company’s net investment in a foreign subsidiary.<br />

18. FINANCIAL INSTRUMENTS<br />

Exposure to credit, interest rate and currency risks arise in the normal course of the consolidated entity’s business.<br />

F-22