COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Summary of Financial<br />

Information:<br />

Management expects the BFS to be completed in May 2007. There can be no<br />

assurance that the outcome of the BFS will be positive or that additional financing<br />

will be available at all or on terms acceptable to <strong>Mirabela</strong> to finance the balance of<br />

the estimated US$223 million capital cost of the Santa Rita Project. Accordingly,<br />

<strong>Mirabela</strong> may determine not to proceed with the Santa Rita Project. In such event,<br />

any expenditure of the net proceeds would be at the discretion of management of<br />

<strong>Mirabela</strong>, and there can be no assurance as of the date of this prospectus as to how<br />

such funds will be expended.<br />

<strong>Mirabela</strong> intends to hold the net proceeds of the Offering in term deposits at<br />

major Canadian and/or Australian banks pending their expenditure.<br />

While <strong>Mirabela</strong> intends to spend further funds available to it as stated above,<br />

there may be circumstances where, for sound business reasons, a re-allocation of<br />

funds may be necessary or advisable. See ‘‘Use of Proceeds’’.<br />

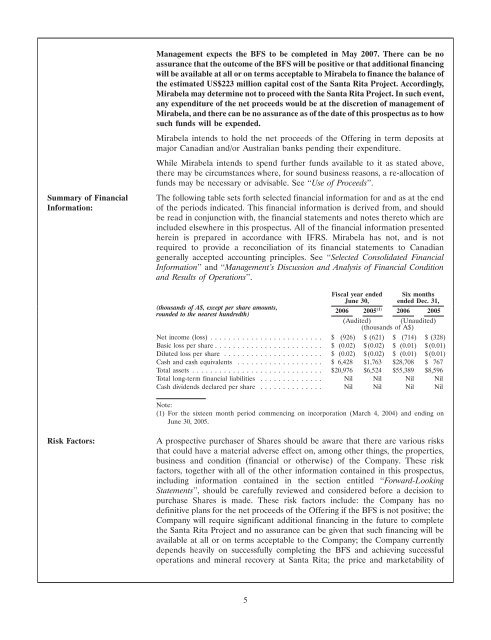

The following table sets forth selected financial information for and as at the end<br />

of the periods indicated. This financial information is derived from, and should<br />

be read in conjunction with, the financial statements and notes thereto which are<br />

included elsewhere in this prospectus. All of the financial information presented<br />

herein is prepared in accordance with IFRS. <strong>Mirabela</strong> has not, and is not<br />

required to provide a reconciliation of its financial statements to Canadian<br />

generally accepted accounting principles. See ‘‘Selected Consolidated Financial<br />

Information’’ and ‘‘Management’s Discussion and Analysis of Financial Condition<br />

and Results of Operations’’.<br />

(thousands of A$, except per share amounts,<br />

rounded to the nearest hundredth)<br />

Fiscal year ended Six months<br />

June 30, ended Dec. 31,<br />

2006 2005 (1) 2006 2005<br />

(Audited) (Unaudited)<br />

(thousands of A$)<br />

Net income (loss) ......................... $ (926) $ (621) $ (714) $ (328)<br />

Basic loss per share ........................ $ (0.02) $(0.02) $ (0.01) $(0.01)<br />

Diluted loss per share ...................... $ (0.02) $(0.02) $ (0.01) $(0.01)<br />

Cash and cash equivalents ................... $6,428 $1,763 $28,708 $ 767<br />

Total assets ............................. $20,976 $6,524 $55,389 $8,596<br />

Total long-term financial liabilities .............. Nil Nil Nil Nil<br />

Cash dividends declared per share .............. Nil Nil Nil Nil<br />

Note:<br />

(1) For the sixteen month period commencing on incorporation (March 4, 2004) and ending on<br />

June 30, 2005.<br />

Risk Factors:<br />

A prospective purchaser of Shares should be aware that there are various risks<br />

that could have a material adverse effect on, among other things, the properties,<br />

business and condition (financial or otherwise) of the Company. These risk<br />

factors, together with all of the other information contained in this prospectus,<br />

including information contained in the section entitled ‘‘Forward-Looking<br />

Statements’’, should be carefully reviewed and considered before a decision to<br />

purchase Shares is made. These risk factors include: the Company has no<br />

definitive plans for the net proceeds of the Offering if the BFS is not positive; the<br />

Company will require significant additional financing in the future to complete<br />

the Santa Rita Project and no assurance can be given that such financing will be<br />

available at all or on terms acceptable to the Company; the Company currently<br />

depends heavily on successfully completing the BFS and achieving successful<br />

operations and mineral recovery at Santa Rita; the price and marketability of<br />

5