COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

COPY OF FINAL PROSPECTUS - Mirabela Nickel

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MIRABELA NICKEL LIMITED<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

For the year ended 30 June 2006<br />

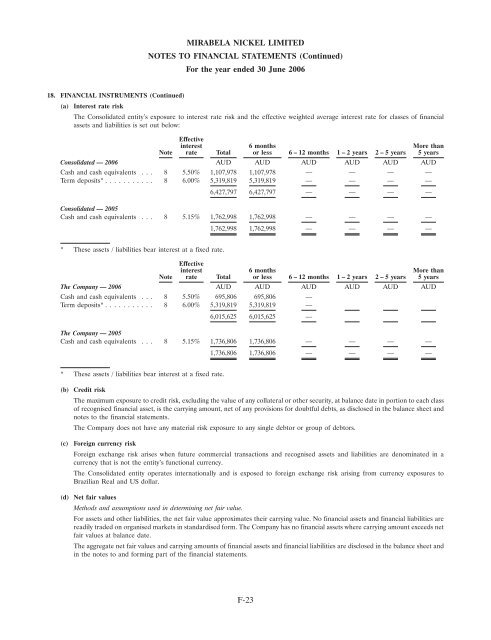

18. FINANCIAL INSTRUMENTS (Continued)<br />

(a) Interest rate risk<br />

The Consolidated entity’s exposure to interest rate risk and the effective weighted average interest rate for classes of financial<br />

assets and liabilities is set out below:<br />

Effective<br />

interest 6 months More than<br />

Note rate Total or less 6 – 12 months 1 – 2 years 2 – 5 years 5 years<br />

Consolidated — 2006 AUD AUD AUD AUD AUD AUD<br />

Cash and cash equivalents . . . 8 5.50% 1,107,978 1,107,978 — — — —<br />

Term deposits* ........... 8 6.00% 5,319,819 5,319,819 — — — —<br />

6,427,797 6,427,797 — — — —<br />

Consolidated — 2005<br />

Cash and cash equivalents . . . 8 5.15% 1,762,998 1,762,998 — — — —<br />

1,762,998 1,762,998 — — — —<br />

* These assets / liabilities bear interest at a fixed rate.<br />

Effective<br />

interest 6 months More than<br />

Note rate Total or less 6 – 12 months 1 – 2 years 2 – 5 years 5 years<br />

The Company — 2006 AUD AUD AUD AUD AUD AUD<br />

Cash and cash equivalents . . . 8 5.50% 695,806 695,806 —<br />

Term deposits* ........... 8 6.00% 5,319,819 5,319,819 —<br />

6,015,625 6,015,625 —<br />

The Company — 2005<br />

Cash and cash equivalents . . . 8 5.15% 1,736,806 1,736,806 — — — —<br />

1,736,806 1,736,806 — — — —<br />

* These assets / liabilities bear interest at a fixed rate.<br />

(b) Credit risk<br />

The maximum exposure to credit risk, excluding the value of any collateral or other security, at balance date in portion to each class<br />

of recognised financial asset, is the carrying amount, net of any provisions for doubtful debts, as disclosed in the balance sheet and<br />

notes to the financial statements.<br />

The Company does not have any material risk exposure to any single debtor or group of debtors.<br />

(c)<br />

Foreign currency risk<br />

Foreign exchange risk arises when future commercial transactions and recognised assets and liabilities are denominated in a<br />

currency that is not the entity’s functional currency.<br />

The Consolidated entity operates internationally and is exposed to foreign exchange risk arising from currency exposures to<br />

Brazilian Real and US dollar.<br />

(d) Net fair values<br />

Methods and assumptions used in determining net fair value.<br />

For assets and other liabilities, the net fair value approximates their carrying value. No financial assets and financial liabilities are<br />

readily traded on organised markets in standardised form. The Company has no financial assets where carrying amount exceeds net<br />

fair values at balance date.<br />

The aggregate net fair values and carrying amounts of financial assets and financial liabilities are disclosed in the balance sheet and<br />

in the notes to and forming part of the financial statements.<br />

F-23